-

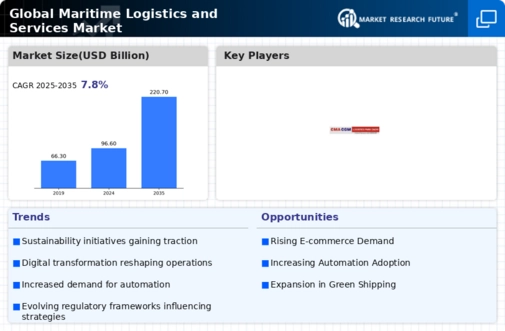

Executive Summary

-

Market Attractiveness Analysis

- Global Maritime Logistics and Services Market, by Cargo Type

- Global Maritime Logistics and Services Market, by Services

- Global Maritime Logistics and Services Market, by Solutions

- Global Maritime Logistics and Services Market, by Region

-

Market Introduction

-

Market Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Market Factor Indicator Analysis

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

Market Insights

-

Market Dynamics

-

Introduction

-

Drivers

- Growing Seaborne Trade

- Increase in Free Trade Agreements Between Various Countries

- Improving Economic Conditions of Several Countries Paired with the Increase in Export and Import

- Drivers Impact Analysis

-

Restraints

- Implementation of the IMO Sulfur 2020 Regulation

- Tariff Hike

- Restraints Impact Analysis

-

Opportunities

- Consolidation of Container Shipping Business

- Digitalization and Automation

- Rapid Development of New Ports in the Developing Countries

-

Market/Technological Trends

- Artificial Intelligence

- Data Science

- Satellites

- Smart Ports

- 5G

-

Patent Trends

-

Regulatory Landscape/Standards

-

Market Factor Analysis

-

Value Chain/Supply Chain Analysis

- R&D

- Manufacturing

- Distribution & Sales

- Post-Sales Monitoring

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of Rivalry

-

Global Maritime Logistics and Services Market, by Cargo Type

-

Introduction

-

General Cargo

- Break Bulk

- Neo Bulk

- Containerized

-

Bulk Cargo

- Liquid Bulk

- Dry Bulk

-

Global Maritime Logistics and Services Market, by Services

-

Introduction

-

Port and Cargo Handling

-

Route Surveys

-

Multimodal Transportation

-

Lifting Equipment Management

-

Packing and Crating

-

Vessel Chartering

-

Insurance and Legal Support

-

Crew Management

-

Global Maritime Logistics and Services Market, by Solutions

-

Introduction

-

Supply Chain Management

-

Warehouse Management

-

Port Equipment Training

-

Others

-

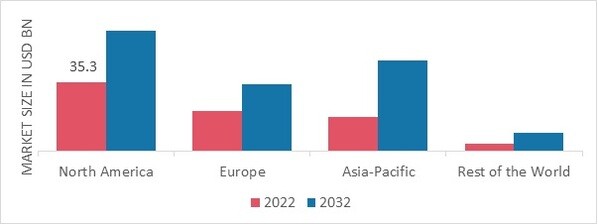

Global Maritime Logistics and Services Market, by Region

-

Introduction

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Rest of Latin America

-

Competitive Landscape

-

Competitive Overview

-

Competitor Dashboard

-

Major Growth Strategies in the Global Maritime Logistics and Services Market

-

Competitive Benchmarking

-

Market Share Analysis

-

Leading Player in Terms of Number of Developments in the Global Maritime Logistics and Services Market

-

Key Developments & Growth Strategies

- New Product Launches/Developments

- Mergers & Acquisitions

- Joint Ventures

-

Company Profiles

-

Key Market Players

- A.P. Moller-Maersk A/S

- Mediterranean Shipping Company S.A.

- China Ocean Shipping Company Limited

- CMA CGM S.A.

- Hapag-Lloyd AG

- Ocean Network Express Pte. Ltd

- Evergreen Line

- YangMing Marine Transport Corp.

- Hyundai Merchant Marine

- Pacific International Lines

-

(Company overview, products & services offered, financial overview, key developments, SWOT analysis, and key strategies to be covered for public companies)

-

Other Prominent Players

-

Wilh. Wilhelmsen Holding ASA

-

NorSea Group AS

-

Anglo Eastern Univan Group

-

Tata Martrade International Logistics Limited

-

Algeposa Group

-

MTL Marine Trans Logistics Pvt Ltd

-

Toll Group

-

ClearMetal, Inc.

-

Shipamax Ltd

-

We4Sea BV

-

Appendix

-

References

-

Related Reports

-

List of Abbreviations

-

List of Tables

-

LIST OF ASSUMPTIONS

-

MAJOR PATENTS GRANTED FOR MARITIME LOGISTICS AND SERVICES (2014–2020)

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET, BY REGION, 2025-2034 (USD MILLION)

-

NORTH AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

-

NORTH AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

NORTH AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

NORTH AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

US: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

US: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

US: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

CANADA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

CANADA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

CANADA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

-

EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

UK: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

UK: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

UK: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

GERMANY: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

GERMANY: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

GERMANY: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

FRANCE: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

FRANCE: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

FRANCE: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

ITALY: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

ITALY: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

ITALY: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

REST OF EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

REST OF EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

REST OF EUROPE: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

-

ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

CHINA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

CHINA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

CHINA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

INDIA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

INDIA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

INDIA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

JAPAN: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

JAPAN: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

JAPAN: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

AUSTRALIA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

AUSTRALIA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

AUSTRALIA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

REST OF ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

REST OF ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

REST OF ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

-

MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

SAUDI ARABIA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

SAUDI ARABIA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

SAUDI ARABIA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

UAE: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

UAE: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

UAE: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

-

LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

BRAZIL: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

BRAZIL: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

BRAZIL: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

REST OF LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY CARGO TYPE, 2025-2034 (USD MILLION)

-

REST OF LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SERVICES, 2025-2034 (USD MILLION)

-

REST OF LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET, BY SOLUTIONS, 2025-2034 (USD MILLION)

-

THE MOST ACTIVE PLAYERS IN THE GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

CONTRACTS & AGREEMENTS

-

MERGERS & ACQUISITIONS

-

PRODUCT DEVELOPMENTS

-

EXPANSIONS & INVESTMENTS

-

JOINT VENTURES & PARTNERSHIPS

-

-

List of Figures

-

MARKET SYNOPSIS

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET: MARKET ATTRACTIVENESS ANALYSIS

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET ANALYSIS, BY CARGO TYPE

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET ANALYSIS, BY SERVICES

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET ANALYSIS, BY SOLUTIONS

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET ANALYSIS, BY REGION

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET: MARKET STRUCTURE

-

KEY BUYING CRITERIA FOR MARITIME LOGISTICS AND SERVICES

-

RESEARCH PROCESS OF MRFR

-

NORTH AMERICA: MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

-

EUROPE: MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

-

ASIA-PACIFIC: MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

-

MIDDLE EAST & AFRICA: MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

-

LATIN AMERICA: MARKET SIZE & MARKET SHARE, BY REGION, 2020 VS 2027

-

MARKET DYNAMICS OVERVIEW

-

DRIVERS IMPACT ANALYSIS: GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

RESTRAINTS IMPACT ANALYSIS: GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

PORTER’S FIVE FORCES ANALYSIS OF THE GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

SUPPLY CHAIN: GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY CARGO TYPE, 2020 (% SHARE)

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY SOLUTIONS, 2020 (% SHARE)

-

GLOBAL MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY REGION, 2020 (% SHARE)

-

NORTH AMERICA: MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

EUROPE: MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

ASIA-PACIFIC: MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

MIDDLE EAST & AFRICA: MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

LATIN AMERICA: MARITIME LOGISTICS AND SERVICES MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

COMPETITOR DASHBOARD: GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

CAPITAL MARKET RATIO AND FINANCIAL MATRIX

-

CONTRACTS & AGREEMENTS: THE MAJOR STRATEGY ADOPTED BY KEY PLAYERS IN THE GLOBAL MARITIME LOGISTICS AND SERVICES MARKET

-

BENCHMARKING OF MAJOR COMPETITORS

-

MAJOR MANUFACTURERS MARKET SHARE ANALYSIS, 2020

-

"

Leave a Comment