-

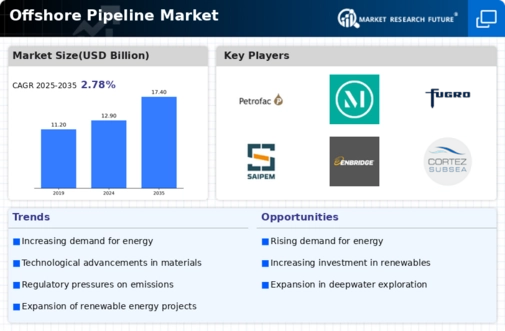

Executive Summary

-

Market Attractiveness Analysis 15

- Global Offshore Pipeline Market, BY PRODUCT 15

- GLOBAL OFFSHORE

-

PIPELINE MARKET, BY LINE TYPE 16

-

BY DIAMETER 17

-

GLOBAL OFFSHORE PIPELINE MARKET,

-

GLOBAL OFFSHORE PIPELINE MARKET, BY REGION 18

-

Market Introduction

-

Definition 19

-

Scope

-

Of The Study 19

-

Market Structure 19

-

Key Buying Criteria

-

20

-

Research Methodology

-

Research Process 21

-

Primary Research 22

-

Secondary Research 23

-

Market

-

Size Estimation 23

-

Forecast Model 24

-

List Of Assumptions

-

25

-

MARKET INSIGHTS

-

Market Factor Analysis

-

Porter’s Five Forces Model 29

- Threat Of New Entrants

- Bargaining Power Of Suppliers 30

- Bargaining

- Threat Of Substitutes 30

- Rivalry

-

29

-

Power Of Buyers 30

-

30

-

Supply Chain Analysis 31

- Research & Development

- Raw Material Supply 32

- Pipeline Manufacturing

- Distribution 32

- End Use 32

-

31

-

32

-

Drivers

- Increasing Demand For Natural Gas In Asia-Pacific 33

- Rising Investments In Offshore Pipeline Infrastructure 34

- Geopolitical And Geological Instability 34

-

33

-

5.4

-

Restraint 34

-

Opportunity 35

- Demand For Refined Products 35

-

6

-

Global Offshore Pipeline Market, By Product

-

Overview 36

-

Oil 37

-

Gas 37

-

Refined Product 37

-

7

-

Global Offshore Pipeline Market, By Line Diameter

-

Overview 38

-

Export Line 39

-

Transport Line 39

-

Global

-

Offshore Pipeline Market, By Diameter

-

Overview 40

-

8.2

-

Below 24” 41

-

Greater Than 24” 41

-

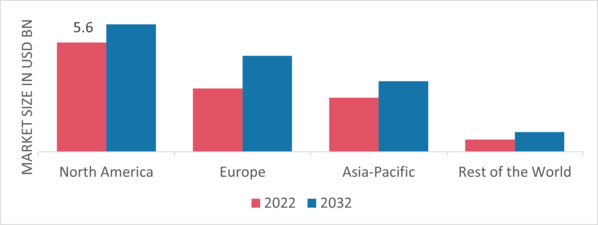

Global

-

Offshore Pipeline Market, By Region

-

Overview 42

-

North

-

America 43

-

US 45

-

Canada 47

-

Mexico 49

-

Europe 51

-

Germany 53

-

UK 55

-

9.9

-

Russia 57

-

Norway 59

-

Rest Of Europe 61

-

9.12

-

Asia-Pacific 63

-

China 65

-

India 67

-

9.15

-

Australia 69

-

Indonesia 71

-

Rest Of Asia-Pacific 73

-

Middle East & Africa 75

-

Saudi Arabia 77

-

UAE 79

-

South Africa 81

-

Nigeria 83

-

Rest Of Middle East & Europe 85

-

South America 87

-

Argentina 89

-

Brazil 91

-

Rest Of South America

-

93

-

Competitive Landscape

-

Competitive Overview 95

-

Competitive Benchmarking 96

-

Market Share Analysis 97

-

Company Profiles

-

Saipem 98

- Company

- Financial Overview 99

- Products Offered

- Key Developments 100

- SWOT Analysis 101

- Key Strategies 101

-

Overview 98

-

99

-

Subsea 7 S.A. 102

- Financial Overview 102

- Key Developments 103

- SWOT

- Key Strategies 104

-

11.2.1

-

Company Overview 102

-

11.2.3

-

Products Offered 103

-

Analysis 103

-

TechnipFMC Plc

- Company Overview 105

- Financial Overview

- Products Offered 106

- Key Developments 107

- SWOT Analysis 107

- Key Strategies 107

- Company Overview 108

- Products Offered 109

-

105

-

105

-

11.4

-

Sapura Energy Berhad 108

-

11.4.2

-

Financial Overview 108

-

11.4.4

-

Key Developments 109

-

Fugro 110

- Company Overview

- Financial Overview 110

- Products Offered

- Key Developments 111

-

110

-

111

-

Petrofac Limited 112

- Company Overview 112

- Financial Overview 112

- Products Offered 113

- Key Developments 113

-

John Wood Group PLC 114

- Company Overview 114

- Products Offered 115

- SWOT Analysis 115

- Key Strategies

-

11.7.2

-

Financial Overview 114

-

11.7.4

-

Key Developments 115

-

115

-

McDermott 116

- Company Overview 116

- Financial Overview 116

- Products Offered 117

- Key Developments 117

- SWOT Analysis 117

-

11.8.6

-

Key Strategies 118

-

ENBRIDGE INC. 119

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW 120

- Products Offered

- KEY DEVELOPMENTS 121

-

119

-

121

-

Cortez Subsea 122

- Company Overview 122

- Financial Overview 122

- Products Offered 122

- Key Developments 123

-

List Of Tables

-

LIST OF ASSUMPTIONS 25

-

TABLE

-

GLOBAL OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 36

-

GLOBAL OFFSHORE PIPELINE MARKET, BY LINE DIAMETER, 2023-2032 (USD MILLION)

-

38

-

GLOBAL OFFSHORE PIPELINE MARKET, BY DIAMETER, 2023-2032 (USD

-

MILLION) 40

-

GLOBAL OFFSHORE PIPELINE MARKET, BY REGION, 2023-2032

-

(USD MILLION) 42

-

NORTH AMERICA: OFFSHORE PIPELINE MARKET, BY

-

COUNTRY, 2023-2032 (USD MILLION) 43

-

NORTH AMERICA: OFFSHORE PIPELINE

-

MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 44

-

NORTH AMERICA:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD

-

MILLION) 44

-

NORTH AMERICA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 44

-

US:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 45

-

TABLE

-

US: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 45

-

US: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 46

-

CANADA: OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 47

-

CANADA:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD

-

MILLION) 47

-

CANADA: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 48

-

MEXICO: OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 49

-

MEXICO:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD

-

MILLION) 49

-

MEXICO: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 50

-

EUROPE: OFFSHORE

-

PIPELINE MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 51

-

EUROPE:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 51

-

TABLE

-

EUROPE: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 52

-

EUROPE: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 52

-

GERMANY:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 53

-

TABLE

-

GERMANY: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 53

-

GERMANY: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 54

-

UK:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 55

-

TABLE

-

UK: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 55

-

UK: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 56

-

RUSSIA: OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 57

-

RUSSIA:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD

-

MILLION) 57

-

RUSSIA: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 58

-

NORWAY: OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 59

-

NORWAY:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD

-

MILLION) 59

-

NORWAY: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 60

-

REST OF EUROPE:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 61

-

TABLE

-

REST OF EUROPE: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE,

-

REST OF EUROPE: OFFSHORE PIPELINE

-

MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 62

-

ASIA-PACIFIC: OFFSHORE PIPELINE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

-

63

-

ASIA-PACIFIC: OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032

-

(USD MILLION) 63

-

ASIA-PACIFIC: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 64

-

ASIA-PACIFIC:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032 (USD MILLION)

-

64

-

CHINA: OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD

-

MILLION) 65

-

CHINA: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 65

-

INDIA: OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 67

-

INDIA:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD

-

MILLION) 67

-

INDIA: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 68

-

AUSTRALIA:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 69

-

TABLE

-

AUSTRALIA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 69

-

AUSTRALIA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 70

-

INDONESIA:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 71

-

TABLE

-

INDONESIA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 71

-

INDONESIA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 72

-

REST

-

OF ASIA-PACIFIC: OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 73

-

REST OF ASIA-PACIFIC: OFFSHORE PIPELINE MARKET ESTIMATES &

-

FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 73

-

REST OF ASIA-PACIFIC:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032 (USD MILLION)

-

74

-

MIDDLE EAST & AFRICA: OFFSHORE PIPELINE MARKET, BY COUNTRY,

-

MIDDLE EAST & AFRICA: GLOBAL

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 75

-

TABLE

-

MIDDLE EAST & AFRICA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST,

-

BY LINE TYPE, 2023-2032 (USD MILLION) 76

-

MIDDLE EAST & AFRICA:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032 (USD MILLION)

-

76

-

SAUDI ARABIA: OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032

-

(USD MILLION) 77

-

SAUDI ARABIA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 77

-

SAUDI

-

ARABIA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032

-

(USD MILLION) 78

-

UAE: OFFSHORE PIPELINE MARKET, BY PRODUCT,

-

UAE: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 79

-

UAE:

-

OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032 (USD MILLION)

-

80

-

SOUTH AFRICA: OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032

-

(USD MILLION) 81

-

SOUTH AFRICA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 81

-

SOUTH

-

AFRICA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032

-

(USD MILLION) 82

-

NIGERIA: OFFSHORE PIPELINE MARKET, BY PRODUCT,

-

NIGERIA: OFFSHORE PIPELINE MARKET

-

ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 83

-

TABLE

-

NIGERIA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032

-

(USD MILLION) 84

-

REST OF MIDDLE EAST & AFRICA: OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 85

-

REST

-

OF MIDDLE EAST & AFRICA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST,

-

BY LINE TYPE, 2023-2032 (USD MILLION) 85

-

REST OF MIDDLE EAST

-

& AFRICA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER, 2023-2032

-

(USD MILLION) 86

-

SOUTH AMERICA: OFFSHORE PIPELINE MARKET, BY

-

COUNTRY, 2023-2032 (USD MILLION) 87

-

SOUTH AMERICA: GLOBAL OFFSHORE

-

PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 87

-

SOUTH

-

AMERICA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 88

-

SOUTH AMERICA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 88

-

ARGENTINA:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 89

-

TABLE

-

ARGENTINA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 89

-

ARGENTINA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 90

-

BRAZIL:

-

OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 91

-

TABLE

-

BRAZIL: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY LINE TYPE, 2023-2032

-

(USD MILLION) 91

-

BRAZIL: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY DIAMETER, 2023-2032 (USD MILLION) 92

-

REST

-

OF SOUTH AMERICA: OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION)

-

93

-

REST OF SOUTH AMERICA: OFFSHORE PIPELINE MARKET ESTIMATES

-

& FORECAST, BY LINE TYPE, 2023-2032 (USD MILLION) 93

-

REST

-

OF SOUTH AMERICA: OFFSHORE PIPELINE MARKET ESTIMATES & FORECAST, BY DIAMETER,

-

SAIPEM: PRODUCTS OFFERED 99

-

SAIPEM: KEY DEVELOPMENTS 100

-

SUBSEA 7 S.A.: PRODUCTS

-

OFFERED 103

-

SUBSEA 7 S.A.: KEY DEVELOPMENTS 103

-

TABLE

-

TECHNIPFMC PLC: PRODUCTS OFFERED 106

-

TECHNIPFMC PLC: KEY

-

DEVELOPMENTS 107

-

SAPURA ENERGY BERHAD: PRODUCTS OFFERED 109

-

SAPURA ENERGY BERHAD: KEY DEVELOPMENTS 109

-

TABLE 96

-

FUGRO: PRODUCTS OFFERED 111

-

FUGRO: KEY DEVELOPMENTS 111

-

PETROFAC LIMITED: PRODUCTS OFFERED 113

-

PETROFAC LIMITED:

-

KEY DEVELOPMENTS 113

-

JOHN WOOD GROUP PLC: PRODUCTS OFFERED

-

115

-

JOHN WOOD GROUP PLC: KEY DEVELOPMENTS 115

-

TABLE

-

MCDERMOTT: KEY DEVELOPMENTS 117

-

ENBRIDGE INC.: PRODUCTS

-

OFFERED 121

-

CORTEZ SUBSEA: PRODUCT OFFERED 122

-

TABLE

-

CORTEZ SUBSEA: KEY DEVELOPMENTS 123

-

List Of Figures

-

FIGURE

-

MARKET SYNOPSIS 14

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL

-

OFFSHORE PIPELINE MARKET 15

-

GLOBAL OFFSHORE PIPELINE MARKET

-

ANALYSIS BY PRODUCT 15

-

GLOBAL OFFSHORE PIPELINE MARKET ANALYSIS

-

BY LINE TYPE 16

-

GLOBAL OFFSHORE PIPELINE MARKET ANALYSIS BY

-

DIAMETER 17

-

GLOBAL OFFSHORE PIPELINE MARKET ANALYSIS BY REGION

-

18

-

GLOBAL OFFSHORE PIPELINE MARKET: MARKET STRUCTURE 19

-

KEY BUYING CRITERIA OF OFFSHORE PIPELINE 20

-

RESEARCH

-

PROCESS OF MRFR 21

-

TOP DOWN & BOTTOM UP APPROACH 24

-

NORTH AMERICA MARKET SIZE & MARKET SHARE, BY REGION (2023

-

VS 2025) 26

-

ASIA-PACIFIC MARKET SIZE & MARKET SHARE, BY

-

REGION (2023 VS 2025) 27

-

MIDDLE EAST & AFRICA MARKET SIZE

-

& MARKET SHARE, BY REGION (2023 VS 2025) 27

-

EUROPE MARKET

-

SIZE & MARKET SHARE, BY REGION (2023 VS 2025) 28

-

SOUTH

-

AMERICA MARKET SIZE & MARKET SHARE, BY REGION (2023 VS 2025) 28

-

FIGURE

-

PORTER'S FIVE FORCES ANALYSIS: GLOBAL OFFSHORE PIPELINE MARKET 29

-

FIGURE

-

SUPPLY CHAIN ANALYSIS: GLOBAL OFFSHORE PIPELINE MARKET 31

-

FIGURE 18

-

GLOBAL OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023 (% SHARE) 36

-

FIGURE

-

GLOBAL OFFSHORE PIPELINE MARKET, BY PRODUCT, 2023-2032 (USD MILLION) 37

-

GLOBAL OFFSHORE PIPELINE MARKET, BY LINE DIAMETER, 2023 (% SHARE) 38

-

GLOBAL OFFSHORE PIPELINE MARKET, BY LINE DIAMETER, 2023-2032 (USD

-

MILLION) 39

-

GLOBAL OFFSHORE PIPELINE MARKET, BY DIAMETER, 2023

-

(% SHARE) 40

-

GLOBAL OFFSHORE PIPELINE MARKET, BY DIAMETER,

-

GLOBAL OFFSHORE PIPELINE MARKET,

-

BY REGION, 2023-2032 (USD MILLION) 43

-

BENCHMARKING OF MAJOR

-

COMPETITORS 96

-

MAJOR MANUFACTURER MARKET SHARE ANALYSIS, 2017

-

97

-

SAIPEM: TOTAL REVENUE, 2023 (USD MILLION) 99

-

FIGURE

-

SAIPEM: SWOT ANALYSIS 101

-

SUBSEA 7 S.A.: TOTAL REVENUE,

-

SUBSEA 7 S.A.: SWOT ANALYSIS 103

-

TECHNIPFMC PLC: TOTAL REVENUE, 2023 (USD MILLION) 105

-

TECHNIPFMC PLC: SWOT ANALYSIS 107

-

SAPURA ENERGY

-

BERHAD: TOTAL REVENUE, 2023 (USD MILLION) 108

-

FUGRO: TOTAL

-

REVENUE, 2023 (USD MILLION) 110

-

PETROFAC LIMITED: TOTAL REVENUE,

-

JOHN WOOD GROUP PLC: TOTAL REVENUE,

-

JOHN WOOD GROUP PLC: SWOT ANALYSIS 115

-

MCDERMOTT: TOTAL REVENUE, 2023 (USD MILLION) 116

-

FIGURE

-

MCDERMOTT: PRODUCTS OFFERED 117

-

MCDERMOTT: SWOT ANALYSIS

-

117

-

ENBRIDGE INC.: FINANCIAL OVERVIEW SNAPSHOT 120

Leave a Comment