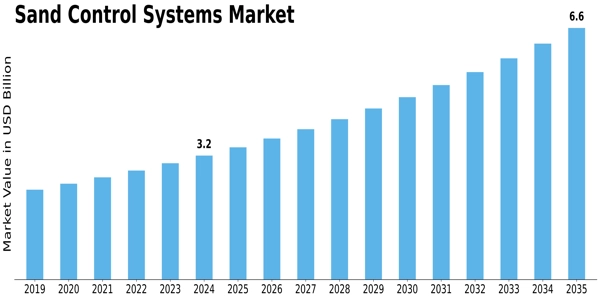

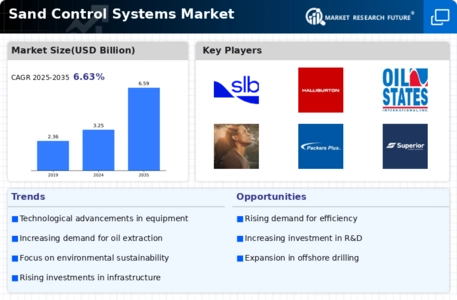

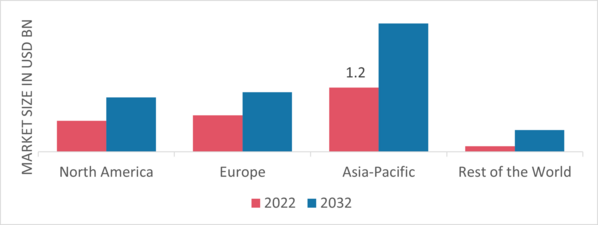

Sand Control Systems Size

Sand Control Systems Market Growth Projections and Opportunities

Sand control systems play a significant role in the flow of oil and the production setup. This technology allows for decreased sand hamper in the borehole. During this stage, the process is monitored effectively and endorses the productivity and well-being of the people involved. Concerning today, the major part of the world's oil and gas wells produces the sandstone which is disintegrated into granular sand with reservoir fluids. Issues with sand testing cover the topics of destruction of perforation tunnels, sand composition of surface separators, reduction of the production interval, and later, more equipment’s failure either from the top or from the bottom due to erosion. Such problems endanger they might lead to security and economic risks. While sand control systems market operates in a rapidly changing environment, there are some factors that can be considered as major competitive segments, market trends and growth drivers. In dealing with the oil and gas industry, sand control strategies are becoming vital as they assist to handle the sand influx in the production phase. Market dynamics which encompass technological innovations, recent drillings, reservoir properties, demand in the market and strategies of competitors accordingly be studied.

The technical developments are main drive for the modification of sand control market trends. The sand control techniques are now innovated regularly and than the materials and equipment is also upgraded as a result the systems are now more productive and reliable than before. Among these developments, the previously mentioned methods, like gravel packing, screens, chemical treatments, and portable tools that were designed to effectively curb sand production while the integrity of the well is maintained have become popular. The emphasis is still on ways to optimize reservoir productivity, less operational cost, and better wellflow efficiency.

Reservoir conditions and the activities of the drilling industry are responsible in influencing the workings of sand control systems market. Saturated rocks are also susceptible to the phenomenon due to the pressure of sand carried by underground fluids. Elements such as the reservoir envelope pressure, the characteristics of the reservoirs, physical and chemical properties of the fluids and well stability all influence the creation and deployment process of sand control systems. Mankind can never stop using their brains and will find a through different means making adjustments over down time until society is once again needs the Sand.

Market demand is a fundamental force which exerts profound influence on this system. The demand for downhole tools is paramount when new wells are drilled or interventions on the existing wells are performed to enhance the production. While the application of sand control in the oil and gas industry has grown in response to the need to optimize oil recovery and improve the efficiency of operations, the industry is facing challenges stemming from sand production, for which the need for sand control solutions has become recurring.

Leave a Comment