Increased Military Expenditure

The cognitive electronic warfare system Market is significantly influenced by rising military expenditures across various nations. Governments are prioritizing the enhancement of their defense capabilities, particularly in electronic warfare, to counter emerging threats. In recent years, military budgets have seen an upward trend, with many countries allocating substantial resources to modernize their electronic warfare systems. This trend is expected to continue, as nations recognize the strategic importance of cognitive electronic warfare in maintaining national security. The increased funding is likely to facilitate the development and deployment of advanced cognitive systems, thereby propelling market growth and innovation.

Integration of Machine Learning

The Cognitive Electronic Warfare System Market is witnessing a transformative shift with the integration of machine learning technologies. These advancements enable systems to learn from past encounters and adapt to new electronic threats dynamically. By leveraging machine learning algorithms, cognitive electronic warfare systems can enhance their decision-making processes, improving response times and effectiveness in the field. This integration is expected to drive market growth, as military organizations increasingly seek to implement intelligent systems that can autonomously analyze and respond to complex electronic environments. The potential for machine learning to revolutionize electronic warfare capabilities is substantial, indicating a promising future for the market.

Advancements in Signal Processing

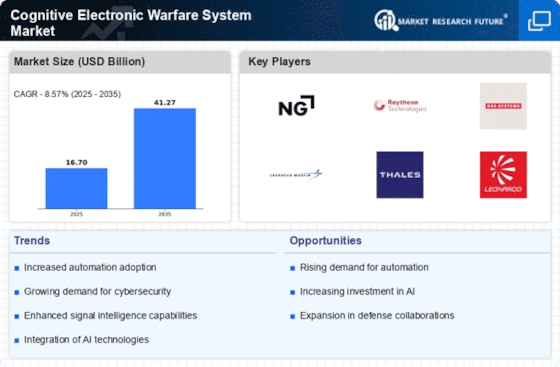

The Cognitive Electronic Warfare System Market is experiencing a surge in advancements in signal processing technologies. These innovations enhance the ability to detect, analyze, and respond to electronic threats in real-time. As military and defense sectors increasingly rely on sophisticated electronic warfare capabilities, the demand for systems that can process vast amounts of data efficiently is paramount. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by the need for improved situational awareness and threat mitigation. This growth indicates a robust investment in research and development, as stakeholders seek to integrate cutting-edge signal processing techniques into their electronic warfare systems.

Collaborative Defense Initiatives

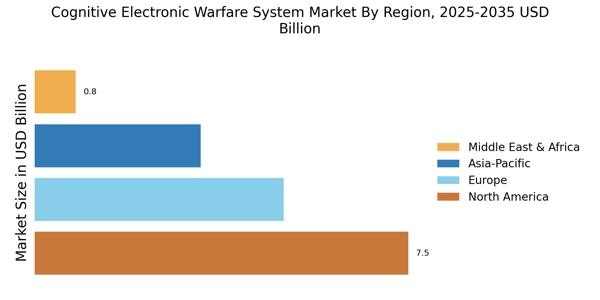

The Cognitive Electronic Warfare System Market is benefiting from collaborative defense initiatives among nations. These partnerships aim to share knowledge, technology, and resources to enhance electronic warfare capabilities collectively. By pooling expertise and fostering innovation, countries can develop more effective cognitive electronic warfare systems that address shared security challenges. Such collaborations are likely to accelerate the pace of technological advancements and improve the overall effectiveness of electronic warfare strategies. As nations recognize the importance of working together in this domain, the market is expected to see increased investment and development, further driving growth in cognitive electronic warfare systems.

Growing Threat of Electronic Warfare

The Cognitive Electronic Warfare System Market is propelled by the escalating threat of electronic warfare. As adversaries increasingly employ sophisticated electronic tactics, the need for advanced cognitive systems becomes more pressing. This environment necessitates the development of systems capable of countering a wide array of electronic threats, including jamming and spoofing. The market is responding to this challenge by innovating solutions that enhance resilience against such tactics. Analysts suggest that the demand for cognitive electronic warfare systems will rise sharply, as military organizations seek to safeguard their operations and maintain a technological edge over potential adversaries.