-

MARKET 13

-

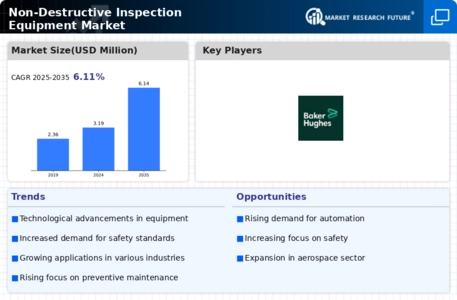

GLOBAL NON-DESTRUCTIVE INSPECTION

- GLOBAL NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

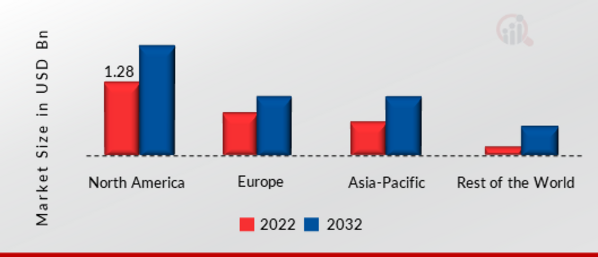

EQUIPMENT MARKET BY REGION 13

-

MARKET, BY REGION, 2024 VS 2032 (USD MILLION) 13

-

GLOBAL NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY REGION, 2024-2032 (USD MILLION) 14

-

NORTH

- NORTH AMERICA: NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

- NORTH AMERICA: NON-DESTRUCTIVE

-

AMERICA 15

-

BY COUNTRY, 2024-2032

-

(USD MILLION) 16

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

16

-

INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 17

-

1.2.6

-

US 17

-

US NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY

-

CANADA 17

-

CANADA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 17

-

MEXICO 18

-

MEXICO NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 18

-

1.3

-

EUROPE 19

-

EUROPE: NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY,

-

EUROPE: NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 20

-

22

-

(USD MILLION) 22

-

GERMANY

-

GERMANY NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

FRANCE 22

-

FRANCE NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION)

-

22

-

INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 23

-

1.3.10

-

UK 23

-

UK NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY

-

RUSSIA 23

-

RUSSIA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 23

-

ITALY 24

-

ITALY NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 24

-

1.3.13

-

REST OF EUROPE 24

-

REST OF EUROPE NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL,

-

ASIA-PACIFIC

- ASIA-PACIFIC: NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY,

- ASIA-PACIFIC: NON-DESTRUCTIVE INSPECTION

-

26

-

(USD MILLION) 27

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

1.4.3

-

CHINA 28

-

VERTICAL, 2024-2032

-

(USD MILLION) 28

-

CHINA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

JAPAN 29

-

JAPAN NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION)

-

29

-

SOUTH KOREA 29

-

SOUTH KOREA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL,

-

(USD MILLION) 30

-

INDIA 30

-

INDIA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

SOUTHEAST ASIA 30

-

SOUTHEAST

-

ASIA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

(USD MILLION) 30

-

REST OF ASIA-PACIFIC 31

-

REST OF ASIA-PACIFIC

-

NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

(USD MILLION) 31

-

SOUTH AMERICA 32

- SOUTH AMERICA: NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2024-2032

-

(USD MILLION) 33

-

1.5.2

-

SOUTH AMERICA: NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

BRAZIL 34

-

BRAZIL NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION)

-

34

-

ARGENTINA 34

-

ARGENTINA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 34

-

35

-

VERTICAL, 2024-2032

-

(USD MILLION) 35

-

VERTICAL,

-

COUNTRY, 2024-2032

-

(USD MILLION) 38

-

COLUMBIA

-

COLUMBIA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

REST OF SOUTH AMERICA 35

-

REST OF SOUTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

MIDDLE EAST & AFRICA 37

- MIDDLE EAST & AFRICA: NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY

- MIDDLE EAST & AFRICA: NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

38

-

SAUDI ARABIA 39

-

SAUDI ARABIA NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 39

-

1.6.5

-

UAE 39

-

(USD MILLION) 40

-

UAE NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

EGYPT 40

-

EGYPT NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION)

-

40

-

NIGERIA 41

-

NIGERIA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 41

-

AFRICA 41

-

BY INDUSTRY VERTICAL,

-

EAST & AFRICA 42

-

INSPECTION EQUIPMENT MARKET,

-

BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION)

-

42

-

1.7.4

-

SOUTH AMERICA 46

-

OF THE MARKET 47

-

SAFETY REGULATIONS 48

-

INFRASTRUCTURE 48

-

-

49

-

IMPACT ANALYSIS 49

-

INDUSTRY 49

-

& LACK OF AWARENESS 50

-

TESTING (PAUT) METHOD 50

-

CHAIN ANALYSIS 51

-

51

-

FIVE FORCES MODEL 52

-

POWER OF SUPPLIERS 53

-

POWER OF BUYERS 53

-

SOUTH

-

SOUTH AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

REST OF MIDDLE

-

REST OF MIDDLE EAST & AFRICA NON-DESTRUCTIVE

-

QUALITATIVE INFORMATION ON LARGE FLUCTUATION BY COUNTRY/REGION 43

- NORTH AMERICA 43

- EUROPE 44

- ASIA-PACIFIC 45

- MIDDLE EAST & AFRICA 46

-

VARIABLE FACTORS

- INTRODUCTION 47

- DRIVERS 48

- DRIVER IMPACT ANALYSIS 48

- RESTRAINTS

- RESTRAINT

- OPPORTUNITIES 49

- CHALLENGES 50

- TRENDS 50

- VALUE /SUPPLY

- PORTER’S

-

CUSTOMER 54

-

2.1

-

GLOBAL NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET BY INDUSTRY/APPLICATION 54

-

BY INDUSTRY/APPLICATION,

-

& TRANSPORTATION 55

-

& FORECAST, BY REGION, 2024-2032

-

(USD MILLION) 55

-

& DEFENSE 56

-

BY REGION, 2024-2032 (USD MILLION) 56

-

OVERVIEW 54

-

GLOBAL NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

RAILWAYS

-

RAILWAYS & TRASPORTATION: MARKET ESTIMATES

-

AEROSPACE

-

AEROSPACE & DEFENSE: MARKET ESTIMATES & FORECAST,

-

OIL & GAS 56

-

OIL

-

& GAS: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2032 (USD MILLION) 56

-

& FORECAST, BY REGION, 2024-2032 (USD MILLION) 57

-

-

57

-

(USD MILLION) 57

-

FORECAST, BY REGION, 2024-2032 (USD MILLION) 58

-

POWER & ENERGY 57

-

POWER & ENERGY: MARKET ESTIMATES

-

HEALTHCARE

-

HEALTHCARE: MARKET ESTIMATES & FORECAST, BY REGION, 2024-2032

-

OTHERS 58

-

OTHERS: MARKET ESTIMATES &

-

NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY CUSTOMER ANALYSIS 58

-

KEY BUYING FACTORS 59

- SERVICE AND SUPPORT 59

- INSPECTION METHOD 60

- ELECTRICAL POWER & PART SIZE 60

- BUYING COST 60

- DRONE TECHNOLOGY 61

-

2.3.1

-

INTRODUCTION 59

-

2.3.6

-

NDT CODES AND STANDARDS 61

-

COMPETITION 62

-

KEY COMPANY PROFILLING 62

- PROMAG TECHNOLOGIES DEVELOPMENT LIMITED

- OKONDT GROUP 63

- LABQUIP (IRELAND) LIMITED

- MFE INSPECTION SOLUTIONS

- TWI LTD 67

- STANLAY 68

- NEXXIS 69

- NON-DESTRUCTIVE TESTING (NDT) PRODUCTS LIMITED 70

- BAKER HUGHES COMPANY 71

- OLYMPUS CORPORATION 74

- ZETEC, INC. 77

-

62

-

3.1.1.3

-

PRODUCTS OFFERED 62

-

OFFERED 63

-

64

-

3.1.3.3

-

PRODUCTS OFFERED 64

-

65

-

3.1.4.3

-

PRODUCTS OFFERED 65

-

3.1.5.1

-

COMPANY OVERVIEW 67

-

67

-

68

-

3.1.6.4

-

KEY DEVELOPMENTS 68

-

3.1.7.2

-

FINANCIAL OVERVIEW 69

-

69

-

OVERVIEW 70

-

OVERVIEW 71

-

73

-

3.1.10.2

-

FINANCIAL OVERVIEW 75

-

76

-

-

OVERVIEW 77

-

MARKET SHARE ANALYSIS (% SHARE) 2021 79

-

KEY SUCCESS FACTORS TO MEET

-

KEY BUYING FACTORS 80

-

-

LIST OF TABLES

-

GLOBAL NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY REGION, 2024-2032 (USD MILLION) 14

-

TABLE 2

-

NORTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2024-2032

-

(USD MILLION) 16

-

NORTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 16

-

US NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 17

-

CANADA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

MEXICO NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 18

-

EUROPE NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2024-2032 (USD MILLION) 20

-

TABLE 8

-

EUROPE NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 20

-

GERMANY NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 22

-

FRANCE NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 22

-

UK NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

RUSSIA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 23

-

ITALY NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 24

-

REST OF EUROPE NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

VERTICAL, 2024-2032 (USD MILLION) 24

-

ASIA-PACIFIC NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2024-2032 (USD MILLION) 27

-

TABLE 16

-

ASIA-PACIFIC NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

CHINA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 28

-

JAPAN NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 29

-

SOUTH KOREA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

VERTICAL, 2024-2032 (USD MILLION) 29

-

INDIA NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 30

-

TABLE 21

-

SOUTHEAST ASIA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

(USD MILLION) 30

-

REST OF ASIA-PACIFIC NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION)

-

31

-

SOUTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY,

-

SOUTH AMERICA NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 33

-

TABLE 25

-

BRAZIL NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 34

-

ARGENTINA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 34

-

COLUMBIA NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 35

-

REST OF SOUTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY

-

INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 35

-

MIDDLE EAST &

-

AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2024-2032 (USD MILLION)

-

38

-

MIDDLE EAST & AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 38

-

SAUDI ARABIA

-

NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD

-

MILLION) 39

-

UAE NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

VERTICAL, 2024-2032 (USD MILLION) 40

-

EGYPT NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 40

-

TABLE 34

-

NIGERIA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024-2032

-

(USD MILLION) 41

-

SOUTH AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY INDUSTRY VERTICAL, 2024-2032 (USD MILLION) 41

-

REST OF MIDDLE

-

EAST & AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL,

-

RAILWAYS & TRASPORTATION MARKET ESTIMATES

-

& FORECAST, BY REGION, 2024-2032 (USD MILLION) 55

-

AEROSPACE &

-

DEFENSE MARKET ESTIMATES & FORECAST, BY REGION, 2024-2032 (USD MILLION) 56

-

OIL & GAS MARKET ESTIMATES & FORECAST, BY REGION, 2024-2032 (USD

-

MILLION) 56

-

POWER & ENERGY MARKET ESTIMATES & FORECAST, BY

-

REGION, 2024-2032 (USD MILLION) 57

-

HEALTHCARE MARKET ESTIMATES &

-

FORECAST, BY REGION, 2024-2032 (USD MILLION) 57

-

OTHERS MARKET ESTIMATES

-

& FORECAST, BY REGION, 2024-2032 (USD MILLION) 58

-

PROMAG TECHNOLOGIES

-

DEVELOPMENT LIMITED: PRODUCTS OFFERED 62

-

OKONDT GROUP: PRODUCTS OFFERED

-

63

-

LABQUIP (IRELAND) LIMITED: PRODUCTS OFFERED 64

-

MFE

-

INSPECTION SOLUTIONS: PRODUCTS OFFERED 65

-

TWI LTD: PRODUCTS OFFERED

-

67

-

STANLAY: PRODUCTS OFFERED 68

-

NEXXIS: PRODUCTS OFFERED

-

69

-

NON-DESTRUCTIVE TESTING (NDT) PRODUCTS LIMITED: PRODUCTS OFFERED

-

70

-

BAKER HUGHES COMPANY: PRODUCTS OFFERED 72

-

OLYMPUS

-

CORPORATION: PRODUCTS OFFERED 75

-

OLYMPUS CORPORATION: KEY DEVELOPMENTS

-

76

-

ZETEC, INC.: PRODUCTS OFFERED 77

-

ZETEC, INC.: KEY

-

DEVELOPMENTS 78

-

-

LIST OF FIGURES

-

GLOBAL NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY REGION, 2021 (% SHARE) 13

-

GLOBAL NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY REGION, 2024 VS 2032 (USD MILLION) 13

-

FIGURE

-

NORTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2021 (%

-

SHARE) 15

-

AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY

-

COUNTRY, 2024 VS 2032 (USD MILLION) 15

-

NORTH AMERICA NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024 VS 2032

-

(USD MILLION)

-

16

-

EUROPE NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY,

-

EUROPE NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

BY COUNTRY, 2024 VS 2032 (USD MILLION) 19

-

EUROPE NON-DESTRUCTIVE INSPECTION

-

EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024 VS 2032 (USD MILLION) 21

-

FIGURE

-

ASIA-PACIFIC NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2021 (%

-

SHARE) 26

-

ASIA-PACIFIC NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET,

-

BY COUNTRY, 2024 VS 2032 (USD MILLION) 26

-

ASIA-PACIFIC NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024 VS 2032 (USD MILLION) 27

-

SOUTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY COUNTRY,

-

SOUTH AMERICA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY COUNTRY, 2024 VS 2032 (USD MILLION) 32

-

SOUTH AMERICA NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY INDUSTRY VERTICAL, 2024 VS 2032

-

(USD MILLION)

-

33

-

MIDDLE EAST & AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY COUNTRY, 2021 (% SHARE) 37

-

MIDDLE EAST & AFRICA NON-DESTRUCTIVE

-

INSPECTION EQUIPMENT MARKET, BY COUNTRY, 2024 VS 2032 (USD MILLION) 37

-

FIGURE

-

MIDDLE EAST & AFRICA NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY

-

VERTICAL, 2024 VS 2032

-

(USD MILLION) 38

-

MARKET DYNAMICS OVERVIEW

-

47

-

DRIVER IMPACT ANALYSIS 48

-

RESTRAINT IMPACT ANALYSIS

-

49

-

VALUE/SUPPLY CHAIN ANALYSIS 51

-

PORTER’S FIVE

-

FORCES MODEL: NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET 52

-

GLOBAL

-

NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY/APPLICATION, 2021 (% SHARE)

-

54

-

GLOBAL NON-DESTRUCTIVE INSPECTION EQUIPMENT MARKET, BY INDUSTRY/APPLICATION,

-

GLOBAL NON-DESTRUCTIVE INSPECTION EQUIPMENT

-

MARKET, BY CUSTOMER ANALYSIS, 2021 (% SHARE) 58

-

BAKER HUGHES COMPANY:

-

FINANCIAL OVERVIEW SNAPSHOT 71

-

BAKER HUGHES COMPANY: SWOT ANALYSIS

-

73

-

OLYMPUS CORPORATION: FINANCIAL OVERVIEW SNAPSHOT 75

-

FIGURE

-

OLYMPUS CORPORATION: SWOT ANALYSIS 76

-

MAJOR MANUFACTURER MARKET

-

SHARE ANALYSIS (%), 2021 79

Leave a Comment