Plating on Plastics Market Share

Plating on Plastics (POP) Market Research Report By Plating (Chromium, Copper, Nickel, Others), By Plastics (ABS, Polypropylene, Polyetherimide, Polyethylene terephthalate, Others) and By Application (Automotive, Electrical & Electronics, Sanitary Fittings, Others) – Forecast to 2035

Market Summary

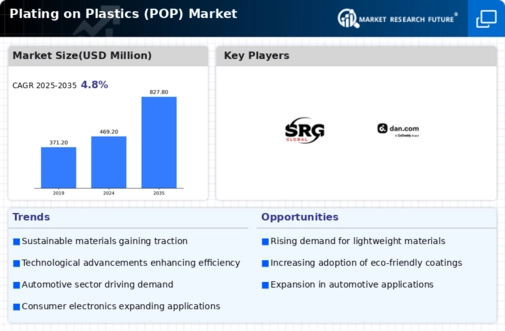

As per Market Research Future Analysis, the Plating on Plastics (POP) market is projected to reach a value of $654.79 Million by 2030, growing at a CAGR of 4.8%. This advanced technique enhances the properties of plastics by applying metal coatings, primarily for decorative and functional benefits. The automotive and electronics industries are the primary consumers, with rising demand for lightweight and corrosion-resistant materials driving market growth. The COVID-19 pandemic negatively impacted the market, particularly in the automotive sector, due to production halts and reduced consumer spending. However, increasing consumer awareness of environmental benefits and government initiatives to control emissions are expected to boost demand. The market is segmented by type (nickel, chrome, others) and application (automotive, electrical and electronics, construction). North America holds a significant market share, driven by its large automobile market, while Asia-Pacific is anticipated to experience rapid growth due to the demand for electric vehicles.

Key Market Trends & Highlights

Key trends influencing the Plating on Plastics market include technological advancements and increasing applications across various sectors.

- Market value expected to reach $654.79 Million by 2030.

- CAGR of 4.8% projected during the forecast period.

- Automotive sector is the largest consumer, driven by lightweight vehicle demand.

- North America holds a 20% share of the market.

Market Size & Forecast

| Market Size | USD 654.79 Million by 2030 |

| CAGR | 4.8% |

| Largest Regional Market Share | North America |

| Major Application | Automotive. |

Major Players

Key players include Month Group, Cybershield Inc., Phillips Plating Corporation, and GROHE AG.

Market Trends

The ongoing advancements in plating technologies are likely to enhance the aesthetic appeal and functional performance of plastic components across various industries, indicating a robust growth trajectory for the Plating on Plastics market.

U.S. Department of Commerce

Plating on Plastics Market Market Drivers

Growing Automotive Sector

The Global Plating on Plastics (POP) Market Industry is significantly influenced by the growth of the automotive sector. As automotive manufacturers increasingly incorporate plastic components for aesthetic and functional purposes, the demand for plating on these materials rises. This trend is particularly evident in the production of interior and exterior parts, where plated plastics enhance visual appeal and performance. The automotive industry is expected to be a key contributor to the market's expansion, with a projected compound annual growth rate of 5.3% from 2025 to 2035. This growth trajectory underscores the importance of plating technologies in meeting the evolving needs of automotive design and manufacturing.

Market Growth Projections

The Global Plating on Plastics (POP) Market Industry is poised for substantial growth, with projections indicating a market size of 469.2 USD Million in 2024 and an anticipated increase to 827.8 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 5.3% from 2025 to 2035, reflecting the industry's resilience and adaptability to emerging trends. Factors such as technological advancements, rising demand for lightweight materials, and increasing focus on aesthetics contribute to this positive outlook. The market's expansion underscores the importance of plating technologies in various applications, from automotive to consumer electronics, highlighting its integral role in modern manufacturing.

Rising Demand for Lightweight Materials

The Global Plating on Plastics (POP) Market Industry experiences a notable surge in demand for lightweight materials across various sectors, particularly in automotive and aerospace. As manufacturers strive to enhance fuel efficiency and reduce emissions, the adoption of lightweight components becomes increasingly critical. For instance, the automotive sector is projected to witness a significant shift towards plastic substrates that can be effectively plated, thereby reducing overall vehicle weight. This trend is expected to contribute to the market's growth, with the industry valued at 469.2 USD Million in 2024, indicating a robust trajectory as companies seek innovative solutions to meet regulatory standards.

Increasing Focus on Aesthetics and Customization

A growing emphasis on aesthetics and customization within various industries is driving the Global Plating on Plastics (POP) Market Industry. Consumers increasingly seek personalized products that reflect their individual styles, prompting manufacturers to explore innovative plating options. This trend is particularly pronounced in consumer electronics, where plated plastics are used to enhance the visual appeal of devices. As companies strive to differentiate their offerings in a competitive market, the demand for high-quality plating solutions is likely to rise. This shift towards customization may further propel the market, aligning with the broader trend of personalization across consumer goods.

Technological Advancements in Plating Techniques

Technological advancements play a pivotal role in shaping the Global Plating on Plastics (POP) Market Industry. Innovations in electroplating and vacuum metallization techniques are enhancing the efficiency and quality of plating processes. These advancements not only improve adhesion and durability but also expand the range of applications for plated plastics. For example, the introduction of environmentally friendly plating methods aligns with global sustainability goals, appealing to eco-conscious consumers. As these technologies evolve, they are likely to drive market growth, with projections indicating a market size of 827.8 USD Million by 2035, reflecting the industry's adaptability to changing consumer preferences.

Environmental Regulations and Sustainability Initiatives

The Global Plating on Plastics (POP) Market Industry is increasingly shaped by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing the environmental impact of manufacturing processes, which includes the use of eco-friendly plating techniques. Companies are compelled to adopt sustainable practices, such as utilizing non-toxic materials and minimizing waste during production. This shift not only aligns with regulatory requirements but also resonates with environmentally conscious consumers. As a result, the market is expected to witness growth driven by the demand for sustainable plating solutions, reflecting a broader commitment to environmental stewardship.

Market Segment Insights

Regional Insights

Key Companies in the Plating on Plastics Market market include

Industry Developments

In February 2019, SRG Global Inc, who is a manufacturer of chrome-plated plastic parts for the automotive industry, produced a new polymer for the plating of parts for automobiles.

On April 29, 2024, Cybershield Inc., a U.S. producer of metalized plastic components announced that it is collaborating with SABIC, a global leader in the chemical industry to promote the use of plated ULTEM resins in aerospace. This collaboration will be showcased at NPE2024 and the 2024 Aircraft Interiors Expo (AIX). In this respect, SABIC’s team had imparted to Cybershield their extensive knowledge on injection molding of high-heat ULTEM resins. These are high-performance thermoplastics having excellent mechanical properties, thermal stability, and resistance to harsh environments.

Further benefits can be achieved by metallizing these resins with improved durability against electromagnetic interference shielding (EMI).

Atotech has launched the Atotech CMA Closed-Loop System for alkaline zinc nickel plating on July 28th, 2023. It is certified by TÜV Rheinland and facilitates virtually wastewater-free operations while reducing waste generation to minimize carbon footprinting. The closed-loop system allows all-inclusive functions under such solution covering every aspect of alkaline zinc nickel plating including rinsing process requirements. Implementing this closed-loop water system significantly reduces or eliminates wastewater discharges during plating operations making it an eco-friendly process.

As a result, cleaner and more sustainable operations are realized due to optimizing the plating process by CMA systems which reduces the amount of waste produced. It helps improve overall carbon footprints of the plating process aligning with worldwide sustainability targets.

GROHE AG, world's biggest producer of sanitary fittings continues expanding succeeding in investing in its facility located in Lahr Germany. The development of an electroplating facility allowing chrome-plating plastic parts like showerheads increased plastics chrome-plating capacity at site by up to seventy percent.

Market overview

This global Plating on plastics market outlook report is based on the qualitative and quantitative analysis of the Plating on plastics market outlook. This report highlights the Plating on plastics market outlook on the market overviews, covid-19 analysis, market dynamics, and Plating on plastics market analysis. This plating on the plastics (POP) market also gives an idea about the regional analysis, competitive landscape, and recent development of the market.

Segmental table

By Type

- Nickel

- Chrome

- Others

By Application

- Automotive

- Electrical & Electronics

- Construction & Building

- Others

By region

- North America

- Europe

- Asia Pacific

- middle east and Africa

- Latin America

Future Outlook

Plating on Plastics Market Future Outlook

The Plating on Plastics (POP) Market is projected to grow at a 5.3% CAGR from 2024 to 2035, driven by advancements in technology and increasing demand in automotive and electronics sectors.

New opportunities lie in:

- Invest in eco-friendly plating technologies to meet regulatory demands.

- Expand product offerings for automotive applications to capture emerging markets.

- Leverage digitalization for process optimization and cost reduction in manufacturing.

By 2035, the Plating on Plastics market is expected to achieve robust growth, solidifying its position in diverse industries.

Market Segmentation

Report Scope

| Report Attribute/Metric | Details |

| Market Size | 2030: USD 654.79 Million |

| CAGR | 4.8% (2022-2030) |

| Base Year | 2023 |

| Forecast Period | 2022-2030 |

| Historical Data | 2019 & 2020 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Plating, Plastics and Application |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors | Atotech (Germany), SRG Global (US), Plamingo Ltd (Germany), Artcraft Plating & Finishing (US), Astro Electroplating, Inc (US), Surface Coatings LLC (India), Quality Plated Products Ltd (UK), Precision Plating (Aust) Pty Ltd (Australia), Cuptronic (Sweden), Phillips Plating (US), MPC Plating, Inc (US), DuPont (US), ENS Technology (US), Okuno International (US), Sharretts Plating Company (SPC) (US), Component Surfaces Inc (US) |

| Key Market Opportunities | The demand for lightweight vehicles and increased over the years due to environmental concerns |

| Key Market Drivers | The changing lifestyle of people. The use of Plating on Plastics in the automotive sector |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the market’s valuation?

plating on plastics market is expected to rise to a valuation of USD 654.79 million by 2030.

What is the CAGR of the market?

The market is expected to exhibit a strong 4.8% CAGR over the forecast period from 2024-2032.

What are the major drivers in the Plating on plastics market?

The application of Plating on Plastics in automotive and construction are the drivers of the Plating on plastics market.

Which is the leading regional market?

North America holds the largest share in the plating on plastics market.

What are the leading market players?

Leading players in the plating on plastics market include Atotech, SRG Global, and Plamingo, among others.

-

Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Markets Structure

-

Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce Merchants

- Application

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Intensity of Competitive Rivalry

- Market Price Analysis 2020–2027

-

Supply Chain Analysis

-

Industry Overview of Global Plating on Plastics (POP) Market

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

-

Market Trends

- Introduction

- Growth Trends

- Impact Analysis

-

Global Plating on Plastics (POP) Market, by Plating

- Introduction

-

Chromium

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Copper

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Nickel

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Plating on Plastics (POP) Market, by Plastic

- Introduction

-

Acrylonitrile-butadiene-styrene (ABS)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Polycarbonate (PC)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Polyetherimide (PEI)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Polyethylene terephthalate (PET)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Polybutylene terephthalate (PBT)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

PC/ABS

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Liquid Crystal Polymers (LCP)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Polyether ether ketone (PEEK)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Polypropylene (PP)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Nylon

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Plating on Plastics (POP) Market, by Application

- Introduction

-

Automotive

- Interior

- Exterior

-

Sanitary Fittings

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Electrical & Electronics

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Utilities

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Plating on Plastics (POP) Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast by Plating, 2020–2027

- Market Estimates & Forecast by Plastic, 2020–2027

- Market Estimates & Forecast by Application, 2020–2027

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast by Plating, 2020–2027

- Market Estimates & Forecast by Plastic, 2020–2027

- Market Estimates & Forecast by Application, 2020–2027

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Netherlands

- Rest of Europe

-

Asia Pacific

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast by Plating, 2020–2027

- Market Estimates & Forecast by Plastic, 2020–2027

- Market Estimates & Forecast by Application, 2020–2027

- China

- India

- Japan

- Thailand

- Malaysia

- Vietnam

- Rest of Asia Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast by Plating, 2020–2027

- Market Estimates & Forecast by Plastic, 2020–2027

- Market Estimates & Forecast by Application, 2020–2027

- Saudi Arabia

- UAE

- Africa

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast by Plating, 2020–2027

- Market Estimates & Forecast by Plastic, 2020–2027

- Market Estimates & Forecast by Application, 2020–2027

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Competitive Landscape

- Introduction

- Market Key Strategies

- Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New

-

Developments/Agreements/Investments)

-

Company Profiles

-

Atotech

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

SRG Global

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Plamingo Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Artcraft Plating & Finishing

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Astro Electroplating, Inc

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Surface Coatings LLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Quality Plated Products Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Precision Plating (Aust) Pty Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Tiptronic

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Phillips Plating

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

MPC Plating, Inc

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

DuPont

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

ENS Technology

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Okuno International

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sharretts Plating Company (SPC)

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Component Surfaces Inc

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Atotech

-

Conclusion

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Plating on Plastics (POP) Market, by Region, 2020–2027

- Table 2 North America: Plating on Plastics (POP) Market, by Country, 2020–2027

- Table 3 Europe: Plating on Plastics (POP) Market, by Country, 2020–2027

- Table 4 Asia-Pacific: Plating on Plastics (POP) Market, by Country, 2020–2027

- Table 5 Middle East & Africa: Plating on Plastics (POP) Market, by Country, 2020–2027

- Table 6 Latin America: Plating on Plastics (POP) Market, by Country, 2020–2027

- Table 7 Plating on Plastics (POP) Plating Market, by Region, 2020–2027

- Table 8 North America: Plating on Plastics (POP) Plating Market, by Country, 2020–2027

- Table 9 Europe: Plating on Plastics (POP) Plating Market, by Country, 2020–2027

- Table 10 Asia-Pacific: Plating on Plastics (POP) Product Market, by Country, 2020–2027

- Table 11 Middle East & Africa: Plating on Plastics (POP) Plating Market, by Country, 2020–2027

- Table 12 Latin America: Plating on Plastics (POP) Plating Market, by Country, 2020–2027

- Table 13 Plating on Plastics (POP) Plastic Market, by Region, 2020–2027

- Table 14 North America: Plating on Plastics (POP) Plastic Market, by Country, 2020–2027

- Table 15 Europe: Plating on Plastics (POP) Plastic Market, by Country, 2020–2027

- Table 16 Asia-Pacific: Plating on Plastics (POP) Plastic Market, by Country, 2020–2027

- Table 17 Middle East & Africa: Plating on Plastics (POP) Plastic Market, by Country, 2020–2027

- Table 18 Latin America: Plating on Plastics (POP) Plastic Market, by Country, 2020–2027 LIST OF FIGURES

- FIGURE 1 Plating on Plastics (POP) Market Segmentation

- FIGURE 2 Forecast Methodology

- FIGURE 3 Porter’s Five Forces Analysis of Plating on Plastics (POP) Market

- FIGURE 4 Supply Chain of Plating on Plastics (POP) Market

- FIGURE 5 Share of Plating on Plastics (POP) Market, by Country, 2020 (%)

- FIGURE 6 Global Plating on Plastics (POP) Market, 2020–2027

- FIGURE 7 Sub Segments of Plating

- FIGURE 8 Plating on Plastics (POP) Market size, by Plating, 2020 (%)

- FIGURE 9 Share of Plating on Plastics (POP) Market, by Plating, 2020–2027

- FIGURE 10 Sub Segments of Plastic

- FIGURE 11 Plating on Plastics (POP) Market size, by Plastic, 2020 (%)

- FIGURE 12 Share of Plating on Plastics (POP) Market, by Plastic, 2020–2027

- FIGURE 13 Sub Segments of Application

- FIGURE 14 Plating on Plastics (POP) Market size, by Application, 2020 (%)

- FIGURE 15 Share of Plating on Plastics (POP) Market, by Application, 2020–2027

Plating on Plastics (POP) Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment