-

Market Introduction

-

Definition 19

-

Scope of the Study 19

-

Market Structure 20

-

Key Takeaways 20

-

Macro Factor Indicators Analysis 20

-

List of Assumptions 21

-

Research Methodology

-

Research Process 23

-

Primary Research 24

-

Secondary Research 25

-

Market Size Estimation 25

-

Forecast Model 26

-

Market Dynamics

-

Introduction 28

-

Drivers 28

- Increasing Investment in Construction Industry 28

- Urbanization leading to Rise in Construction Activities 30

- Reduced Construction Waste 30

- Drivers Impact Analysis 31

-

Restraints 31

- Economic Downturn in Major Regions 31

- Fluctuating Raw Material Prices 31

- Restraints Impact Analysis 32

-

Opportunity 32

- Scope in Emerging Economies 32

-

Market Factor Analysis

-

Supply Chain Analysis 34

- Design and Development 34

- Raw Material Supply 34

- Precast Concrete Manufacturing 34

- Distribution 35

- End-Use 35

-

Porter’s Five Forces Model 35

- Threat of New Entrants 35

- Bargaining Power of Suppliers 36

- Bargaining Power of Buyers 36

- Threat of Substitutes 36

- Intensity of Rivalry 36

- Threat of Substitutes 36

- Rivalry 36

-

Import Analysis of Refractory cements, mortars, concretes and similar compositions 37

-

Export Analysis of Refractory cements, mortars, concretes and similar compositions 38

-

Global Precast concrete Market, By Product

-

Overview 41

- Columns & Beams 43

- Floors & Roofs 43

- Walls 43

- Stairs and Landings 44

- Others 44

-

Global Precast Concrete Market, By Application

-

Overview 46

- Structural Components 47

- Architectural Components 47

- Bridge Components 47

- Others 47

-

Global Precast concrete Market, By End-use

-

Overview 49

- Residential 50

- Non-Residential 50

- Agriculture 50

-

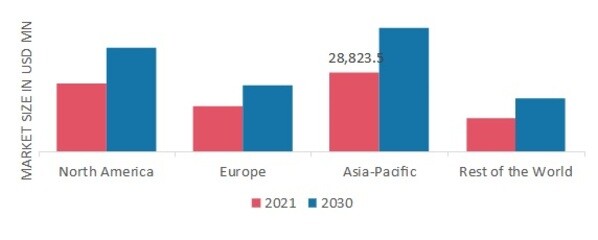

Global Precast Concrete Market, By Region

-

Overview 52

-

North America 54

- US 58

- Canada 61

-

Europe 64

- Germany 68

- UK 72

- France 75

- Spain 78

- Rest of Europe 81

-

Asia-Pacific 84

- China 88

- Japan 92

- India 95

- Rest of Asia Pacific 99

-

Rest of the World 102

- Middle East and Africa 106

-

Latin America 109

-

Competitive Landscape

-

Competitive Scenario 114

- Market Share Analysis 115

- Competitive BENCHMARKING OF MAJOR COMPETITORS 116

-

Company Profiles

-

Metromont Corporation 118

- Company Overview 118

- Financial Overview 118

- Products Offered 118

- Key Developments (2020-2027) 119

- SWOT Analysis 119

- Key Strategies 119

-

Coreslab Structures 120

- Company Overview 120

- Financial Overview 120

- Products Offered 120

- Key Developments (2020-2027) 121

- SWOT Analysis 121

- Key Strategies 122

-

CRH 122

- Company Overview 122

- Financial Overview 122

- Products Offered 123

- Key Developments (2015 – 2018) 123

- SWOT Analysis 124

- Key Strategies 124

-

Coltman Precast Concrete Limited 125

- Company Overview 125

- Financial Overview 125

- Products Offered 125

- Key Developments (2020-2027) 125

- SWOT Analysis 126

- Key Strategies 126

-

HEIDELBERGCEMENT AG 127

- Company Overview 127

- Financial Overview 127

- Products Offered 128

- Key Developments (2020-2027) 129

- SWOT Analysis 129

- Key Strategies 129

-

TAIHEIYO CEMENT CORPORATION 130

- Company Overview 130

- Financial Overview 130

- Products Offered 131

- Key Developments (2020-2027) 132

- SWOT Analysis 132

- Key Strategies 132

-

SMEET 133

- Company Overview 133

- Financial Overview 133

- Products Offered 133

- Key Developments (2020-2027) 133

- SWOT Analysis 134

- Key Strategies 134

-

LARSEN & TOUBRO LIMITED 135

- Company Overview 135

- Financial Overview 135

- Products Offered 136

- Key Developments (2020-2027) 137

- SWOT Analysis 137

- Key Strategies 137

-

Jensen Precast 138

- Company Overview 138

- Financial Overview 138

- Products Offered 138

- Key Developments (2020-2027) 138

- SWOT Analysis 139

- Key Strategies 139

-

SKANSKA AB 140

- Company Overview 140

- Financial Overview 140

- Products Offered 141

- Key Developments (2020-2027) 141

- SWOT Analysis 141

- Key Strategies 142

-

Tindall Corporation 142

- Company Overview 142

- Financial Overview 142

- Products Offered 142

- Key Developments (2020-2027) 143

- SWOT Analysis 143

- Key Strategies 143

-

Molin Concrete Products Company, Inc. 144

- Company Overview 144

- Financial Overview 144

- Products Offered 144

- Key Developments 145

- SWOT Analysis 145

- Key Strategies 145

-

-

List of Tables

-

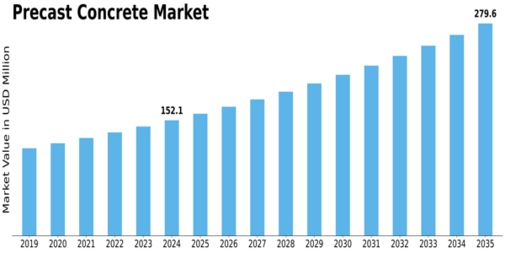

MARKET SYNOPSIS 17

-

LIST OF ASSUMPTIONS 21

-

SHARE OF TOP FIVE COUNTRIES ATTRACTING FDI EQUITY INFLOWS FOR CONSTRUCTION DEVELOPMENT, 2020-2027 (USD MILLION) 29

-

FDI INFLOWS, ASIA-PACIFIC, 2020-2027 (USD BILLION) 30

-

NORTH AMERICA: IMPORTS, 2020-2027 (USD THOUSAND) 37

-

EUROPE: IMPORTS, 2020-2027 (USD THOUSAND) 37

-

ASIA PACIFIC: IMPORTS, 2020-2027 (USD THOUSAND) 37

-

REST OF THE WORLD (ROW): IMPORTS, 2020-2027 (USD THOUSAND) 38

-

NORTH AMERICA: EXPORTS, 2020-2027 (USD THOUSAND) 38

-

EUROPE: EXPORTS, 2020-2027 (USD THOUSAND) 39

-

ASIA PACIFIC: EXPORTS, 2020-2027 (USD THOUSAND) 39

-

REST OF THE WORLD (ROW): EXPORTS, 2020-2027 (USD THOUSAND) 39

-

GLOBAL PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 41

-

GLOBAL PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 41

-

WALLS: GLOBAL PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 42

-

WALLS: GLOBAL PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 42

-

GLOBAL PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 46

-

GLOBAL PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 46

-

GLOBAL PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 49

-

GLOBAL PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 49

-

GLOBAL PRECAST CONCRETE MARKET, BY REGION, 2020-2027 (USD MILLION) 52

-

GLOBAL PRECAST CONCRETE MARKET, BY REGION, 2020-2027 (MILLION TONNES) 53

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 54

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY COUNTRY, 2020-2027 (MILLION TONNES) 54

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 55

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 55

-

WALLS: NORTH AMERICA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 56

-

WALLS: NORTH AMERICA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 56

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 56

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 57

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 57

-

NORTH AMERICA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 57

-

US: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 58

-

US: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 58

-

WALLS: US: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 59

-

WALLS: US: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 59

-

US: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 59

-

US: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 60

-

US: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 60

-

US: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 60

-

CANADA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 61

-

CANADA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 61

-

WALLS: CANADA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 62

-

WALLS: CANADA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 62

-

CANADA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 62

-

CANADA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 63

-

CANADA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 63

-

CANADA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 63

-

EUROPE: PRECAST CONCRETE MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 64

-

EUROPE: PRECAST CONCRETE MARKET, BY COUNTRY, 2020-2027 (MILLION TONNES) 65

-

EUROPE: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 65

-

EUROPE: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 66

-

WALLS: EUROPE: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 66

-

WALLS: EUROPE: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 66

-

EUROPE: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 67

-

EUROPE: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 67

-

EUROPE: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 68

-

EUROPE: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 68

-

GERMANY: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 69

-

GERMANY: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 69

-

WALLS: GERMANY: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 69

-

WALLS: GERMANY: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 70

-

GERMANY: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 70

-

GERMANY: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 71

-

GERMANY: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 71

-

GERMANY: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 71

-

UK: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 72

-

UK: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 72

-

WALLS: UK: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 73

-

WALLS: UK: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 73

-

UK: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 73

-

UK: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 74

-

UK: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 74

-

UK: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 74

-

FRANCE: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 75

-

FRANCE: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 75

-

WALLS: FRANCE: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 76

-

WALLS: FRANCE: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 76

-

FRANCE: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 76

-

FRANCE: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 77

-

FRANCE: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 77

-

FRANCE: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 77

-

SPAIN: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 78

-

SPAIN: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 78

-

WALLS: SPAIN: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 79

-

WALLS: SPAIN: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 79

-

SPAIN: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 79

-

SPAIN: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 80

-

SPAIN: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 80

-

SPAIN: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 80

-

REST OF EUROPE: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 81

-

REST OF EUROPE: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 81

-

WALLS: REST OF EUROPE: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 82

-

WALLS: REST OF EUROPE: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 82

-

REST OF EUROPE: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 82

-

REST OF EUROPE: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 83

-

REST OF EUROPE: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 83

-

REST OF EUROPE: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 83

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 84

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY COUNTRY, 2020-2027 (MILLION TONNES) 85

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 85

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 86

-

WALLS: ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 86

-

WALLS: ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 86

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 87

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 87

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 88

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 88

-

CHINA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 89

-

CHINA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 89

-

WALLS: CHINA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 89

-

WALLS: CHINA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 90

-

CHINA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 91

-

CHINA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 91

-

CHINA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 91

-

CHINA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 92

-

JAPAN: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 92

-

JAPAN: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 93

-

WALLS: JAPAN: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 93

-

WALLS: JAPAN: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 93

-

JAPAN: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 94

-

JAPAN: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 94

-

JAPAN: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 95

-

JAPAN: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 95

-

INDIA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 96

-

INDIA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 96

-

WALLS: INDIA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 96

-

WALLS: INDIA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 97

-

INDIA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 97

-

INDIA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 98

-

INDIA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 98

-

INDIA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 98

-

REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 99

-

REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 99

-

WALLS: REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 100

-

WALLS: REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 100

-

REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 100

-

REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 101

-

REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 101

-

REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 101

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY REGION, 2020-2027 (USD MILLION) 102

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY REGION, 2020-2027 (MILLION TONNES) 102

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 103

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 103

-

WALLS: REST OF THE WORLD: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 104

-

WALLS: REST OF THE WORLD: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 104

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 104

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 105

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 105

-

REST OF THE WORLD: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 105

-

MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 106

-

MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 106

-

WALLS: MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 107

-

WALLS: MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 107

-

MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 107

-

MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 108

-

MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 108

-

MIDDLE EAST AND AFRICA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 108

-

LATIN AMERICA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 109

-

LATIN AMERICA: PRECAST CONCRETE MARKET, BY PRODUCT, 2020-2027 (MILLION TONNES) 109

-

WALLS: LATIN AMERICA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (USD MILLION) 110

-

WALLS: LATIN AMERICA: PRECAST CONCRETE MARKET, BY TYPE, 2020-2027 (MILLION TONNES) 110

-

LATIN AMERICA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 110

-

LATIN AMERICA: PRECAST CONCRETE MARKET, BY APPLICATION, 2020-2027 (MILLION TONNES) 111

-

LATIN AMERICA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (USD MILLION) 111

-

LATIN AMERICA: PRECAST CONCRETE MARKET, BY END-USE, 2020-2027 (MILLION TONNES) 111

-

MAJOR MERGERS AND ACQUISITION: PRECAST CONCRETE MARKET 114

-

List of Figures

-

GLOBAL PRECAST CONCRETE MARKET: MARKET STRUCTURE 20

-

KEY TAKEAWAYS FROM PRECAST CONCRETE MARKET 20

-

RESEARCH PROCESS OF MRFR 23

-

TOP DOWN & BOTTOM-UP APPROACH 26

-

DRO ANALYSIS OF GLOBAL PRECAST CONCRETE MARKET 28

-

CONSTRUCTION INDUSTRY IN USD MILLION (2020-2027) 29

-

DRIVERS IMPACT ANALYSIS: PRECAST CONCRETE MARKET 31

-

RESTRAINTS IMPACT ANALYSIS: PRECAST CONCRETE MARKET 32

-

SUPPLY CHAIN: GLOBAL PRECAST CONCRETE MARKET 34

-

GLOBAL PRECAST CONCRETE MARKET, BY PRODUCT, 2020 (% SHARE - VALUE) 42

-

WALLS: PRECAST CONCRETE MARKET, BY TYPE, 2020 (% SHARE - VALUE) 43

-

GLOBAL PRECAST CONCRETE MARKET, BY TECHNOLOGY, 2020 (% SHARE - VALUE) 47

-

GLOBAL PRECAST CONCRETE MARKET, BY END-USE, 2020 (% SHARE - VALUE) 50

-

GLOBAL PRECAST CONCRETE MARKET SHARE, BY REGION, 2020 (% SHARE - VALUE) 52

-

NORTH AMERICA: PRECAST CONCRETE MARKET SHARE, BY COUNTRY, 2020 (% SHARE - VALUE) 54

-

EUROPE: PRECAST CONCRETE MARKET SHARE, BY COUNTRY, 2020 (% SHARE - VALUE) 64

-

ASIA-PACIFIC: PRECAST CONCRETE MARKET SHARE, BY COUNTRY, 2020 (% SHARE - VALUE) 84

-

REST OF THE WORLD: PRECAST CONCRETE MARKET SHARE, BY REGION, 2020 (% SHARE - VALUE) 102

-

MARKET SHARE ANALYSIS PRECAST CONCRETE MARKET, 2020 (%): KEY COMPETITORS 115

-

COMPETITIVE BENCHMARKING OF MAJOR COMPETITORS: PRECAST CONCRETE MARKET 116

-

METROMONT CORPORATION SWOT ANALYSIS 119

-

CORESLAB STRUCTURES: SWOT ANALYSIS 121

-

CRH: SALES REVENUE, 2020-2027 (USD MILLION) 122

-

CRH: SEGMENTAL REVENUE, 2020 (%) 123

-

CRH: GEOGRAPHIC REVENUE, 2020 (%) 123

-

CRH: SWOT ANALYSIS 124

-

COLTMAN PRECAST CONCRETE LIMITED: SWOT ANALYSIS 126

-

HEIDELBERGCEMENT AG: TOTAL REVENUE, 2015–2020 (USD MILLION) 127

-

HEIDELBERGCEMENT AG: SEGMENTAL REVENUE, 2020 (%) 128

-

HEIDELBERGCEMENT AG: REGIONAL REVENUE, 2020 (%) 128

-

HEIDELBERGCEMENT AG: SWOT ANALYSIS 129

-

TAIHEIYO CEMENT CORPORATION: TOTAL REVENUE, 2015–2020 (USD MILLION) 130

-

TAIHEIYO CEMENT CORPORATION: SEGMENTAL REVENUE, 2020 (%) 131

-

TAIHEIYO CEMENT CORPORATION: REGIONAL REVENUE, 2020 (%) 131

-

TAIHEIYO CEMENT CORPORATION: SWOT ANALYSIS 132

-

SMEET: SWOT ANALYSIS 134

-

LARSEN & TOUBRO LIMITED: TOTAL REVENUE, 2020-2027 (USD MILLION) 135

-

LARSEN & TOUBRO LIMITED: SEGMENTAL REVENUE, 2020 (%) 136

-

LARSEN & TOUBRO LIMITED: REGIONAL REVENUE, 2020 (%) 136

-

LARSEN & TOUBRO LIMITED: SWOT ANALYSIS 137

-

JENSEN PRECAST: SWOT ANALYSIS 139

-

SKANSKA AB: TOTAL REVENUE, 2020-2027 (USD MILLION) 140

-

SKANSKA AB: REGIONAL REVENUE, 2020 (%) 141

-

SKANSKA AB: SWOT ANALYSIS 141

-

TINDALL CORPORATION: SWOT ANALYSIS 143

-

MOLIN CONCRETE PRODUCTS COMPANY, INC.: SWOT ANALYSIS 145'

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment