Advancements in Data Analytics

The integration of advanced data analytics into the Oil & Gas SCADA Market is transforming how companies manage their operations. Enhanced data analytics capabilities allow for better predictive maintenance, risk assessment, and decision-making processes. By leveraging big data, organizations can analyze vast amounts of operational data to identify trends and anomalies, thereby improving overall efficiency. The market for data analytics in the oil and gas sector is expected to reach USD 5 billion by 2026, reflecting a growing recognition of the value of data-driven insights. This trend underscores the importance of SCADA systems that can seamlessly integrate with analytics platforms to provide actionable intelligence.

Focus on Operational Efficiency

Operational efficiency remains a critical driver in the Oil & Gas SCADA Market. Companies are under constant pressure to reduce costs while maximizing output. SCADA systems play a pivotal role in achieving these objectives by automating processes, reducing manual intervention, and providing real-time data for informed decision-making. The implementation of SCADA solutions has been shown to reduce operational costs by up to 20%, making them an attractive investment for oil and gas companies. As the industry continues to evolve, the emphasis on efficiency is likely to drive further adoption of SCADA technologies, ensuring that organizations remain competitive in a challenging market.

Integration of Renewable Energy Sources

The integration of renewable energy sources into traditional oil and gas operations is emerging as a key driver in the Oil & Gas SCADA Market. As the energy landscape shifts towards sustainability, SCADA systems are being adapted to manage hybrid energy systems that include both fossil fuels and renewable sources. This transition requires sophisticated monitoring and control capabilities to ensure seamless operation and energy efficiency. The market for SCADA systems that support renewable integration is anticipated to grow, reflecting the industry's commitment to reducing carbon footprints and embracing cleaner energy solutions. This trend indicates a broader shift in the oil and gas sector towards more sustainable practices.

Increased Demand for Real-Time Monitoring

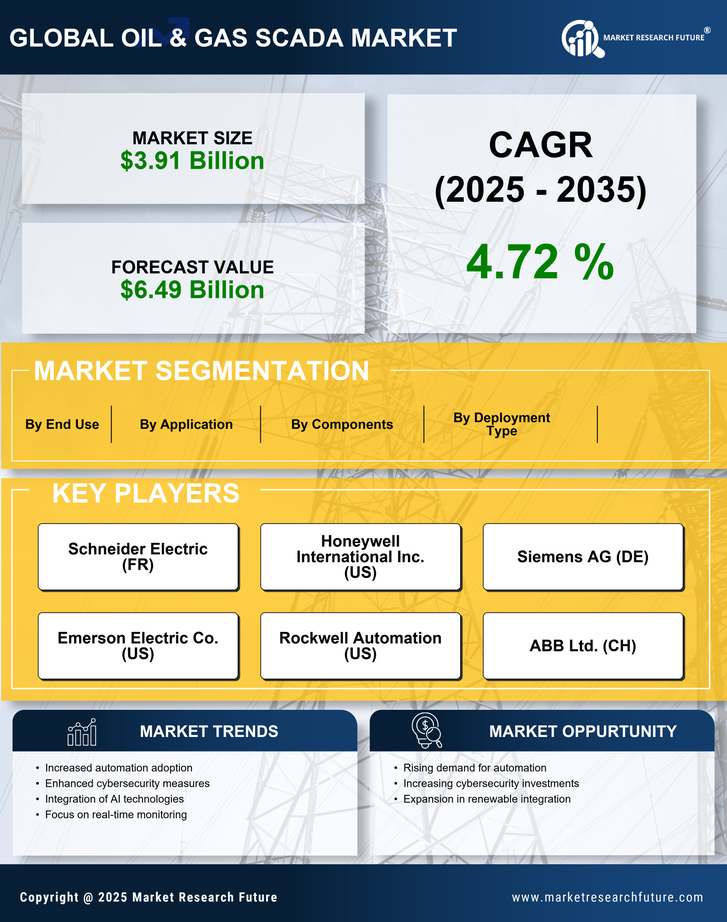

The Oil & Gas SCADA Market is experiencing heightened demand for real-time monitoring solutions. This trend is driven by the need for enhanced operational efficiency and safety in oil and gas operations. Companies are increasingly adopting SCADA systems to monitor pipeline integrity, equipment performance, and environmental conditions in real-time. According to recent data, the market for SCADA systems in the oil and gas sector is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% over the next five years. This growth is indicative of the industry's shift towards more automated and responsive operational frameworks, which are essential for minimizing downtime and optimizing resource allocation.

Regulatory Compliance and Safety Standards

The Oil & Gas SCADA Market is significantly influenced by the need for regulatory compliance and adherence to safety standards. Governments and regulatory bodies are increasingly imposing stringent regulations to ensure environmental protection and worker safety. SCADA systems are essential tools for monitoring compliance with these regulations, as they provide real-time data on emissions, spills, and other critical safety metrics. The market for compliance-related SCADA solutions is expected to grow as companies seek to avoid penalties and enhance their reputations. This focus on compliance not only drives technology adoption but also fosters a culture of safety within organizations.