Market Share

Power over Ethernet Chipsets Market Share Analysis

Within the Power over Ethernet (PoE) Chipsets Market, companies deploy various strategic approaches to establish and enhance their market share positioning. This dynamic sector, integral to the networking and connectivity industry, relies on effective strategies to navigate competition and meet evolving customer demands. One primary strategy employed is differentiation, where manufacturers aim to set their PoE chipsets apart by incorporating unique features or capabilities. This may include advancements in power delivery efficiency, support for higher data transfer rates, or compatibility with emerging PoE standards. Through differentiation, companies can attract customers seeking specialized solutions and carve a distinct niche for themselves within the PoE Chipsets Market.

Pricing strategies play a pivotal role in the market, reflecting the diversity of customer needs and budget considerations. Some manufacturers adopt a cost leadership strategy, emphasizing efficient production processes and economies of scale to offer competitively priced PoE chipsets. This appeals to a broad customer base looking for affordable and reliable solutions. Conversely, premium pricing strategies are embraced by companies focusing on high-performance PoE chipsets with advanced features or enhanced power management. This approach targets customers willing to invest more for superior functionality and efficiency in their networking applications.

Strategic collaborations and partnerships are commonplace in the PoE Chipsets Market. Companies often form alliances with networking equipment manufacturers, system integrators, or other stakeholders in the technology ecosystem. These collaborations can result in mutually beneficial agreements, ensuring a steady demand for PoE chipsets and securing strategic market positions. Additionally, partnerships may lead to joint research and development efforts, fostering innovation and aligning products with emerging industry standards.

Market segmentation is a key strategy, where PoE chipset manufacturers tailor their products to meet the specific requirements of different applications. This could involve developing chipsets optimized for security cameras, wireless access points, lighting systems, or other PoE-powered devices. By catering to the unique needs of diverse markets, companies can capture a larger share within each segment and establish themselves as specialists in specific applications.

Innovation is fundamental in the PoE Chipsets Market, given the rapid evolution of networking technologies. Continuous investment in research and development is essential to stay ahead of industry trends and technological advancements. PoE chipset manufacturers strive to integrate the latest technologies, such as support for higher power levels, improved energy efficiency, or enhanced compatibility with evolving networking standards. Innovations not only attract early adopters but also position companies as leaders in the industry, contributing to increased market share.

Brand positioning and marketing strategies are crucial for success in the competitive PoE Chipsets Market. Effective marketing campaigns, participation in industry events, and highlighting the reliability and performance of PoE chipsets contribute to brand recognition and trust. A strong brand presence can influence purchasing decisions and contribute to a larger market share.

Customer support and post-sale services are vital elements in market share positioning. Responsive customer service, warranty programs, and ongoing technical support contribute to customer satisfaction and loyalty. Satisfied customers are more likely to recommend products and become repeat buyers, positively influencing the reputation of the PoE chipset manufacturer and contributing to market share growth.

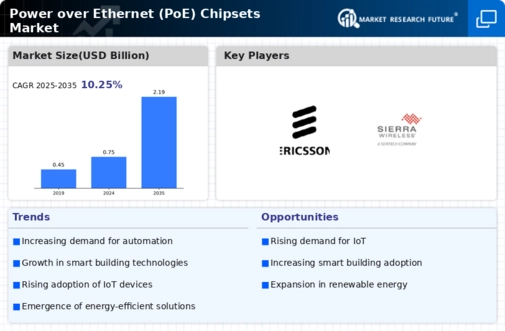

Power over Ethernet (PoE) Chipsets offer several advantages. They are crucial for easy maintenance, reducing downtime in infrastructure management, and improving flexibility while remaining cost-effective. The demand for chipsets is increasing due to the adoption of advanced technologies like the Industrial Internet-of-Things (IIoT) in smart buildings, factories, and industrial networks with automation. The significant infrastructure developments in developing economies, coupled with the use of big data analytics and cloud-based systems, will further contribute to the growth of the market.

Leave a Comment