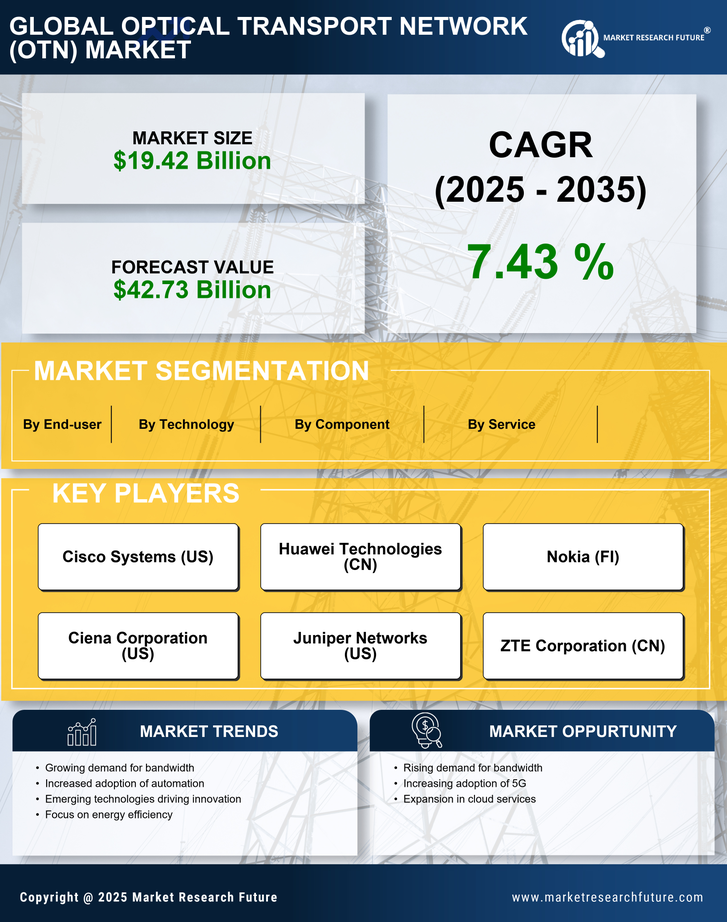

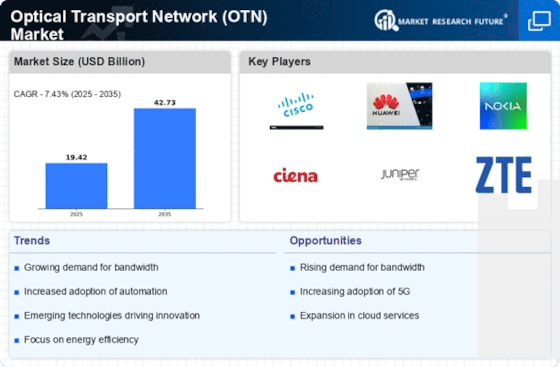

The Optical Transport Network Market (OTN) market is growing due to comprehensive R&D efforts by key industry participants to broaden their product ranges. Significant market developments can occur through agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Important industrial companies also meticulously plan several initiatives to increase their footprint. The optical transport network (OTN) industry must offer services at fair costs to expand and survive in an increasingly challenging and competitive market environment.

Local production to cut operating costs is one of the primary strategies businesses use to serve customers and expand the market sector in the Optical Transport Network Market (OTN) market. Recently, the Optical Transport Network Market (OTN) market has greatly helped the Retail industry. Major corporations in the Optical Transport Network Market (OTN) market, including Huawei Technologies Co. Ltd (China), ZTE Corp (China), Cisco System Inc. (US), NOKIA (Espoo), Ciena Corporation (US), and others, are trying to surge market demand by spending on research and development processes.

Huawei is a multinational technology company with its main office in Shenzhen, Guangdong. This company manufactures, develops, markets, and distributes rooftop solar products, consumer electronics, smart gadgets, and telecom equipment. Ren Zhengfei, a former officer in the People's Liberation Army (PLA), created the company in 1987. Huawei's business has grown from its initial focus on producing phone switches to include the construction of telecommunications networks, the provision of operational and consulting services and equipment to businesses both inside and outside of China, and the production of communications products for the consumer market.

In December 2022, Huawei presented its new strategy for optical transport networks at the Huawei Optical Innovation Forum. To build eco-friendly and simple optical networks and provide all-pervasive premium connectivity, this new vision is focused on delivering the optical transport network (OTN) to edge nodes. This will help operators succeed financially.

Network infrastructure and cutting-edge technologies are the areas of business for Nokia Corp (Nokia), a communications and information technology firm. It provides services for fixed networks, mobile devices, BSS/OSS, IP routing, optical networks, private networks, data centers, radio controllers, network implementation, the

Internet of Things, and 5G. Nokia also provides application services, management, analytics, and network security. Mobile network operators, businesses, the government, the public sector, financial services, retail, energy and resources, healthcare, logistics, manufacturing, and transportation industries are just a few sectors Nokia serves.

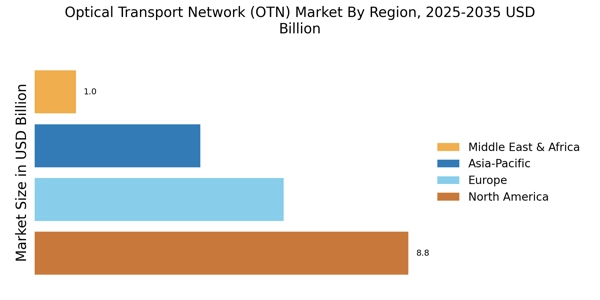

In addition to North America, Asia-Pacific, and Latin America, the corporation also conducts business in Europe, the Middle East, and Africa. Espoo, Finland, serves as the home office for Nokia.

In April Nokia announced that it had added new indoor and outdoor solutions for businesses and communications service providers to its portfolio of mobile transport products. With Nokia's increased Wavence range, there is a complete microwave solution available for all application scenarios.