Mining Explosives Market Analysis

Mining Explosives Market Research Report Information By Type (Bulk Explosives, Packaged Explosives and Others), By Application (Coal Mining, Metal Mining and Quarry & Non-Metal Mining), and By Region (North America, Europe, Asia-Pacific, and Rest of the World) - Forecast Till 2035

Market Summary

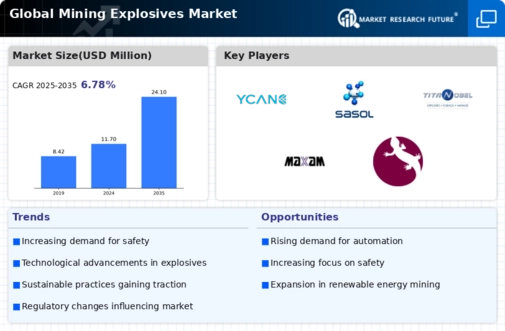

As per Market Research Future Analysis, the Global Mining Explosives Market was valued at USD 11687.02 million in 2024 and is projected to reach USD 24053.79 million by 2035, growing at a CAGR of 6.78% from 2025 to 2035. The market growth is driven by rising metal extraction activities and increasing demand for coal, which accounts for 30% of global energy consumption. Major coal-producing countries include China, the U.S., India, Indonesia, and South Africa, with China alone contributing to 50% of global coal demand. The market is characterized by a significant share of bulk explosives and ammonium nitrate fuel oil (ANFO), which together represent over 60% of the market. Strategic partnerships and technological advancements are shaping the industry's future, focusing on safety and environmental sustainability.

Key Market Trends & Highlights

Market Size & Forecast

| 2024 Market Size | USD 11687.02 million |

| 2035 Market Size | USD 24053.79 million |

| CAGR (2024-2035) | 6.78% |

Market Trends

Growing demand for coal, representing one of the major factors to boost market growth globally.

The global production of coal was around 3.2% in 2020, mainly due to China's transition to less energy-intensive products for power generation, the weakening of the global economy, and the flagging electricity demand in Asian countries. Apart from China, coal mining in the US continues to be the dominant use for explosives, with about 64% of total consumption in 2020. Thus, in the coming years, this might change as the US economy is shifting to gas in power plants. Furthermore, coal mining in India accounts for more than 70% of the explosive's application in 2020.

Bulk explosives and ammonium nitrate fuel oil (ANFO) account for more than 60% of the market share as ANFO is gaining prominence owing to its safety advantage over the other products. Higher production of coal implies a higher requirement for explosives. Sustained efforts to increase coal production for power generation, steel production, cement manufacturing, and liquid fuel are expected to gain momentum during the assessment period.

Dyno Nobel and BHP merged together at the beginning of January 2024. The venture aims to encourage sustainable mining by producing environmentally friendly explosives or blast technologies. Moreover, this partnership is a part of BHP’s larger framework aimed at achieving net-zero emissions by 2050 and endorsing Dyno Nobel’s commitment to environmental aspects resulting from mining operations.

<p>The Global Mining Explosives Market is poised for growth as advancements in technology and increasing demand for minerals drive innovation in explosive materials and applications.</p>

U.S. Geological Survey (USGS)

Mining Explosives Market Market Drivers

Market Growth Projections

Rising Demand for Minerals

The Global Mining Explosives Market Industry is experiencing a surge in demand for minerals, driven by the increasing need for raw materials in various sectors such as construction, automotive, and electronics. As urbanization accelerates globally, the extraction of minerals becomes paramount. For instance, the demand for copper and lithium is projected to rise significantly, which in turn propels the need for efficient blasting solutions. This trend is reflected in the market's anticipated growth, with a valuation of 11.7 USD Billion in 2024 and a forecasted increase to 24.1 USD Billion by 2035, indicating a robust compound annual growth rate of 6.78% from 2025 to 2035.

Increased Investment in Mining Projects

Investment in mining projects is a critical driver for the Global Mining Explosives Market Industry. Governments and private entities are increasingly funding exploration and extraction initiatives, particularly in regions rich in untapped mineral resources. For instance, countries in Africa and South America are witnessing a surge in mining investments, which directly correlates with the demand for explosives. This influx of capital is likely to stimulate market growth, as mining companies seek efficient blasting solutions to maximize output. The market is projected to grow from 11.7 USD Billion in 2024 to 24.1 USD Billion by 2035, reflecting the positive impact of these investments.

Technological Advancements in Explosives

Innovations in explosive technology are reshaping the Global Mining Explosives Market Industry. Enhanced safety features, precision in blasting, and environmentally friendly options are becoming increasingly prevalent. For example, the development of electronic detonators allows for improved timing and control, minimizing the risk of accidents and optimizing resource extraction. These advancements not only enhance operational efficiency but also align with global sustainability goals. As the industry embraces these technologies, it is likely to attract investments and foster growth, contributing to the market's projected expansion to 24.1 USD Billion by 2035.

Regulatory Framework and Safety Standards

The Global Mining Explosives Market Industry is significantly influenced by stringent regulatory frameworks and safety standards imposed by governments worldwide. These regulations aim to ensure safe handling, storage, and usage of explosives in mining operations. Compliance with these standards often necessitates the adoption of advanced explosive products that meet safety requirements. As a result, manufacturers are compelled to innovate and improve their offerings, which may lead to increased market penetration. The focus on safety and compliance is expected to drive the market's growth trajectory, supporting its rise to an estimated 24.1 USD Billion by 2035.

Growing Focus on Sustainable Mining Practices

The Global Mining Explosives Market Industry is increasingly aligning with sustainable mining practices, driven by environmental concerns and corporate responsibility. Mining companies are adopting greener explosives and methods that reduce environmental impact, such as lower emissions and minimized land disturbance. This shift not only meets regulatory requirements but also appeals to environmentally conscious investors and consumers. As sustainability becomes a core focus, the market is likely to witness a transformation in product offerings, potentially enhancing growth prospects. The anticipated market expansion to 24.1 USD Billion by 2035 underscores the importance of sustainability in shaping future trends.

Market Segment Insights

Get more detailed insights about Mining Explosives Market Research Report—Global Forecast till 2032

Regional Insights

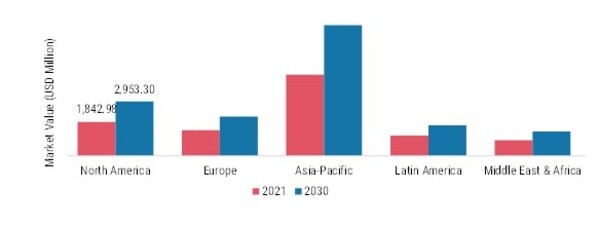

By Region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific mining explosives market accounted for USD 4,418.98 million in 2021 and is expected to exhibit a 7.06 % CAGR during the study period. The growing mineral extraction activities in emerging economies have led to a strong increase in the demand for commodities from the mining and metal industries.

For instance, india's mining explosives market is among the fastest growing market as India is one of the largest emerging markets in the Asia-Pacific region. According to the Ministry of Mines, mineral production in India has increased by 9.7% in November 2022 with the cumulative growth of 4.7% between April 2022-November 2022. Hence, Asia-Pacific is anticipated to register the highest growth rate over the forecast period from 2022–2030.

Further, the major countries studied are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: MINING EXPLOSIVES MARKET SHARE BY REGION 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

North America's mining explosives market accounts for the second-largest market share due to the rising infrastructure activities along with high demand for energy in the industrial sector. Further, the US mining explosives market held the largest market share, and the Canadian mining explosives market also holds a significant market share in the North American region.

The Europe mining explosives market is expected to grow at a CAGR of 6.31% from 2022 to 2030. This is due to growing industrialization, along with rapid demand for mining explosives for various application. Moreover, the German mining explosives market held the largest market share, and the France mining explosives market was the fastest-growing market in the European region

Key Players and Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the mining explosives market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the mining explosives industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the global mining explosives industry to benefit clients and expand the mining explosives market sector is to manufacture locally to reduce operating costs. In recent years, mining explosives have come up with various features with some of the most significant benefits.

Orica Limited is a global mining explosives manufacturing company committed to improving the lives of people through advancement in mining explosives technologies, services, and solutions. In November 2021, Orica had launched 4D bulk explosives technology at MINExpo, Las Vegas. The 4D bulk explosives technology will enable Orica’s customers to seamlessly match a greater range of explosives energy in mining and target specific blast outcomes in real-time.

Also, BME has planned the expansion of the offices in the US in Denver, Colorado, and Utah IN January 2021. BME is set to provide service and supply across the US, which offers an explosives product range, including electronic and non-electric initiation systems and packaged explosives products.

Key Companies in the Mining Explosives Market market include

Industry Developments

In April 2021 Austin Powder introduced its explosives production to a new level with the modernization of its HMX plant in Rafaela. Austin can produce a new “Class 5” granulometry product (micronized) required for shock tube manufacturing. Class 5 HMX was developed in Rafaela Plant in partnership with a customer & competitor in the explosives industry.

In August 2020 MAXAM announced the official launch of its new integrated blasting service: X-Energy, to optimize the total cost of ownership in mining, quarrying, and infrastructures operations. X-Energy combines the most advanced explosives technology in the market (Smart Rioflex) and a set of digital tools for optimized blast design and execution, integrated in MAXAM Blast Center.

In April 2024, Orica, a global leader in mining explosives, announced its strategic collaboration with Enaex, a leading provider of mining services in Latin America. This partnership aims to develop digital blasting solutions that enhance the effectiveness and safety of mines. With Orica's knowledge of digital innovation and Enaex's knowledge of our region, this agreement is set to achieve advanced blasting techniques for better environment-friendly methods to reduce environmental impacts as well as operational costs.

In March 2023, Sasol partnered with Rio Tinto to improve blasting technology in the mining industry. This cooperation intends to employ new explosive mixtures that enable easy breaking down into smaller pieces and reduce pollution levels caused by them. By linking Sasol's chemical expertise with RIO Tinto's experience in mine operations, this agreement aims to create innovative solutions that will improve project productivity and sustainability.

Future Outlook

Mining Explosives Market Future Outlook

<p>The Global Mining Explosives Market is projected to grow at a 6.78% CAGR from 2025 to 2035, driven by technological advancements, increasing mining activities, and stringent safety regulations.</p>

New opportunities lie in:

- <p>Invest in eco-friendly explosives to meet regulatory demands and attract environmentally conscious clients. Leverage automation and digital technologies to enhance operational efficiency and reduce costs. Expand into emerging markets with untapped mineral resources to capture new customer segments.</p>

<p>By 2035, the Global Mining Explosives Market is expected to exhibit robust growth, reflecting evolving industry dynamics and increased demand.</p>

Market Segmentation

Mining Explosives Type Outlook

- Bulk Explosives

- Packaged Explosives

- Others

Mining Explosives Regional Outlook

- {"North America"=>["US"

- "Canada"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Russia"

- "Poland"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Indonesia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Mining Explosives Application Outlook

- Coal Mining

- Metal Mining

- Quarry & Non-Metal Mining

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 11,687.02 million |

| Market Size 2035 | 24053.79 |

| Compound Annual Growth Rate (CAGR) | 6.78% (2025 - 2035) |

| Base Year | 2024 |

| Forecast Period | 2025 - 2035 |

| Historical Data | 2019 & 2020 |

| Forecast Units | Value (USD million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Orica Limited, BME South Africa, Solar Industries India Ltd, Incitec Pivot Ltd, SASOL, YARA, Titanobel, MAXAM, Austin Detonator, Eurenco SA, Explosia, Inc., EPC Groupe, Nitroerg SA, NOF Corporation, Hanwa Corporation |

| Key Market Opportunities | The growing demand from coal industry is expected to argument the market growth Rise in infrastructure activity |

| Key Market Dynamics | Promising growth of the mining industry in Middle East region |

| Market Size 2025 | 12479.64 |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the mining explosives market?

19,752.55 million (2023)

Which industry will play a crucial role in taking the Mining Explosives market ahead??

The coal mining industry will play a prominent role in taking the market forward.

How Big is the China mining explosives market?

1,262.45 million (2023)

What is the growth rate of the mining explosives market?

6.78%

Which region held the largest market share in the mining explosives market?

Asia Pacific

Who are the key players in the mining explosives market?

Orica Limited, BME South Africa, Solar Industries India Ltd, Incitec Pivot Ltd, SASOL, YARA, Titanobel, MAXAM, Austin Detonator, Eurenco SA, Explosia, Inc., EPC Groupe, Nitroerg SA, NOF Corporation, Hanwa Corporation

Which Type led the mining explosives market?

Packaged explosive

Which application had the largest market share in the mining explosives market?

Coal Mining

-

--- "Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

- Scope of the Study

- List of Assumptions

- Markets Structure

-

Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Forecast Model

-

Market Factor Analysis

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Service Providers of Mining Explosives

- Distributors/Retailers/Wholesalers/E-Commerce Merchants

- End-Users

-

Porter’s Five Forces Model

- Threat of New Entrants

- Intensity of Competitive Rivalry

- Threat of Substitutes

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Pricing Analysis

-

Supply Chain Analysis

-

Market Dynamics of Global Mining Explosives Market

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

-

Global Mining Explosives Market, by Type

- Introduction

-

Bulk Explosives

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Packaged Explosives

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Global Mining Explosives Market, by Application

- Introduction

-

Coal Mining

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Metal Mining

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Quarry & Non-Metal Mining

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Global Mining Explosives Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Poland

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2022–2030

- China

- India

- South Korea

- Japan

- Indonesia

- Rest of Asia-Pacific

-

Latin America

- Market Estimates & Forecast, 2022–2030

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Middle East & Africa

- Market Estimates & Forecast, 2022–2030

- Saudi Arabia

- UAE

- Turkey

- Egypt

- South Africa

- Rest of the Middle East & Africa

-

Competitive Landscape

- Introduction

- Market Key Strategies

- Competitive Benchmarking

- Key Development Analysis (Expansions/Mergers & Acquisitions/Joint Ventures/New Mining Explosives Developments/Agreements/Investments)

-

Company Profiles

-

Orica Limited

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- BME South Africa

- Solar Industries India Ltd

- Incitec Pivot Ltd

- SASOL

- YARA

- Titanobel

- MAXAM

- Austin Detonator

- Eurenco SA

- Explosia, Inc.

- EPC Groupe

- Nitroerg SA

- NOF Corporation

- Hanwa Corporation

-

Orica Limited

-

Appendix

-

-

List of Tables and Figures

- LIST OF TABLES

- Table 1: Global Mining Explosives Market, by region, 2022–2030

- Table 2: North America: Mining Explosives Market, by Country, 2022–2030

- Table 3: Europe: Mining Explosives Market, by Country, 2022–2030

- Table 4: Asia-Pacific: Mining Explosives Market, by Country, 2022–2030

- Table 5: Middle East & Africa: Mining Explosives Market, by Country, 2022–2030

- Table 6: Latin America: Mining Explosives Market, by Country, 2022–2030

- Table 13: Global Mining Explosives Type Market, by Region, 2022–2030

- Table 14: North America: Mining Explosives Type Market, by Country, 2022–2030

- Table 15: Europe: Mining Explosives Type Market, by Country, 2022–2030

- Table 16: Asia-Pacific: Mining Explosives Type Market, by Country, 2022–2030

- Table 17: Middle East & Africa: Mining Explosives Type Market, by Country, 2022–2030

- Table 18: Latin America: Mining Explosives Type Market, by Country, 2022–2030

- Table 19: Global Mining Explosives Type Market, by Region, 2022–2030

- Table 20: North America: Mining Explosives Type Market, by Country, 2022–2030

- Table 21: Europe: Mining Explosives Type Market, by Country, 2022–2030

- Table 22: Asia-Pacific: Mining Explosives Type Market, by Country, 2022–2030

- Table 23: Middle East & Africa: Mining Explosives Type Market, by Country, 2022–2030

- Table 24: Latin America: Mining Explosives Type Market, by Country, 2022–2030

- Table 25: Global Mining Explosives Type Market, by Region, 2022–2030

- Table 26: Global Mining Explosives Type Market, by Region, 2022–2030

- Table 27: North America: Mining Explosives Market, by Country, 2022–2030

- Table 29: North America: Mining Explosives Market, by Type, 2022–2030

- Table 30: North America: Mining Explosives Market, by Application, 2022–2030

- Table 31: Europe: Mining Explosives Market, by Country, 2022–2030

- Table 32: Europe: Mining Explosives Market, by Type, 2022–2030

- Table 33: Europe: Mining Explosives Market, by Application, 2022–2030

- Table 34: Asia-Pacific: Mining Explosives Market, by Country, 2022–2030

- Table 35: Asia-Pacific: Mining Explosives Market, by Type, 2022–2030

- Table 36: Asia-Pacific: Mining Explosives Market, by Application, 2022–2030

- Table 37: Middle East & Africa: Mining Explosives Market, by Country, 2022–2030

- Table 38: Middle East & Africa: Mining Explosives Market, by Type, 2022–2030

- Table 39: Middle East & Africa: Mining Explosives Market, by Application, 2022–2030

- Table 40: Latin America: Mining Explosives Market, by Country, 2022–2030

- Table 41: Latin America: Mining Explosives Market, by Type, 2022–2030

- Table 42: Latin America: Mining Explosives Market, by Application, 2022–2030 LIST OF FIGURES

- FIGURE 1 Global Mining Explosives Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Porter’s Five Forces Analysis of Global Mining Explosives Market

- FIGURE 4 Value Chain/Supply Chain of Global Mining Explosives Market

- FIGURE 5 Share of Global Mining Explosives Market, by Country, 2021 (%)

- FIGURE 6 Global Mining Explosives Market, 2022–2030

- FIGURE 7 Global Mining Explosives Market Size, by Type, 2022–2030

- FIGURE 8 Share of Global Mining Explosives Market, by Type, 2020 (%)

- FIGURE 9 Global Mining Explosives Market Size, by Application, 2022–2030

- FIGURE 10 Share of Global Mining Explosives Market, by Application, 2021 (%)"

Mining Explosives Market Segmentation

Mining Explosives Type Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Mining Explosives Application Outlook (USD Million, 2019–2028)

Coal Mining

Metal Mining

Quarry & Non-Metal Mining

Mining Explosives Regional Outlook (USD Million, 2019–2028)

North America Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

North America Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

US Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

US Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

CANADA Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

CANADA Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Europe Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Europe Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Germany Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Germany Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

France Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

France Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

UK Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

UK Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

ITALY Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

ITALY Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

SPAIN Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Spain Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Rest Of Europe Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

REST of EUROPE Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Asia-Pacific Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Asia-Pacific Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

China Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

China Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Japan Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Japan Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

India Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

India Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Indonesia Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Indonesia Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

South Korea Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

South Korea Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Rest of Asia-Pacific Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Rest of Asia-Pacific Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Rest of the World Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Rest of the World Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Middle East Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Middle East Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Africa Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Africa Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Latin America Outlook (USD Million, 2019–2028)

Bulk Explosives

Packaged Explosives

Others

Latin America Mining Explosives by ApplicationCoal Mining

Metal Mining

Quarry & Non-Metal Mining

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment