Optical Transport Network Size

Market Size Snapshot

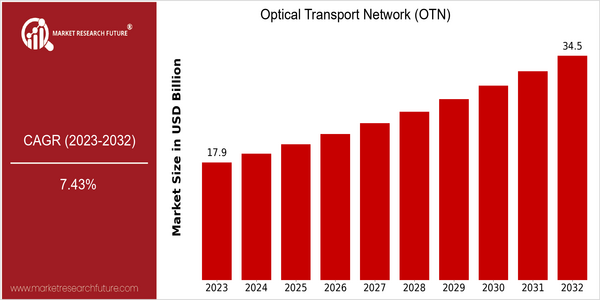

| Year | Value |

|---|---|

| 2023 | USD 17.9 Billion |

| 2032 | USD 34.46 Billion |

| CAGR (2024-2032) | 7.43 % |

Note – Market size depicts the revenue generated over the financial year

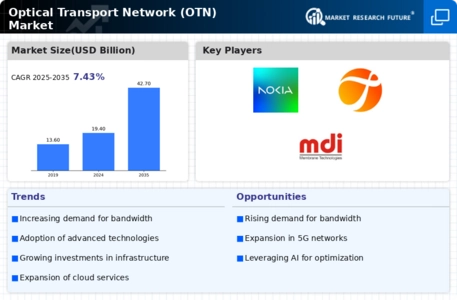

The Optical Transport Network (OTN) market is set to experience substantial growth. The current market size for 2023 is estimated to be $17.9 billion, and by 2032 it is expected to be $34.46 billion. This represents a CAGR of 7.43% between 2024 and 2032. The high demand for data transmission is being driven by the development of cloud computing, big data and the Internet of Things (IoT). Hence, as companies seek to enhance their network and ensure reliable data transmission, the importance of OTN will increase. The development of OTN is accompanied by the emergence of new technology, such as the integration of artificial intelligence and machine learning into network management. The key players in this market, such as Cisco, Ciena and Nokia, are all investing in research and development to enhance their product offerings. Also, strategic initiatives, such as the formation of alliances to increase the service capabilities and enhance the customer experience, are reshaping the market. Hence, the recent collaboration between telecommunication operators and technology companies to deploy next-generation OTN solutions demonstrates the commitment of the industry to meet the growing data transmission requirements of modern applications.

Regional Market Size

Regional Deep Dive

The Optical Transport Network (OTN) market is growing rapidly in many regions, driven by the increasing demand for high-speed data transmission and the proliferation of cloud services. North America is characterized by a highly developed telecommunications network and rapid uptake of new technology. Europe is seeing a boom in the fiber-optic network market, while Asia-Pacific is experiencing rapid growth, driven by rapid urbanization and digital transformation initiatives. The Middle East and Africa are gradually adopting OTN solutions, which are largely driven by government initiatives to improve network connections. Latin America is also emerging as a key market, with the aim of improving the region’s economic development through investment in telecommunications.

Europe

- The European Union's Digital Single Market strategy is pushing for the deployment of high-speed broadband, leading to increased investments in OTN infrastructure by companies such as Deutsche Telekom and Orange.

- Regulatory changes aimed at reducing barriers to network sharing are encouraging collaboration among telecom operators, fostering innovation in OTN technologies.

Asia Pacific

- Countries like China and India are rapidly expanding their telecommunications infrastructure, with significant government support for OTN projects to facilitate digital transformation.

- The rise of 5G technology is driving the demand for OTN solutions, as telecom operators seek to enhance their network efficiency and capacity.

Latin America

- Brazil's National Broadband Plan is driving investments in OTN infrastructure to enhance connectivity and support economic growth in the region.

- Telecom operators in Latin America are increasingly adopting OTN solutions to improve service quality and meet the rising demand for data services.

North America

- Major telecommunications companies like AT&T and Verizon are investing heavily in OTN technology to enhance their network capabilities and meet the growing demand for bandwidth.

- The Federal Communications Commission (FCC) has introduced initiatives to promote broadband expansion, which is expected to drive the adoption of OTN solutions across rural and underserved areas.

Middle East And Africa

- The UAE's Vision 2021 initiative is promoting advanced telecommunications infrastructure, leading to increased investments in OTN technologies by local operators like Etisalat.

- The African Union's Agenda 2063 emphasizes the importance of connectivity, prompting governments to invest in OTN solutions to improve internet access across the continent.

Did You Know?

“Did you know that OTN technology can support data rates of up to 100 Gbps and beyond, making it a crucial component for modern telecommunications networks?” — Telecommunications Industry Association (TIA)

Segmental Market Size

Optical transport network (OTN) is a crucial part of the telecommunications network, enabling high-speed data transfer over long distances. Its share of the market is growing steadily, primarily because of the increasing demand for bandwidth from cloud services and HD streaming. Also driving this growth is the need for higher reliability of the network and the transition to 5G, which requires a robust backhaul solution. OTN is currently being rolled out in a large scale, and the big telecommunications companies in North America are leading the way. In Asia-Pacific, too, there are big investments in the digital backbone, particularly in China and India. OTN is mainly used in data center connections and metropolitan networks, where it enables efficient routing and data management. Also driving the growth are the need for network operators to become more energy-efficient and the digital transformation taking place in all industries. In addition, the use of wavelength division multiplexing (WDM) and the use of software-defined networks (SDN) is defining the market’s development.

Future Outlook

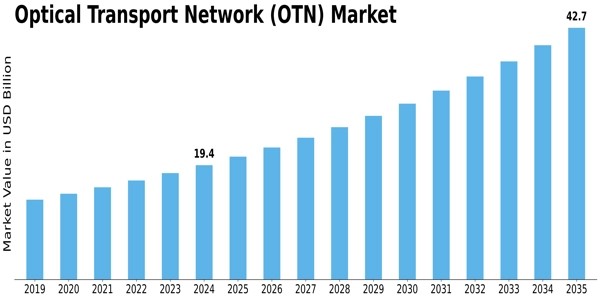

The optical transport network (OTN) market is expected to grow at a fast CAGR of 7.43% from 2023 to 2032. The demand for high-speed data transmission is expected to increase with the expansion of cloud computing, 5G networks and the Internet of Things. In the future, as more and more data-driven applications are developed, the need for efficient and reliable transport solutions will increase, resulting in a higher penetration of OTN technology in various industries such as telecommunications, enterprise networks and data centers. The key technology is expected to be the integration of artificial intelligence into the management of the network, and the development of advanced wavelength division multiplexing (WDM) technology. This will help OTNs to be more flexible and scalable. The government's support for the construction of digital infrastructure and the investment in next-generation broadband networks will also promote the development of the market. The development of virtualization and SDN will also help to create a more flexible and efficient network. OTNs will become the backbone of the world's communications network, and their penetration rate will continue to rise in developed and developing countries.

Leave a Comment