-

Executive Summary

-

Scope of the Report

-

2.1

-

Market Definition

-

Scope of the

-

Study

-

List of Assumptions

-

Markets Structure

-

Market

-

Research Methodology

-

Research Process

-

Primary Research

-

3.3

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

Market

-

Factor Analysis

-

Supply Chain Analysis

- Raw Material Suppliers

- Intensity

- Threat of

- Bargaining Power of

- Bargaining Power of Buyers

-

4.1.2

-

Manufacturers/Producers of Industrial Catalyst

-

4.1.3

-

Distributors/Retailers/Wholesalers/E-Commerce Merchants

-

4.1.4

-

End-Use Industries/Material

-

4.2

-

Porter’s Five Forces Model

-

4.2.1

-

Threat of New Entrants

-

of Competitive Rivalry

-

Substitutes

-

Suppliers

-

Pricing Analysis

-

5

-

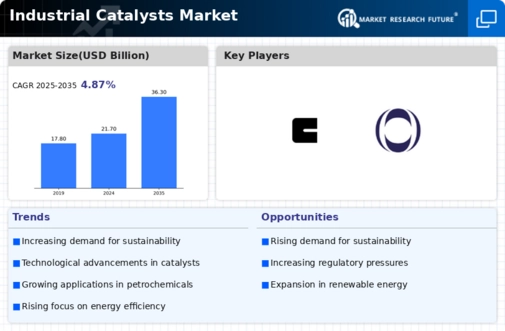

Market Dynamics of the Global Industrial Catalyst Market

-

Introduction

-

Drivers

-

Restraints

-

5.4

-

Opportunities

-

Challenges

-

6.

-

Global Industrial Catalyst Market, by Type

-

Introduction

-

Homogenous

- Market Estimates

- Market Estimates & Forecast,

-

& Forecast, 2023-2030

-

by Region, 2023-2030

-

Heterogenous

- Market Estimates & Forecast,

-

6.3.1

-

Market Estimates & Forecast, 2023-2030

-

by Region, 2023-2030

-

Global Industrial Catalyst Market,

-

by Material

-

Introduction

-

Metals

- Market Estimates & Forecast, 2023-2030

- Market Estimates &

-

Forecast, by Region, 2023-2030

-

Chemical

- Market

- Market Estimates & Forecast,

-

Estimates & Forecast, 2023-2030

-

by Region, 2023-2030

-

Organometallic

- Market

- Market Estimates & Forecast,

-

Estimates & Forecast, 2023-2030

-

by Region, 2023-2030

-

Others

- Market Estimates

- Market Estimates & Forecast, by Region,

-

& Forecast, 2023-2030

-

Global Industrial Catalyst Market, by Application

-

Introduction

-

Petroleum Refining

- Market Estimates & Forecast, 2023-2030

- Market Estimates &

-

Forecast, by Region, 2023-2030

-

Chemical Manufacturing

- Market Estimates & Forecast, 2023-2030

- Market Estimates &

-

Forecast, by Region, 2023-2030

-

Environmental

- Market Estimates & Forecast,

-

8.4.1

-

Market Estimates & Forecast, 2023-2030

-

by Region, 2023-2030

-

Food Processing

- Market Estimates & Forecast, 2023-2030

- Market Estimates

-

& Forecast, by Region, 2023-2030

-

Others

- Market Estimates & Forecast, 2023-2030

- Market Estimates

-

& Forecast, by Region, 2023-2030

-

Global Industrial

-

Catalyst Market, by Region

-

Introduction

- Market Estimates & Forecast, 2023-2030

-

9.2

-

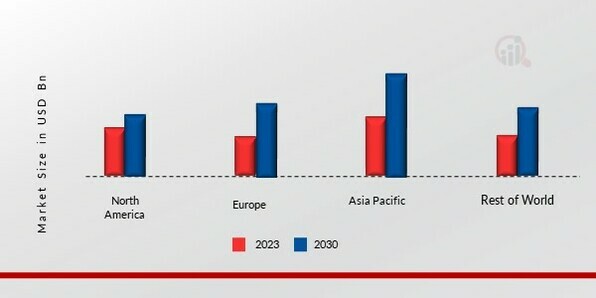

North America

-

9.2.2

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast, by Material, 2023-2030

-

by Application, 2023-2030

-

& Forecast, 2023-2030

-

9.2.6

-

Canada

-

9.2.6.2

-

Market Estimates

-

Market Estimates & Forecast,

-

US

-

Market Estimates

-

Market Estimates & Forecast, by Type

-

Market Estimates & Forecast, by Material, 2023-2030

-

Market Estimates & Forecast, by Application, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast, by Material, 2023-2030

-

by Application, 2023-2030

-

& Forecast, 2023-2030

-

Estimates & Forecast, by Application, 2023-2030

-

& Forecast, by Type, 2023-2030

-

by Material, 2023-2030

-

Forecast, 2023-2030

-

Estimates & Forecast, by Application, 2023-2030

-

& Forecast, by Type, 2023-2030

-

by Material, 2023-2030

-

Forecast, 2023-2030

-

Estimates & Forecast, by Application, 2023-2030

-

& Forecast, by Type, 2023-2030

-

by Material, 2023-2030

-

Forecast, 2023-2030

-

9.3.10.4

-

Market Estimates

-

Market Estimates & Forecast,

-

Europe

- Market Estimates

- Market Estimates & Forecast, by Type, 2023-2030

- Market Estimates & Forecast, by Material, 2023-2030

- Market

- Germany

- France

- Italy

- Spain

- UK

- Russia

-

Market Estimates & Forecast, by Application, 2023-2030

-

9.3.11

-

Rest of Europe

-

Estimates & Forecast, by Material, 2023-2030

-

& Forecast, by Application, 2023-2030

-

Forecast, by Type, 2023-2030

-

Estimates & Forecast by Material, 2023-2030

-

Forecast, by Application, 2023-2030

-

9.4.6.1

-

Market Estimates & Forecast, 2023-2030

-

by Type, 2023-2030

-

9.4.7

-

South Korea

-

9.4.7.2

-

Market Estimates & Forecast, 2023-2030

-

Market Estimates & Forecast, by Type, 2023-2030

-

Market

-

Market Estimates

-

Asia-Pacific

- Market Estimates & Forecast, 2023-2030

- Market Estimates &

- Market Estimates & Forecast, by Material,

- Market Estimates & Forecast, by Application, 2023-2030

- China

- India

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast by Material, 2023-2030

-

by Application, 2023-2030

-

Estimates & Forecast, 2023-2030

-

by Type, 2023-2030

-

9.4.9

-

Australia & New Zealand

-

9.4.9.3

-

Market Estimates

-

Market Estimates & Forecast,

-

Indonesia

-

Market

-

Market Estimates & Forecast,

-

Market Estimates & Forecast by Material, 2023-2030

-

Market Estimates & Forecast, by Application, 2023-2030

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Type, 2023-2030

-

Market Estimates & Forecast, by Material, 2023-2030

-

& Forecast, by Application, 2023-2030

-

Asia-Pacific

-

9.4.10.2

-

Market Estimates

-

Rest of

-

Market Estimates & Forecast, 2023-2030

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast, by Material, 2023-2030

-

by Application, 2023-2030

-

Forecast, by Type, 2023-2030

-

9.5.5.2

-

Market Estimates

-

Market Estimates & Forecast,

-

Middle East & Africa

- Market Estimates & Forecast, 2023-2030

- Market Estimates &

- Market Estimates & Forecast by Material,

- Market Estimates & Forecast, by Application, 2023-2030

- Turkey

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast, by Material, 2023-2030

-

by Application, 2023-2030

-

& Forecast, 2023-2030

-

9.5.7

-

North Africa

-

9.5.7.2

-

Market Estimates

-

Market Estimates & Forecast,

-

Israel

-

Market Estimates

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Material, 2023-2030

-

Market Estimates & Forecast, by Application, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast, by Material, 2023-2030

-

by Application, 2023-2030

-

9.5.8.3

-

Market Estimates

-

Market Estimates & Forecast,

-

GCC

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Type, 2023-2030

-

Market Estimates & Forecast, by Material, 2023-2030

-

& Forecast, by Application, 2023-2030

-

& Forecast, by Type, 2023-2030

-

by Material, 2023-2030

-

Forecast, 2023-2030

-

Estimates & Forecast, by Application, 2023-2030

-

9.6.5.1

-

Market Estimates & Forecast, 2023-2030

-

by Type, 2023-2030

-

9.6.6

-

Argentina

-

9.6.6.2

-

Market Estimates

-

Rest of Middle East & Africa

-

Market Estimates & Forecast, 2023-2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application,

-

Latin America

- Market Estimates &

- Market Estimates & Forecast, by Type, 2023-2030

- Market Estimates & Forecast, by Material, 2023-2030

- Market

- Brazil

-

Market Estimates & Forecast, by Type, 2023-2030

-

& Forecast, by Material, 2023-2030

-

by Application, 2023-2030

-

& Forecast, 2023-2030

-

9.6.8

-

Rest of Latin America

-

Estimates & Forecast, by Material, 2023-2030

-

Forecast, by Application, 2023-2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Mexico

-

Market Estimates

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Material, 2023-2030

-

Market Estimates & Forecast, by Application, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

Market Estimates & Forecast, by Type, 2023-2030

-

Market

-

Market Estimates &

-

Competitive

-

Landscape

-

Introduction

-

10.2

-

Market Key Strategies

-

Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

Company Profiles

-

Bayer AG

- Company

- Financial Overview

- Key Developments

- Key Strategies

- Company Overview

- Financial Overview

- Products

- Key Developments

- SWOT

- Key Strategies

-

Overview

-

11.1.3

-

Products Offered

-

11.1.5

-

SWOT Analysis

-

11.2

-

The Dow Chemical Company

-

Offered

-

Analysis

-

Albemarle

- Company Overview

- Products Offered

- SWOT Analysis

-

Corporation

-

11.3.2

-

Financial Overview

-

11.3.4

-

Key Developments

-

11.3.6

-

Key Strategies

-

BASF SE

- Financial Overview

- Key Developments

- Key Strategies

- Company Overview

- Financial Overview

- Products

- Key Developments

- SWOT

- Key Strategies

-

11.4.1

-

Company Overview

-

11.4.3

-

Products Offered

-

11.4.5

-

SWOT Analysis

-

11.5

-

Exxon Mobil Corporation

-

Offered

-

Analysis

-

Akzo

- Company Overview

- Products Offered

- SWOT Analysis

-

Nobel N.V.

-

11.6.2

-

Financial Overview

-

11.6.4

-

Key Developments

-

11.6.6

-

Key Strategies

-

Chevron Phillips Chemical Company

- Company Overview

- Financial

- Products Offered

- SWOT Analysis

-

LLC

-

Overview

-

11.7.4

-

Key Developments

-

11.7.6

-

Key Strategies

-

Clariant

- Financial Overview

- Key Developments

- Key Strategies

-

11.8.1

-

Company Overview

-

11.8.3

-

Products Offered

-

11.8.5

-

SWOT Analysis

-

Haldor Topsøe A/S

- Company

- Financial Overview

- Key Developments

- Key Strategies

- Company Overview

- Products Offered

- SWOT Analysis

-

Overview

-

11.9.3

-

Products Offered

-

11.9.5

-

SWOT Analysis

-

11.10

-

INEOS

-

11.10.2

-

Financial Overview

-

11.10.4

-

Key Developments

-

11.10.6

-

Key Strategies

-

Honeywell International Inc.

- Solvay SA

- The Sherwin-Williams Company

- Valspar Corporation

- Akzo Nobel N.V.

- Dura Coat Products,

- The Lubrizol

-

Inc.

-

Corporation

-

Other Companies

-

12.

-

Appendix

-

-

LIST OF TABLES

-

Global

-

Industrial Catalyst Market, by Region, 2023-2030

-

Table 2

-

North America: Industrial Catalyst Market, by Country, 2023-2030

-

Europe: Industrial Catalyst Market, by Country, 2023-2030

-

Asia-Pacific: Industrial Catalyst Market,

-

by Country, 2023-2030

-

Middle East & Africa:

-

Industrial Catalyst Market, by Country, 2023-2030

-

Table 6

-

Latin America: Industrial Catalyst Market, by Country, 2023-2030

-

Global Industrial Catalyst Type Market, by Region, 2023-2030

-

North America: Industrial Catalyst Type Market,

-

by Country, 2023-2030

-

Europe: Industrial Catalyst

-

Type Market, by Country, 2023-2030

-

Asia-Pacific:

-

Industrial Catalyst Type Market, by Country, 2023-2030

-

Table 11

-

Middle East & Africa: Industrial Catalyst Type Market, by Country, 2023-2030

-

Latin America: Industrial Catalyst Type Market,

-

by Country, 2023-2030

-

Global Industrial Catalyst

-

Material Market, by Region, 2023-2030

-

North

-

America: Industrial Catalyst Material Market, by Country, 2023-2030

-

Table

-

Europe: Industrial Catalyst Material Market, by Country, 2023-2030

-

Asia-Pacific: Industrial Catalyst Material

-

Market, by Country, 2023-2030

-

Middle East

-

& Africa: Industrial Catalyst Material Market, by Country, 2023-2030

-

Latin America: Industrial Catalyst Material Market,

-

by Country, 2023-2030

-

Global Industrial Catalyst

-

Application Market, by Region, 2023-2030

-

North

-

America: Industrial Catalyst Application Market, by Country, 2023-2030

-

Europe: Industrial Catalyst Application Market, by

-

Country, 2023-2030

-

Asia-Pacific: Industrial

-

Catalyst Application Market, by Country, 2023-2030

-

Table 23

-

Middle East & Africa: Industrial Catalyst Application Market, by Country,

-

Latin America: Industrial Catalyst

-

Application Market, by Country, 2023-2030

-

Global

-

Type Market, by Region, 2023-2030

-

Global

-

Material Market, by Region, 2023-2030

-

Global

-

Application Market, by Region, 2023-2030

-

North

-

America: Industrial Catalyst Market, by Country, 2023-2030

-

Table 29

-

North America: Industrial Catalyst Market, by Type, 2023-2030

-

Table 30

-

North America: Industrial Catalyst Market, by Material, 2023-2030

-

Table

-

North America: Industrial Catalyst Market, by Application,

-

Europe: Industrial Catalyst Market, by

-

Country, 2023-2030

-

Europe: Industrial Catalyst Market,

-

by Type, 2023-2030

-

Europe: Industrial Catalyst Market,

-

by Material, 2023-2030

-

Europe: Industrial Catalyst

-

Market, by Application, 2023-2030

-

Asia-Pacific:

-

Industrial Catalyst Market, by Country, 2023-2030

-

Asia-Pacific:

-

Industrial Catalyst Market, by Type, 2023-2030

-

Asia-Pacific:

-

Industrial Catalyst Market, by Material, 2023-2030

-

Asia-Pacific:

-

Industrial Catalyst Market, by Application, 2023-2030

-

Table 40

-

Middle East & Africa: Industrial Catalyst Market, by Country, 2023-2030

-

Middle East & Africa: Industrial Catalyst Market,

-

by Type, 2023-2030

-

Middle East & Africa: Industrial

-

Catalyst Market, by Material, 2023-2030

-

Middle East

-

& Africa: Industrial Catalyst Market, by Application, 2023-2030

-

Table

-

Latin America: Industrial Catalyst Market, by Country, 2023-2030

-

Latin America: Industrial Catalyst Market, by Type,

-

Latin America: Industrial Catalyst Market,

-

by Material, 2023-2030

-

Latin America: Industrial

-

Catalyst Market, by Application, 2023-2030

-

LIST OF FIGURES

-

FIGURE

-

Global Industrial Catalyst Market Segmentation

-

Forecast

-

Research Methodology

-

Porter’s Five Forces Analysis of

-

the Global Industrial Catalyst Market

-

Value Chain/Supply Chain

-

of Global Industrial Catalyst Market

-

Share of the Global Industrial

-

Catalyst Market, by Country, 2020 (%)

-

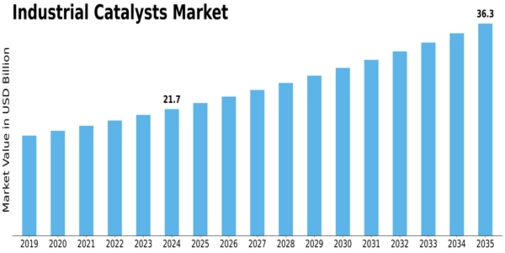

Global Industrial Catalyst

-

Market, 2023-2030

-

Global Industrial Catalyst Market Size, by

-

Type, 2020 (%)

-

Share of the Global Industrial Catalyst Market, by

-

Type, 2023-2030

-

Global Industrial Catalyst Market Size, by Material,

-

Share of the Global Industrial Catalyst Market, by Material,

-

Global Industrial Catalyst Market Size, by Application,

-

Share of the Global Industrial Catalyst Market, by Application,

Leave a Comment