-

Executive Summary

-

Market Introduction

-

Definition 14

-

Scope Of The Study 14

-

List Of Assumptions 14

-

Market Structure 15

-

Research Methodology

-

Research Process 17

-

Primary Research 17

-

Secondary Research 17

-

Market Size Estimation 18

-

Forecast Model 18

-

Market Dynamics

-

Introduction 20

-

Drivers 21

- An Energy-Efficient Flexible Solution 21

- Cost-Effectiveness 22

- Increasing Application In HVAC, Defense, And Aerospace 23

-

Restraint 24

- Slowdown In Chinese Economy 24

-

Opportunities 25

- Growth In Niche Healthcare Applications 25

- Growth In Niche Healthcare Applications 26

-

Market Factor Analysis

-

Value Chain Analysis 28

- Raw Material Supply: 28

- Manufacture 28

- Distribution 28

- End-User 28

-

Porter’s Five Forces Analysis 29

- Threat Of New Entrants 29

- Bargaining Power Of Suppliers 29

- Threat Of Substitutes 29

- Bargaining Power Of Buyers 30

- Rivalry 30

-

Global Magnet Bearing Market, By Type

-

Introduction 32

-

Active Magnet Bearing 32

-

Passive Magnet Bearing 32

-

Hybrid Magnet Bearing 32

-

Global Magnet Bearing Market, By Application

-

Introduction 34

-

Compressor 34

-

Turbine 34

-

Pumps 34

-

Motors 34

-

Generators 34

-

Global Magnet Bearing Market, By Speed

-

Introduction 37

-

Upto 50,000 Rpm 37

-

50,000 To 100,000 Rpm 37

-

Above 10,000 Rpm 37

-

Global Magnet Bearing Market, By End User

-

Introduction 39

-

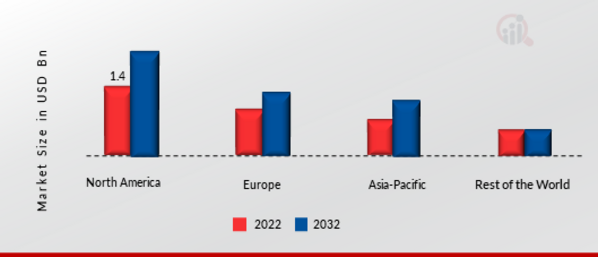

Global Magnet Bearing Market, By Region

-

Introduction 42

-

Americas 43

- U.S. 46

- Canada 49

- Brazil 51

-

Europe 54

- Germany 57

- U.K. 59

- France 61

- Italy 63

- Rest Of Europe 65

-

Asia Pacific 66

- China 69

- India 71

- Japan 73

- Rest Of Asia Pacific 75

-

Middle East & Africa 77

- Middle East 79

- Africa 81

-

Competitive Landscape

-

Competitive Landscape 84

-

Company Profiles

-

Siemens AG 87

- Company Overview 87

- Financials 87

- Products 87

- Strategy 87

- Key Developments 87

-

SKF AB 88

- Company Overview 88

- Financials 88

- Products 88

- Strategy 88

- Key Developments 88

-

Schaeffler AG 90

- Company Overview 90

- Financials 90

- Products 90

- Strategy 90

-

Calnetix Technologies 92

- Company Overview 92

- Financials 92

- Products 92

- Strategy 92

- Key Developments 92

-

-

Waukesha Bearings Corporation 93

- Company Overview 93

- Financials 93

- Products 93

- Strategy 93

- Key Developments 93

-

Mecos AG 95

- Company Overview 95

- Financials 95

- Products 95

- Strategy 95

- Key Developments 95

-

Foshan Genesis 97

- Company Overview 97

- Financials 97

- Products 97

- Strategy 97

- Key Developments 97

-

Synchrony 98

- Company Overview 98

- Financials 98

- Products 98

- Strategy 98

- Key Developments 98

-

Celeroton AG 100

- Company Overview 100

- Financials 100

- Products 100

- Strategy 100

- Key Developments 100

-

Conclusion 102

-

Conclusion 103

-

Appendix 104

-

References 105

-

List Of Tables

-

MARKET SYNOPSIS 12

-

LIST OF ASSUMPTIONS 14

-

GLOBAL MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 32

-

GLOBAL MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 35

-

GLOBAL MAGNET BEARING MARKET, BY SPPED, 2023-2032 (USD MILLION) 37

-

GLOBAL MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 40

-

GLOBAL MAGNET BEARING MARKET, BY REGION, 2023-2032 (USD MILLION) 42

-

AMERICAS: MAGNET BEARING MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 44

-

AMERICAS: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 44

-

AMERICAS: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 44

-

AMERICAS: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 45

-

AMERICAS: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 45

-

U.S.: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 47

-

U.S.: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 47

-

U.S.: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 48

-

U.S.: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 48

-

CANADA POWER GENERATION AND RENEWABLE ENERGY PRODUCTION, 2023-2032 (USD MILLIONS) 49

-

CANADA: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 49

-

CANADA: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 50

-

CANADA: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 50

-

CANADA: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 50

-

BRAZIL: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 52

-

BRAZIL: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 52

-

BRAZIL: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 52

-

BRAZIL: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 53

-

EUROPE: MAGNET BEARING MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 55

-

EUROPE: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 55

-

EUROPE: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 55

-

EUROPE: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 56

-

EUROPE: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 56

-

GERMANY: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 57

-

GERMANY: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 58

-

GERMANY: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 58

-

GERMANY: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 58

-

U.K.: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 59

-

U.K.: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 60

-

U.K.: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 60

-

U.K.: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 60

-

FRANCE: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 61

-

FRANCE: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 62

-

FRANCE: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 62

-

FRANCE: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 62

-

ITALY: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 63

-

ITALY: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 63

-

ITALY: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 64

-

ITALY: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 64

-

REST OF EUROPE: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 65

-

REST OF EUROPE: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 65

-

REST OF EUROPE: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 65

-

REST OF EUROPE: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 66

-

ASIA PACIFIC: MAGNET BEARING MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 67

-

ASIA PACIFIC: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 67

-

ASIA PACIFIC: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 67

-

ASIA PACIFIC: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 68

-

ASIA PACIFIC: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 68

-

CHINA: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 69

-

CHINA: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 69

-

CHINA: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 70

-

CHINA: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 70

-

INDIA: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 71

-

INDIA: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 72

-

INDIA: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 72

-

INDIA: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 72

-

JAPAN: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 73

-

JAPAN: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 74

-

JAPAN: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 74

-

JAPAN: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 74

-

REST OF ASIA PACIFIC: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 75

-

REST OF ASIA PACIFIC: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 75

-

REST OF ASIA PACIFIC: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 75

-

REST OF ASIA PACIFIC: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 76

-

MIDDLE EAST & AFRICA: MAGNET BEARING MARKET, BY REGION, 2023-2032 (USD MILLION) 78

-

MIDDLE EAST & AFRICA: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 78

-

MIDDLE EAST & AFRICA: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 78

-

MIDDLE EAST & AFRICA: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 78

-

MIDDLE EAST & AFRICA: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 79

-

GCC: INVESTMENTS IN MANUFACTURING INDUSTRIES, 2023-2032 (USD MILLION) 79

-

MIDDLE EAST: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 79

-

MIDDLE EAST: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 80

-

MIDDLE EAST: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 80

-

MIDDLE EAST: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 80

-

AFRICA: MAGNET BEARING MARKET, BY TYPE, 2023-2032 (USD MILLION) 81

-

AFRICA: MAGNET BEARING MARKET, BY APPLICATION, 2023-2032 (USD MILLION) 81

-

AFRICA: MAGNET BEARING MARKET, BY END-USER, 2023-2032 (USD MILLION) 81

-

AFRICA: MAGNET BEARING MARKET, BY SPEED, 2023-2032 (USD MILLION) 82

-

List Of Figures

-

GLOBAL MAGNET BEARING MARKET: MARKET STRUCTURE 15

-

RESEARCH PROCESS OF MRFR 17

-

TOP DOWN & BOTTOM UP APPROACH 18

-

DROC ANALYSIS: GLOBAL MAGNET BEARING MARKET 20

-

PORTER’S FIVE FORCES ANALYSIS: MAGNET BEARING MARKET 29

-

ANNUAL VALUE OF CONSTRUCTION, 2023-2032 (USD MILLION) 46

-

TOTAL SALES SUPPORTED BY AEROSPACE & DEFENSE, U.S., 2022(USD BILLION) 47

-

BRAZIL GENERATION CAPACITY, BY FUEL, 2022(GW) 51

-

GERMANY: IMPORTS AND EXPORT OF BEARINGS, 2023-2032 (USD THOUSAND) 57

-

U.K.: VALUE OF CONSTRUCTION, 2023-2032 (USD MILLION) 59

-

FRANCE: IMPORTS AND EXPORT OF BEARINGS, 2023-2032 (USD THOUSAND) 61

-

FDI INFLOWS, ASIA-PACIFIC, 2010-2020 (USD BILLION) 71

-

JAPAN: IMPORT AND EXPORT OF BEARINGS, 2023-2032 (USD THOUSAND) 73

-

GROWTH STRATEGIES ADOPTED BY KEY PLAYERS IN GLOBAL MAGNET BEARING MARKET, 2023-2032 , (% SHARE) 84

-

MARKET SHARE ANALYSIS, BY KEY PLAYERS IN GLOBAL MAGNET BEARING MARKET, 2022(% SHARE) 85

Leave a Comment