-

EXECUTIVE SUMMARY

-

2.

-

SCOPE OF THE REPORT

-

MARKET DEFINITION

- DEFINITION

- LIST OF ASSUMPTIONS

-

2.2.

-

SCOPE OF THE STUDY

-

2.2.2.

-

RESEARCH OBJECTIVE

-

2.2.4.

-

LIMITATIONS

-

RESEARCH METHODOLOGY

-

3.1.

-

RESEARCH PROCESS

-

PRIMARY RESEARCH

-

3.3.

-

SECONDARY RESEARCH

-

MARKET SIZE ESTIMATION

-

3.5.

-

FORECAST MODEL

-

MARKET LANDSCAPE

-

4.1.

-

PORTER’S FIVE FORCES ANALYSIS

-

NEW ENTRANTS

-

4.1.3.

-

THREAT OF SUBSTITUTES

-

4.1.5.

-

BARGAINING POWER OF SUPPLIES

-

THREAT OF

-

BARGAINING POWER OF BUYERS

-

SEGMENT RIVALRY

-

VALUE CHAIN/SUPPLY

-

CHAIN ANALYSIS

-

MARKET DYNAMICS

-

INTRODUCTION

-

MARKET DRIVERS

-

MARKET RESTRAINTS

-

MARKET OPPORTUNITIES

-

MARKET

-

TRENDS

-

PATENT TRENDS

-

REGULATORY

-

LANDSCAPE

-

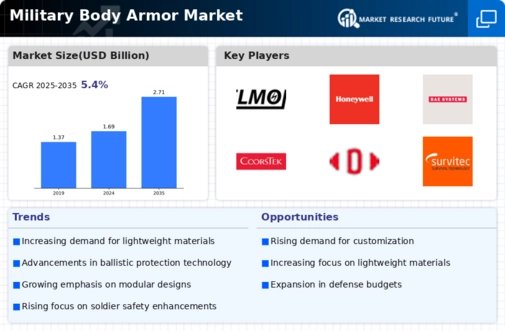

GLOBAL MILITARY BODY ARMOR MARKET, BY PROTECTION

-

LEVEL

-

INTRODUCTION

-

TYPE

- MARKET ESTIMATES & FORECAST, 2023-2030

- MARKET ESTIMATES & FORECAST, 2023-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2023-2030

-

1

-

6.2.2.

-

MARKET ESTIMATES & FORECAST BY REGION, 2023-2030

-

6.3.

-

TYPE 2-A

-

TYPE 2

- MARKET ESTIMATES &

- MARKET ESTIMATES & FORECAST

-

FORECAST, 2023-2030

-

BY REGION, 2023-2030

-

TYPE 3-A

- MARKET

-

6.5.1.

-

MARKET ESTIMATES & FORECAST, 2023-2030

-

ESTIMATES & FORECAST BY REGION, 2023-2030

-

TYPE 3

- MARKET ESTIMATES & FORECAST, 2023-2030

- MARKET ESTIMATES & FORECAST, 2023-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2023-2030

-

6.6.2.

-

MARKET ESTIMATES & FORECAST BY REGION, 2023-2030

-

6.7.

-

TYPE 4

-

GLOBAL MILITARY BODY ARMOR MARKET, BY PROTECTION TYPE

-

INTRODUCTION

-

BALLISTIC PROTECTION

- MARKET ESTIMATES & FORECAST, 2023-2030

- MARKET ESTIMATES & FORECAST,

- MARKET ESTIMATES & FORECAST BY REGION,

-

7.2.2.

-

MARKET ESTIMATES & FORECAST BY REGION, 2023-2030

-

7.3.

-

SPIKE PROTECTION

-

EDGED BLADE PROTECTION

- MARKET

-

7.4.1.

-

MARKET ESTIMATES & FORECAST, 2023-2030

-

ESTIMATES & FORECAST BY REGION, 2023-2030

-

GLOBAL MILITARY

-

BODY ARMOR MARKET, BY MATERIAL

-

INTRODUCTION

- MARKET ESTIMATES & FORECAST, 2023-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2023-2030

-

8.2.

-

STEEL

-

COMPOSITE CERAMICS

- MARKET

- MARKET ESTIMATES

-

ESTIMATES & FORECAST, 2023-2030

-

& FORECAST BY REGION, 2023-2030

-

ARAMID

- MARKET

-

8.4.1.

-

MARKET ESTIMATES & FORECAST, 2023-2030

-

ESTIMATES & FORECAST BY REGION, 2023-2030

-

ULTRA-HIGH-MOLECULAR-WEIGHT

- MARKET ESTIMATES & FORECAST,

- MARKET ESTIMATES & FORECAST BY REGION,

-

POLYETHYLENE (UHMWPE)

-

OTHERS

- MARKET

- MARKET ESTIMATES

-

ESTIMATES & FORECAST, 2023-2030

-

& FORECAST BY REGION, 2023-2030

-

GLOBAL MILITARY BODY

-

ARMOR MARKET, BY REGION

-

INTRODUCTION

- MARKET ESTIMATES & FORECAST

- MARKET ESTIMATES & FORECAST

- MARKET ESTIMATES &

- MARKET ESTIMATES

- US

-

9.2.

-

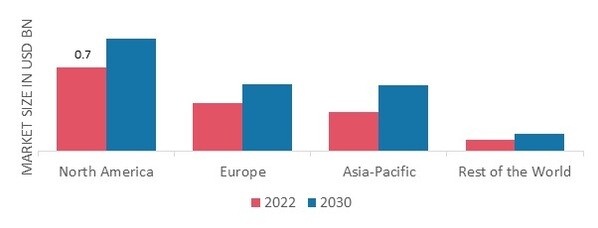

NORTH AMERICA

-

BY COUNTRY, 2023-2030

-

BY PROTECTION LEVEL, 2023-2030

-

FORECAST BY PROTECTION TYPE, 2023-2030

-

& FORECAST BY MATERIAL, 2023-2030

-

9.2.5.1.

-

MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL, 2023-2030

-

9.2.5.2.

-

MARKET ESTIMATES & FORECAST BY PROTECTION TYPE, 2023-2030

-

9.2.5.3.

-

MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

9.2.6.

-

CANADA

-

PROTECTION LEVEL, 2023-2030

-

FORECAST BY PROTECTION TYPE, 2023-2030

-

& FORECAST BY MATERIAL, 2023-2030

-

EUROPE

- GERMANY

- ITALY

-

9.3.1.

-

MARKET ESTIMATES & FORECAST BY COUNTRY, 2023-2030

-

9.3.2.

-

MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL, 2023-2030

-

9.3.3.

-

MARKET ESTIMATES & FORECAST BY PROTECTION TYPE, 2023-2030

-

9.3.4.

-

MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

9.3.5.

-

UK

-

LEVEL, 2023-2030

-

BY PROTECTION TYPE, 2023-2030

-

FORECAST BY MATERIAL, 2023-2030

-

9.3.6.1.

-

MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL, 2023-2030

-

9.3.6.2.

-

MARKET ESTIMATES & FORECAST BY PROTECTION TYPE, 2023-2030

-

9.3.6.3.

-

MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

9.3.7.

-

FRANCE

-

PROTECTION LEVEL, 2023-2030

-

FORECAST BY PROTECTION TYPE, 2023-2030

-

& FORECAST BY MATERIAL, 2023-2030

-

9.3.8.1.

-

MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL, 2023-2030

-

9.3.8.2.

-

MARKET ESTIMATES & FORECAST BY PROTECTION TYPE, 2023-2030

-

9.3.8.3.

-

MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

9.3.9.

-

REST OF EUROPE

-

BY PROTECTION LEVEL, 2023-2030

-

& FORECAST BY PROTECTION TYPE, 2023-2030

-

ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

ASIA-PACIFIC

- MARKET ESTIMATES & FORECAST BY COUNTRY, 2023-2030

- MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL,

- MARKET ESTIMATES & FORECAST BY PROTECTION

- MARKET ESTIMATES & FORECAST BY

- CHINA

- INDIA

-

TYPE, 2023-2030

-

MATERIAL, 2023-2030

-

9.4.5.1.

-

MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL, 2023-2030

-

9.4.5.2.

-

MARKET ESTIMATES & FORECAST BY PROTECTION TYPE, 2023-2030

-

9.4.5.3.

-

MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

9.4.6.

-

JAPAN

-

LEVEL, 2023-2030

-

BY PROTECTION TYPE, 2023-2030

-

FORECAST BY MATERIAL, 2023-2030

-

9.4.7.1.

-

MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL, 2023-2030

-

9.4.7.2.

-

MARKET ESTIMATES & FORECAST BY PROTECTION TYPE, 2023-2030

-

9.4.7.3.

-

MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

9.4.8.

-

REST OF ASIA-PACIFIC

-

FORECAST BY PROTECTION LEVEL, 2023-2030

-

& FORECAST BY PROTECTION TYPE, 2023-2030

-

ESTIMATES & FORECAST BY MATERIAL, 2023-2030

-

MIDDLE

- MARKET ESTIMATES & FORECAST

- MARKET ESTIMATES & FORECAST

- MARKET ESTIMATES &

- MARKET ESTIMATES

-

EAST & AFRICA

-

BY COUNTRY, 2023-2030

-

BY PROTECTION LEVEL, 2023-2030

-

FORECAST BY PROTECTION TYPE, 2023-2030

-

& FORECAST BY MATERIAL, 2023-2030

-

LATIN AMERICA

- MARKET ESTIMATES & FORECAST BY COUNTRY, 2023-2030

- MARKET ESTIMATES & FORECAST BY PROTECTION LEVEL,

- MARKET ESTIMATES & FORECAST BY PROTECTION

- MARKET ESTIMATES & FORECAST BY

-

TYPE, 2023-2030

-

MATERIAL, 2023-2030

-

COMPETITIVE LANDSCAPE

-

10.1.

-

COMPETITIVE SCENARIO

-

COMPETITIVE OVERVIEW

-

COMPETITIVE BENCHMARKING

-

MARKET

-

SHARE ANALYSIS

-

10.1.5.

-

MERGER & ACQUISITION

-

NEW PRODUCT DEVELOPMENT

-

COMPANY PROFILE

-

11.1.

-

3M (US)

-

11.1.2.

-

PRODUCT OFFERING

-

11.1.4.

-

KEY DEVELOPMENTS

-

11.1.6.

-

STRATEGY

-

11.2.1.

-

COMPANY OVERVIEW

-

11.2.3.

-

FINANCIAL OVERVIEW

-

11.2.5.

-

COMPANY OVERVIEW

-

FINANCIAL OVERVIEW

-

SWOT ANALYSIS

-

BAE SYSTEMS (UK)

- PRODUCT OFFERING

- KEY DEVELOPMENTS

-

SWOT ANALYSIS

-

11.3.

-

COORSTEK INC. (US)

-

11.3.2.

-

PRODUCT OFFERING

-

11.3.4.

-

KEY DEVELOPMENTS

-

11.3.6.

-

STRATEGY

-

11.4.1.

-

COMPANY OVERVIEW

-

11.4.3.

-

FINANCIAL OVERVIEW

-

11.4.5.

-

STRATEGY

-

COMPANY OVERVIEW

-

FINANCIAL OVERVIEW

-

SWOT ANALYSIS

-

DU PONT (US)

- PRODUCT OFFERING

- KEY DEVELOPMENTS

-

SWOT ANALYSIS

-

11.5.

-

ELMON (GREECE)

-

11.5.2.

-

PRODUCT OFFERING

-

11.5.4.

-

KEY DEVELOPMENTS

-

11.5.6.

-

STRATEGY

-

OFFERING

-

11.6.4.

-

KEY DEVELOPMENTS

-

11.6.6.

-

STRATEGY

-

11.7.1.

-

COMPANY OVERVIEW

-

11.7.3.

-

FINANCIAL OVERVIEW

-

11.7.5.

-

STRATEGY

-

COMPANY OVERVIEW

-

FINANCIAL OVERVIEW

-

SWOT ANALYSIS

-

HONEYWELL INTERNATIONAL INC. (US)

- COMPANY OVERVIEW

- PRODUCT

- FINANCIAL OVERVIEW

- SWOT ANALYSIS

-

MKU LIMITED (INDIA)

- PRODUCT OFFERING

- KEY DEVELOPMENTS

-

SWOT ANALYSIS

-

11.8.

-

POINT BLANK ENTERPRISES, INC. (US)

-

OVERVIEW

-

11.8.3.

-

FINANCIAL OVERVIEW

-

11.8.5.

-

STRATEGY

-

COMPANY

-

PRODUCT OFFERING

-

KEY DEVELOPMENTS

-

SWOT ANALYSIS

-

11.9.

-

SAFARILAND, LLC (US)

-

11.9.2.

-

PRODUCT OFFERING

-

11.9.4.

-

KEY DEVELOPMENTS

-

11.9.6.

-

STRATEGY

-

11.10.1.

-

COMPANY OVERVIEW

-

11.10.3.

-

FINANCIAL OVERVIEW

-

11.10.5.

-

STRATEGY

-

COMPANY OVERVIEW

-

FINANCIAL OVERVIEW

-

SWOT ANALYSIS

-

SURVITEC GROUP LIMITED (UK)

- PRODUCT OFFERING

- KEY DEVELOPMENTS

-

SWOT ANALYSIS

-

-

STRATEGY

-

LIST OF TABLES

-

GLOBAL MILITARY BODY ARMOR

-

MARKET: BY REGION, 2023-2030

-

NORTH AMERICA:

-

MILITARY BODY ARMOR MARKET: BY COUNTRY, 2023-2030

-

Table 3

-

EUROPE MILITARY BODY ARMOR MARKET: BY COUNTRY, 2023-2030

-

Table

-

ASIA-PACIFIC MILITARY BODY ARMOR MARKET: BY COUNTRY, 2023-2030

-

ROW MILITARY BODY ARMOR MARKET: BY COUNTRY,

-

GLOBAL MILITARY BODY ARMOR MARKET,

-

BY PROTECTION TYPE, BY REGIONS, 2023-2030

-

NORTH

-

AMERICA: MILITARY BODY ARMOR MARKET, BY PROTECTION TYPE, BY COUNTRY, 2023-2030

-

EUROPE MILITARY BODY ARMOR MARKET, BY PROTECTION TYPE,

-

BY COUNTRY, 2023-2030

-

ASIA-PACIFIC MILITARY

-

BODY ARMOR MARKET BY PROTECTION TYPE, BY COUNTRY, 2023-2030

-

Table 10

-

ROW MILITARY BODY ARMOR MARKET BY PROTECTION TYPE, BY COUNTRY, 2023-2030

-

GLOBAL MILITARY BODY ARMOR MARKET BY MATERIAL: BY REGIONS,

-

NORTH AMERICA: MILITARY BODY ARMOR

-

MARKET BY MATERIAL: BY COUNTRY, 2023-2030

-

EUROPE

-

MILITARY BODY ARMOR MARKET BY MATERIAL: BY COUNTRY, 2023-2030

-

Table

-

ASIA-PACIFIC MILITARY BODY ARMOR MARKET BY MATERIAL: BY COUNTRY,

-

ROW MILITARY BODY ARMOR MARKET

-

BY MATERIAL: BY COUNTRY, 2023-2030

-

GLOBAL

-

MILITARY BODY ARMOR MARKET BY PROTECTION LEVEL: BY REGIONS, 2023-2030

-

NORTH AMERICA: MILITARY BODY ARMOR MARKET BY PROTECTION

-

LEVEL: BY COUNTRY, 2023-2030

-

EUROPE MILITARY

-

BODY ARMOR MARKET BY PROTECTION LEVEL: BY COUNTRY, 2023-2030

-

Table 19

-

ASIA-PACIFIC MILITARY BODY ARMOR MARKET BY PROTECTION LEVEL: BY COUNTRY, 2023-2030

-

ROW MILITARY BODY ARMOR MARKET BY PROTECTION

-

LEVEL: BY COUNTRY, 2023-2030

-

GLOBAL MILITARY

-

BODY ARMOR MARKET: BY REGION, 2023-2030

-

GLOBAL

-

MILITARY BODY ARMOR MARKET: BY PROTECTION TYPE, 2023-2030

-

Table 23

-

GLOBAL MILITARY BODY ARMOR MARKET: BY MATERIAL, 2023-2030

-

Table

-

GLOBAL MILITARY BODY ARMOR MARKET: BY PROTECTION LEVEL, 2023-2030

-

NORTH AMERICA: MILITARY BODY ARMOR MARKET,

-

BY COUNTRY

-

NORTH AMERICA: MILITARY BODY ARMOR

-

MARKET, BY PROTECTION TYPE

-

NORTH AMERICA:

-

MILITARY BODY ARMOR MARKET, BY MATERIAL

-

NORTH

-

AMERICA: MILITARY BODY ARMOR MARKET, BY PROTECTION LEVEL

-

Table 29

-

EUROPE: MILITARY BODY ARMOR MARKET, BY COUNTRY

-

Table 30

-

EUROPE: MILITARY BODY ARMOR MARKET, BY PROTECTION TYPE

-

Table

-

EUROPE: MILITARY BODY ARMOR MARKET, BY MATERIAL

-

EUROPE: MILITARY BODY ARMOR MARKET, BY PROTECTION

-

LEVEL

-

ASIA-PACIFIC: MILITARY BODY ARMOR

-

MARKET, BY COUNTRY

-

ASIA-PACIFIC: MILITARY

-

BODY ARMOR MARKET, BY PROTECTION TYPE

-

ASIA-PACIFIC:

-

MILITARY BODY ARMOR MARKET, BY MATERIAL

-

ASIA-PACIFIC:

-

MILITARY BODY ARMOR MARKET, BY PROTECTION LEVEL

-

Table 37

-

ROW: MILITARY BODY ARMOR MARKET, BY REGION

-

Table 38

-

ROW MILITARY BODY ARMOR MARKET, BY PROTECTION TYPE

-

Table 39

-

ROW MILITARY BODY ARMOR MARKET, BY MATERIAL

-

Table 40

-

ROW MILITARY BODY ARMOR MARKET, BY PROTECTION LEVEL

-

LIST

-

OF FIGURES

-

RESEARCH PROCESS OF MRFR

-

FIGURE

-

TOP-DOWN & BOTTOM-UP APPROACH

-

FIGURE 3

-

MARKET DYNAMICS

-

IMPACT ANALYSIS: MARKET DRIVERS

-

IMPACT ANALYSIS: MARKET RESTRAINTS

-

FIGURE 6

-

PORTER'S FIVE FORCES ANALYSIS

-

VALUE CHAIN

-

ANALYSIS

-

GLOBAL MILITARY BODY ARMOR MARKET SHARE,

-

BY PROTECTION LEVEL, 2023 (%)

-

GLOBAL MILITARY BODY

-

ARMOR MARKET, BY PROTECTION LEVEL, 2023-2030 (USD MILLION)

-

FIGURE 10

-

GLOBAL MILITARY BODY ARMOR MARKET SHARE, BY PROTECTION TYPE, 2023 (%)

-

FIGURE

-

GLOBAL MILITARY BODY ARMOR MARKET, BY PROTECTION TYPE, 2023-2030

-

(USD MILLION)

-

GLOBAL MILITARY BODY ARMOR MARKET

-

SHARE, BY MATERIAL, 2023 (%)

-

GLOBAL MILITARY BODY

-

ARMOR MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

-

GLOBAL

-

MILITARY BODY ARMOR MARKET SHARE (%), BY REGION, 2023

-

FIGURE 15

-

GLOBAL MILITARY BODY ARMOR MARKET, BY REGION, 2023-2030 (USD MILLION)

-

FIGURE

-

NORTH AMERICA: MILITARY BODY ARMOR MARKET SHARE (%), 2023

-

NORTH AMERICA: MILITARY BODY ARMOR MARKET BY COUNTRY,

-

EUROPE MILITARY BODY ARMOR

-

MARKET SHARE (%), 2023

-

EUROPE MILITARY BODY ARMOR

-

MARKET BY COUNTRY, 2023-2030 (USD MILLION)

-

ASIA-PACIFIC

-

MILITARY BODY ARMOR MARKET SHARE (%), 2023

-

ASIA-PACIFIC

-

MILITARY BODY ARMOR MARKET BY COUNTRY, 2023-2030 (USD MILLION)

-

FIGURE 22

-

REST OF THE WORLD MILITARY BODY ARMOR MARKET SHARE (%), 2023

-

FIGURE 23

-

REST OF THE WORLD MILITARY BODY ARMOR MARKET BY COUNTRY, 2023-2030 (USD MILLION)

Leave a Comment