-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-commerce

- End Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Intensity of Competitive Rivalry

-

Market Dynamics of Global Neopentyl Glycol Market

-

Introduction

-

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

Trends/Technology

-

Global Neopentyl Glycol Market by Type

-

Introduction

-

Molten

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Flakes

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Slurry

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Global Neopentyl Glycol Market by Application

-

Introduction

-

Coatings

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Adhesives & Sealants

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Insulation

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Plasticizers

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Fibers

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Agrochemicals

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Fuel Additives

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Dyes

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Emollient

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Others

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Global Neopentyl Glycol Market, by End-use industry

-

Introduction

-

Paints & Coatings

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Automotive

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Construction

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Chemicals

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Plastics

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Textiles

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Pharmaceuticals

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Cosmetics & Personal Care

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

Others

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Region, 2025−2034

-

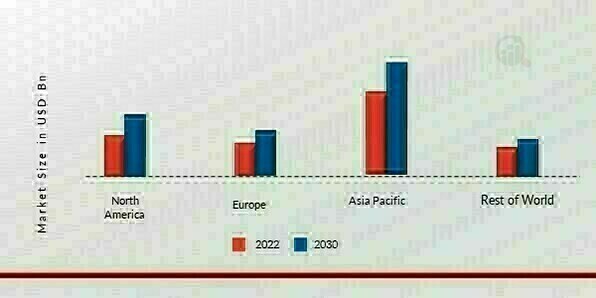

Global Neopentyl Glycol Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Type, 2025−2034

- Market Estimates & Forecast by Application, 2025−2034

- Market Estimates & Forecast by End-use Industry, 2025−2034

- U.S.

- Canada

-

Europe

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Type, 2025−2034

- Market Estimates & Forecast by Application, 2025−2034

- Market Estimates & Forecast by End-use Industry, 2025−2034

- Germany

- France

- Italy

- Spain

- U.K.

- Russia

- Poland

-

Asia Pacific

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Type, 2025−2034

- Market Estimates & Forecast by Application, 2025−2034

- Market Estimates & Forecast by End-use Industry, 2025−2034

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Type, 2025−2034

- Market Estimates & Forecast by Application, 2025−2034

- Market Estimates & Forecast by End-use Industry, 2025−2034

- Turkey

- Israel

- North Africa

- GCC

- Rest of Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2025−2034

- Market Estimates & Forecast by Type, 2025−2034

- Market Estimates & Forecast by Application, 2025−2034

- Market Estimates & Forecast by End-use Industry, 2025−2034

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Company Landscape

-

Introduction

-

Market Strategy

-

Key Development Analysis (Expansion/Merger & Acquisitions/Joint Venture/New Product Development/Agreement/Investment)

-

Company Profiles

-

BASF SE

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Celanese Corporation

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Eastman Chemical Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

LG Chem

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

OXEA GmbH

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Perstorp Orgnr

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Polioli S.p.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Oleon NV

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Shandong Dongchen New Technology Co,Ltd.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Conclusion

-

LIST OF TABLES

-

Global Neopentyl Glycol market: By Region, 2025−2034

-

North America Neopentyl Glycol market: By Country, 2025−2034

-

Europe Neopentyl Glycol market: By Country, 2025−2034

-

Asia-Pacific Neopentyl Glycol market: By Country, 2025−2034

-

Middle East & Africa Neopentyl Glycol market: By Country, 2025−2034

-

Latin America Neopentyl Glycol market: By Country, 2025−2034

-

Global Neopentyl Glycol Type Market: By Regions, 2025−2034

-

North America Neopentyl Glycol Type Market: By Country, 2025−2034

-

Europe Neopentyl Glycol Type Market: By Country, 2025−2034

-

Table10 Asia-Pacific Neopentyl Glycol Type Market: By Country, 2025−2034

-

Table11 Middle East & Africa Neopentyl Glycol Type Market: By Country, 2025−2034

-

Table12 Latin America Neopentyl Glycol Type Market: By Country, 2025−2034

-

Table13 Global Neopentyl Glycol Application Market: By Regions, 2025−2034

-

Table14 North America Neopentyl Glycol by Application Market: By Country, 2025−2034

-

Table15 Europe Neopentyl Glycol Application Market: By Country, 2025−2034

-

Table16 Asia-Pacific Neopentyl Glycol Application Market: By Country, 2025−2034

-

Table17 Middle East & Africa Neopentyl Glycol Application Market: By Country, 2025−2034

-

Table18 Latin America Neopentyl Glycol Application Market: By Country, 2025−2034

-

Table19 Global Neopentyl Glycol End-use Industry Market: By Regions, 2025−2034

-

Table20 North America Neopentyl Glycol End-use Industry Market: By Country, 2025−2034

-

Table21 Europe Neopentyl Glycol End-use Industry Market: By Country, 2025−2034

-

Table22 Asia-Pacific Neopentyl Glycol End-use Industry Market: By Country, 2025−2034

-

Table23 Middle East & Africa Neopentyl Glycol End-use Industry Market: By Country, 2025−2034

-

Table24 Latin America Neopentyl Glycol End-use Industry Market: By Country, 2025−2034

-

Table25 Global Type Market: By Region, 2025−2034

-

Table26 Global Application Market: By Region, 2025−2034

-

Table27 Global End-use Industry Market: By Region, 2025−2034

-

Table28 North America Neopentyl Glycol market, By Country

-

Table29 North America Neopentyl Glycol market, By Type

-

Table30 North America Neopentyl Glycol market, By Application

-

Table31 North America Neopentyl Glycol market, By End-use Industry

-

Table32 Europe: Neopentyl Glycol market, By Country

-

Table33 Europe: Neopentyl Glycol market, By Type

-

Table34 Europe: Neopentyl Glycol market, By Application

-

Table35 Europe: Neopentyl Glycol market, By End-use Industry

-

Table36 Asia-Pacific: Neopentyl Glycol market, By Country

-

Table37 Asia-Pacific: Neopentyl Glycol market, By Type

-

Table38 Asia-Pacific: Neopentyl Glycol market, By Application

-

Table39 Asia-Pacific: Neopentyl Glycol market, By End-use Industry

-

Table40 Middle East & Africa: Neopentyl Glycol market, By Country

-

Table41 Middle East & Africa Neopentyl Glycol market, By Type

-

Table42 Middle East & Africa Neopentyl Glycol market, By Application

-

Table43 Middle East & Africa: Neopentyl Glycol market, By End-use Industry

-

Table44 Latin America: Neopentyl Glycol market, By Country

-

Table45 Latin America Neopentyl Glycol market, By Type

-

Table46 Latin America Neopentyl Glycol market, By Application

-

Table47 Latin America: Neopentyl Glycol market, By End-use Industry

-

LIST OF FIGURES

-

Global Neopentyl Glycol market segmentation

-

Forecast Printing methodology

-

Porter’s Five Forces Analysis of Global Neopentyl Glycol market

-

Value Chain of Global Neopentyl Glycol market

-

Share of Global Neopentyl Glycol market in 2020, by country (in %)

-

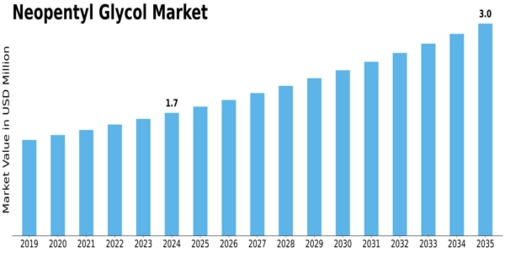

Global Neopentyl Glycol market, 2025−2034,

-

Global Neopentyl Glycol market size by Type, 2020

-

Share of Global Neopentyl Glycol market by Type, 2025−2034

-

Global Neopentyl Glycol market size by Application, 2020

-

Share of Global Neopentyl Glycol market by Application, 2025−2034

-

Global Neopentyl Glycol market size by End-use Industry, 2020

-

Share of Global Neopentyl Glycol market by End-use Industry, 2025−2034

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Leave a Comment