Advancements in Quantum Computing

The Quantum Warfare Market is experiencing a surge in advancements in quantum computing technologies. These innovations are pivotal in enhancing computational capabilities, enabling faster data processing and complex problem-solving. As nations invest heavily in quantum research, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the coming years. This growth is driven by the need for superior military applications, including cryptography and secure communications. The integration of quantum computing into defense strategies is likely to redefine operational capabilities, making it a critical area of focus for military organizations worldwide.

Emerging Threats in Cyber Warfare

The Quantum Warfare Market is increasingly influenced by the emergence of sophisticated cyber threats. As adversaries develop advanced cyber capabilities, the demand for quantum technologies that can counteract these threats is rising. Quantum encryption methods, which leverage the principles of quantum mechanics, offer unprecedented security measures that traditional systems cannot match. This shift is reflected in defense budgets, with a notable increase in allocations for quantum cybersecurity initiatives. The urgency to protect sensitive information and critical infrastructure from cyber attacks is propelling investments in quantum solutions, thereby shaping the future landscape of military operations.

Regulatory Frameworks and Standards

The Quantum Warfare Market is also influenced by the development of regulatory frameworks and standards governing quantum technologies. As the market matures, the establishment of clear guidelines is essential to ensure the safe and ethical use of quantum capabilities in warfare. Governments are actively working to create policies that address the unique challenges posed by quantum technologies, including issues related to security, privacy, and international cooperation. The formulation of these regulations is likely to impact investment decisions and the pace of innovation within the Quantum Warfare Market. A robust regulatory environment may foster trust and encourage broader adoption of quantum solutions in military applications.

International Arms Race in Quantum Technologies

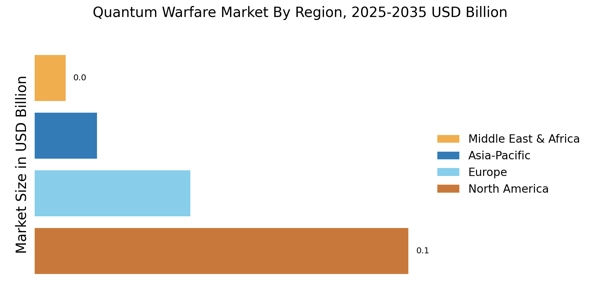

The Quantum Warfare Market is witnessing an international arms race as countries strive to gain a competitive edge in quantum technologies. This race is characterized by significant investments in research and development, with nations recognizing the strategic importance of quantum capabilities in warfare. Reports indicate that defense spending on quantum technologies is expected to reach billions of dollars in the next decade. The pursuit of quantum supremacy is not merely a technological endeavor; it is a matter of national security. As countries enhance their quantum arsenals, the implications for global stability and military strategy are profound, necessitating a reevaluation of defense policies.

Collaboration Between Public and Private Sectors

The Quantum Warfare Market is increasingly shaped by collaboration between public and private sectors. Governments are partnering with private enterprises to accelerate the development of quantum technologies, recognizing that innovation often stems from the private sector. This collaboration is fostering a vibrant ecosystem for quantum research, leading to breakthroughs that enhance military capabilities. The establishment of public-private partnerships is likely to streamline funding and resources, enabling faster deployment of quantum solutions in defense applications. As these partnerships evolve, they may redefine the landscape of the Quantum Warfare Market, creating new opportunities for technological advancements.