-

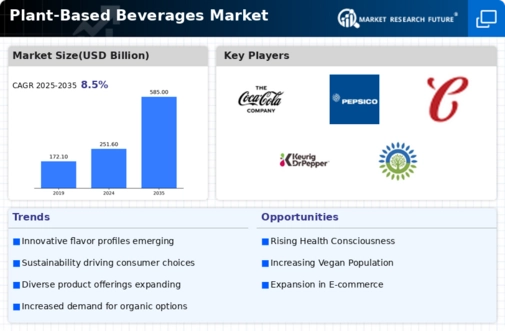

Executive Summary

-

Market Introduction

-

Definition

-

Scope of the Study

-

List of Assumptions

-

Market Structure

-

Key Takeaways

-

Key Buying Criteria

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

Market Dynamics

-

Introduction

-

Drivers

- Increasing Prevalence of Lactose Intolerance

- Rising Demand for Natural and Clean Label Drinks

- Growth of the Retail Sector in Asia-Pacific

-

Restraints

- High Demand for Probiotic Drinks and Sugar-Free Carbonated Beverages

-

Opportunities

- Rising Popularity of Cold Brew and Cold Pressed Beverages

- Innovative Marketing Strategies

-

Market Factor Analysis

-

Value Chain Analysis

- Raw Materials

- Processing and Production

- Packaging

- Distribution and Sales

-

Supply Chain Analysis

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Suppliers

- Threat of Substitutes

- Bargaining Power of Buyers

- Rivalry

-

Plant-Based Beverages Market, by Source

-

Overview

- Fruits

- Vegetables

- Nuts

- Seeds & Leaves

- Soy

- Others

-

Plant-Based Beverages Market, by Type

-

Overview

- RTD Tea & Coffee

- Juices

- Plant-Based Milk

- Others

-

Plant-Based Beverages Market, by Distribution Channel

-

Overview

- Store-Based

- Non-Store-Based

-

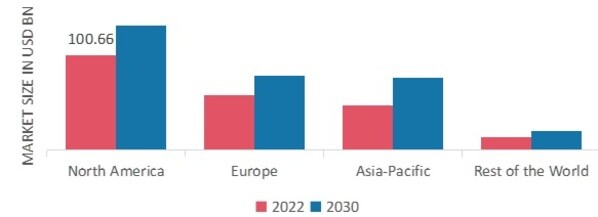

Global Plant-Based Beverages Market, by Region

-

Introduction

-

North America

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

US

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Canada

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Mexico

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Europe

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

UK

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Germany

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

France

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Italy

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Spain

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Rest of Europe

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Asia-Pacific

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

China

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

India

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Japan

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Australia and New Zealand

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Rest of Asia-Pacific

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Rest of the World

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

South America

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Middle East

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Africa

-

Plant-Based Beverages Market, by Source Plant-Based Beverages Market, by Type Plant-Based Beverages Market, by Distribution Channel

-

Competitive Landscape

-

Company Profiles

-

PepsiCo, Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

The Coca-Cola Company

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hain Celestial Group

- Company Overview

- Financial Overview

- Products Offered

- Key Development

- SWOT Analysis

- Key Strategies

-

Danone SA

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fresh Del Monte Produce Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Campbell Soup Company

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Califia Farms

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Koia

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Keurig Dr Pepper Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

SunOpta Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Conclusion

-

Key Findings

-

List of Tables

-

GLOBAL PLANT-BASED BEVERAGES MARKET, BY REGION, 2023-2030 (USD BILLION)

-

GLOBAL: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

GLOBAL: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

GLOBAL: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

LACTOSE SENSITIVITY LEVEL AND DAILY TOLERANCE LIMIT

-

FAT, PROTEIN, AND LACTOSE CONTENT PROFILE OF VARIOUS MILK SOURCES

-

FRUITS: GLOBAL PLANT-BASED BEVERAGES SOURCE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

VEGETABLES: GLOBAL PLANT-BASED BEVERAGES SOURCE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

NUTS: GLOBAL PLANT-BASED BEVERAGES SOURCE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

SEEDS AND LEAVES: GLOBAL PLANT-BASED BEVERAGES SOURCE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

SOY: GLOBAL PLANT-BASED BEVERAGES SOURCE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

OTHERS: GLOBAL PLANT-BASED BEVERAGES SOURCE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

RTD TEA AND COFFEE: GLOBAL PLANT-BASED BEVERAGES TYPE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

JUICES: GLOBAL PLANT-BASED BEVERAGES TYPE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

PLANT-BASED MILK: GLOBAL PLANT-BASED BEVERAGES TYPE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

OTHERS: GLOBAL PLANT-BASED BEVERAGES TYPE MARKET, BY REGION, 2023-2030 (USD BILLION)

-

STORE-BASED: GLOBAL PLANT-BASED BEVERAGES DISTRIBUTION CHANNEL MARKET, BY REGION, 2023-2030 (USD BILLION)

-

NON-STORE-BASED: GLOBAL PLANT-BASED BEVERAGES DISTRIBUTION CHANNEL MARKET, BY REGION, 2023-2030 (USD BILLION)

-

NORTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

-

NORTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

NORTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

NORTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

US: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

US: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

US: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

CANADA: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

CANADA: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

CANADA: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

MEXICO: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

MEXICO: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

MEXICO: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

EUROPE: PLANT-BASED BEVERAGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

-

EUROPE: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

EUROPE: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

EUROPE: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

UK: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

UK: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

UK: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

GERMANY: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

GERMANY: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

GERMANY: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

FRANCE: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

FRANCE: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

FRANCE: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

ITALY: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

ITALY: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

ITALY: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

SPAIN: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

SPAIN: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

SPAIN: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

REST OF EUROPE: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

REST OF EUROPE: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

REST OF EUROPE: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

-

ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

CHINA: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

CHINA: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

CHINA: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

INDIA: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

INDIA: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

INDIA: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

JAPAN: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

JAPAN: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

JAPAN: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

AUSTRALIA AND NEW ZEALAND: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

AUSTRALIA AND NEW ZEALAND: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

AUSTRALIA AND NEW ZEALAND: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

REST OF ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

REST OF ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

REST OF ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

REST OF THE WORLD: PLANT-BASED BEVERAGES MARKET, BY REGION, 2023-2030 (USD BILLION)

-

REST OF THE WORLD: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

REST OF THE WORLD: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

REST OF THE WORLD: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

SOUTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

SOUTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

SOUTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

MIDDLE EAST: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

MIDDLE EAST: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

MIDDLE EAST: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

AFRICA: PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

AFRICA: PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

AFRICA: PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

COMPETITIVE LANDSCAPE: GLOBAL PLANT-BASED BEVERAGES MARKET, BY DEVELOPMENT, 2023-2030101

-

List of Figures

-

GLOBAL PLANT-BASED BEVERAGES MARKET SHARE (%), BY REGION (2017 & 2023)

-

GLOBAL PLANT-BASED BEVERAGES MARKET SHARE (%), BY SOURCE (2017 & 2023)

-

GLOBAL PLANT-BASED BEVERAGES MARKET SHARE (%), BY TYPE (2017 & 2023)

-

GLOBAL PLANT-BASED BEVERAGES MARKET SHARE (%), BY DISTRIBUTION CHANNEL (2017 & 2023)

-

GLOBAL PLANT-BASED BEVERAGES MARKET: MARKET STRUCTURE

-

KEY TAKEAWAYS FROM THE GLOBAL PLANT-BASED BEVERAGES MARKET

-

KEY BUYING CRITERIA IN THE GLOBAL PLANT-BASED BEVERAGES MARKET

-

RESEARCH PROCESS OF MRFR

-

TOP-DOWN & BOTTOM-UP APPROACHES

-

MARKET DYNAMICS OF GLOBAL PLANT-BASED BEVERAGES MARKET

-

GLOBAL PREVALENCE OF LACTOSE INTOLERANCE IN ADULTS, BY REGION,

-

VALUE CHAIN ANALYSIS: PLANT-BASED BEVERAGES MARKET

-

SUPPLY CHAIN ANALYSIS: PLANT-BASED BEVERAGES MARKET

-

PORTER''S FIVE FORCES ANALYSIS OF THE GLOBAL PLANT-BASED BEVERAGES MARKET

-

GLOBAL PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2023-2030 (USD BILLION)

-

GLOBAL PLANT-BASED BEVERAGES MARKET, BY TYPE, 2023-2030 (USD BILLION)

-

GLOBAL PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD BILLION)

-

GLOBAL PLANT-BASED BEVERAGES MARKET, BY REGION, 2023-2030 (USD BILLION)

-

NORTH AMERICA: PLANT-BASED BEVERAGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

-

EUROPE: PLANT-BASED BEVERAGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

-

ASIA-PACIFIC: PLANT-BASED BEVERAGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

-

REST OF THE WORLD: PLANT-BASED BEVERAGES MARKET, BY REGION, 2023-2030 (USD BILLION)

-

GLOBAL PLANT-BASED BEVERAGES MARKET: SHARE OF MARKET DEVELOPMENTS, BY KEY PLAYERS, 2023-2030100

-

GLOBAL PLANT-BASED BEVERAGES MARKET: ANALYSIS OF KEY DEVELOPMENTS

-

GLOBAL PLANT-BASED BEVERAGES MARKET: MARKET DEVELOPMENTS, 2023-2030102

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment