Research Methodology on Electronic Warfare Market

Introduction

The research report on Global Electronic Warfare Market Research Report – Forecast to 2030 provides an insight into the market dynamics including driving forces, restraints, trends and opportunities influencing the growth of the global electronic warfare equipment market for the forecast period of 2023-2030. According to Market Research Future (MRFR), the Global Electronic Warfare Market is expected to witness a steady CAGR during the assessment period (2023–2030).

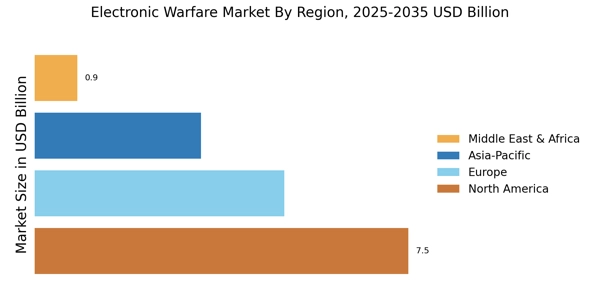

Nowadays, the rising demand for advanced and suitable communication jammers, passive target-identification systems, and existing jamming technology have boosted the growth of the Global Electronic Warfare Market. Additionally, technological innovation is another major driver of the market growth. Effective communication among the defence personnel plays a primary role on the battlefield. Electronic warfare technology finds applications in cognitive radio, communications intelligence, electronic countermeasures, and electronic attacks. Moreover, the increasing telecom infrastructure in regions such as North America, Asia-Pacific, and Europe is likely to propel market growth in the forthcoming years.

PURPOSE AND OBJECTIVES

The purpose of this study is to thoroughly examine the electronic warfare market globally. The primary objective of the research is to evaluate the market size across regions, based on component, platform, system type, and end-user. The research focuses on analyzing the current market trends, emerging markets, and relevant factors influencing the electronic warfare equipment market. The target audience will benefit from the research information as it will help to identify potential industry investments and provide an understanding of key market segments.

RESEARCH METHODOLOGY

The research methodology adopted for this report is based on a mix of both primary and secondary research.

SECONDARY RESEARCH:

Secondary research collected data and information from books, industry journals, published reports, white papers, company reports and press releases. White papers, surveys, and magazines are all sources of secondary research. The research was also conducted by using the internet and industry-leading databases, which include Hoovers, Bloomberg Businessweek, Factiva, S&P Capital IQ, OneSource, and many more.

PRIMARY RESEARCH:

Primary research incorporated a survey of the company's customers, suppliers, and industry experts. The primary research was primarily done through interviews, questionnaires, and analytics of secondary data. Interviews were conducted with industry experts both in person and via Skype. Furthermore, the primary research involved interviews with product manufacturers, distributors and representatives.

APPROACHES USED:

Bottom-Up Approach:

The bottom-up approach was used to predict the size of the electronic warfare market. To some extent, the overall market has been estimated or forecasted by studying the estimated sales of the individual markets. The bottom-up approach makes use of the voter counting technique.

Top-Down Approach:

The top-down approach is used to validate the bottom-up approach used for estimating and predicting the electronic warfare equipment market size. This approach is only used to deduce the overall size of the market when top-level insights into the electronic warfare equipment market are available.

Factor Analysis:

In this study, factor analysis is used to identify the factors that had the greatest impact on the market growth. This is done by analyzing various factors, such as export policies, regulatory landscape, economic trends, and product demand.

Time-Series Analysis:

Time-series analysis was used to record and analyze trends and records. This is done to make accurate forecasts about the future. This analysis is performed to identify the relations between historic, current, and future market trends.

Demand-Side and Supply-Side Data Triangulation:

The estimates and forecasts of the Global Electronic Warfare Equipment Market used demand-side and supply-side triangulation. This method intimately evaluated the exact statistics for each segment and sub-segment. This involves a demand-side assessment of the Global Electronic Warfare Equipment Market and an in-depth assessment of the supply-side in terms of creating capacity and production.

CONCLUSION

In conclusion, through rigorous field research and analysis, this study provides a comprehensive view of the Global Electronic Warfare Equipment Market for the forecast period of 2023-2030. The study covers a stratified analysis of the market from components, platforms, system types, end-users, and regions. Strategic recommendations were also provided in the research report. All these insights presented in the research will help industry players and stakeholders in making informed decisions about their business strategies.