Market Trends

Introduction

In 2024, the industrial packaging market is undergoing a significant transformation, which is largely due to the confluence of macro-economic factors. The emergence of new technological solutions has reshaped the packaging industry, bringing greater efficiency and greater sustainability to meet the evolving demands of various industries. Regulatory pressures have also increased, thereby influencing companies to adopt more sustainable materials and practices, in line with international sustainability goals. In addition, changes in consumers’ preferences, such as their preference for more sustainable and innovative packaging, have influenced product design and functionality. These trends are strategically important for the packaging industry, as they not only influence its positioning in the market but also drive the search for operational efficiencies and compliance with regulatory changes.

Top Trends

-

Sustainability Initiatives

In the meanwhile, the demand for a more sustainable packaging solution is growing. For example, Amcor has already committed itself to producing completely recyclable packaging by 2025. The governments are also increasingly regulating the use of plastics, which has also prompted a shift towards biodegradable materials. By 2023, 60% of consumers prefer to buy from brands that are sustainable. That shows there is a considerable market demand. This trend will lead to innovation in eco-friendly materials and processes and to a reorganization of the supply chain. -

Smart Packaging Technologies

It is now being widely used in the packaging industry. Some companies, such as Sealed Air, have developed smart packages that can monitor the product's condition. It is expected that the smart packaging industry will grow at a rate of 20 percent a year. This technology makes the supply chain more transparent and reduces waste, making the operation more efficient. The next step will be to further optimize logistics through the development of smart tracking systems. -

E-commerce Driven Solutions

The increase in e-commerce has increased the need for protective packaging, and WestRock is one of the companies that is innovating in this field. By 2023, e-commerce packaging is expected to account for a third of the total packaging market. This trend will require the development of lighter, stronger materials that can reduce shipping costs. And as the popularity of e-commerce continues to grow, companies will have to adapt to meet changing customer expectations. -

Regulatory Compliance and Safety Standards

The increasing implementation of stricter regulations on the safety of packaging around the world is forcing companies to increase their compliance efforts. For example, the Food and Drug Administration (FDA) has issued new guidelines on food packaging that affect companies like International Paper. In 2023, 45 percent of packaging companies reported that their compliance costs had risen. This trend will likely lead to greater investment in quality assurance and testing. -

Customization and Personalization

Customized packaging is growing, driven by the growing preference of consumers for personal experiences. Offerings from companies such as Berry are increasingly tailored to meet the individual needs of customers. Surveys have shown that seventy per cent of consumers are more likely to buy from a brand that offers a bespoke package. This trend will encourage innovation in design and production, enhancing customer engagement. -

Circular Economy Practices

The concept of the circular economy has influenced the design of packaging, and the Mondi Group, for example, is concentrating on the use of recyclable and re-usable materials. In 2023, some 50% of packaging companies were undertaking initiatives to reduce waste. The trend is towards closer collaboration between industries in the design of closed-loop systems, which could considerably reduce the impact of industry on the environment. And there are possibilities for the establishment of a more robust system of waste management. -

Advanced Materials Development

The development of new materials in the field of materials is bringing forth advanced packaging, such as biodegradable films and light composites. This is the field in which companies such as the Sappi group are leading the way. Research indicates that the weight of packaging materials can be reduced by up to 30 per cent with the use of advanced materials. This trend will produce both cost advantages and sustainable development. -

Automation and Robotics in Packaging

The automation and use of robots in the packaging process is increasing productivity and reducing costs. Sonoco is investing in automation to increase its efficiency. In 2023, forty percent of the companies producing packaging machines were using automation. This trend is expected to continue. It will lead to shorter production times and more accurate packaging. -

Global Supply Chain Resilience

The COVID-19 pandemic revealed the fragility of the world's supply chains and forced companies to rethink their resilience. The world's leading companies are diversifying their suppliers and investing in local production. A survey of companies shows that 55% are rethinking their supply strategies. This will lead to a stronger logistics system and greater risk management. -

Digital Transformation in Packaging

In the packaging industry, digitalization is reshaping the business model. Firms like Novolex use digital tools to optimize production and reduce waste. In 2023, sixty-five per cent of packaging firms were investing more in digital technology. This trend is expected to enhance their operational efficiency and drive innovation in product development.

Conclusion: Navigating the Industrial Packaging Landscape

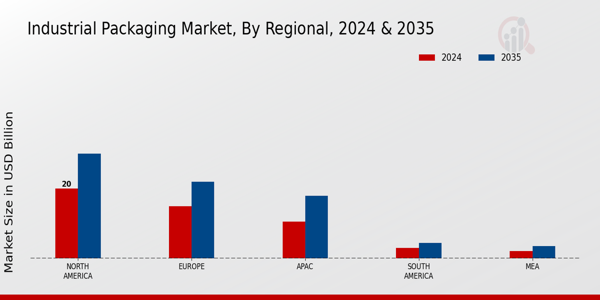

Towards 2024, the industrial packaging market will be characterized by intense competition and marked fragmentation, with both historical and new players competing for market share. The regional trends will be mainly oriented towards automation and sustainability, thereby requiring manufacturers to adapt their strategies accordingly. The historical players are relying on their established network and experience, whereas the newcomers are developing their own products, based on innovation, flexibility and eco-friendliness. As a result, a crucial factor for manufacturers is to be able to integrate the latest technological capabilities, such as automation and artificial intelligence. In order to increase the efficiency of their operations and meet the growing demand for sustainable packaging solutions, they will need to focus their investment efforts on these areas.

Leave a Comment