Market Growth Projections

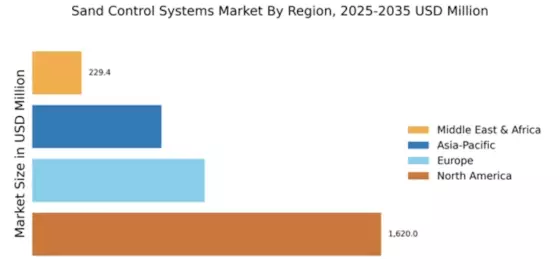

The Global Sand Control Systems Market Industry is poised for substantial growth over the next decade. With a projected market value of 3.25 USD Billion in 2024, the industry is expected to expand significantly, reaching 6.59 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 6.64% from 2025 to 2035. The increasing demand for efficient sand control solutions in oil and gas operations, coupled with technological advancements, is likely to drive this expansion. As the industry evolves, stakeholders must remain vigilant to capitalize on emerging opportunities and navigate potential challenges.

Market Dynamics and Competitive Landscape

The Global Sand Control Systems Market Industry is characterized by a dynamic competitive landscape, with numerous players vying for market share. This competition fosters innovation and drives the development of more efficient sand control solutions. Companies are increasingly collaborating with research institutions to enhance their product offerings and address emerging challenges in sand control. The interplay of supply and demand dynamics, coupled with technological advancements, shapes the market's trajectory. As firms strive to differentiate themselves, the industry is likely to witness a surge in new product introductions and strategic partnerships, further propelling market growth.

Increasing Oil and Gas Exploration Activities

The Global Sand Control Systems Market Industry is experiencing growth due to the rising exploration activities in the oil and gas sector. As companies seek to tap into untapped reserves, the demand for effective sand control solutions becomes paramount. In 2024, the market is projected to reach 3.25 USD Billion, driven by the need for enhanced production efficiency and reduced operational risks. Countries with significant oil reserves, such as the United States and Saudi Arabia, are investing heavily in advanced sand control technologies to mitigate sand production issues. This trend indicates a robust future for the industry as exploration intensifies.

Rising Demand for Enhanced Oil Recovery Techniques

The Global Sand Control Systems Market Industry is significantly influenced by the increasing demand for enhanced oil recovery (EOR) techniques. As conventional oil reserves deplete, operators are turning to EOR methods that often require effective sand control systems to maintain production levels. The integration of sand control technologies in EOR processes ensures that sand production does not hinder oil extraction efficiency. This trend is expected to contribute to the market's growth, with projections indicating a rise to 6.59 USD Billion by 2035. The synergy between EOR and sand control systems is likely to drive further investments in this sector.

Technological Advancements in Sand Control Solutions

Technological innovation plays a crucial role in the expansion of the Global Sand Control Systems Market Industry. The development of advanced materials and techniques, such as gravel packing and chemical consolidation, enhances the effectiveness of sand control measures. These innovations not only improve the longevity of production wells but also reduce maintenance costs. As a result, operators are increasingly adopting these technologies to optimize their operations. The anticipated growth from 2025 to 2035, with a CAGR of 6.64%, suggests that ongoing advancements will continue to shape the market landscape, making it more competitive and efficient.

Growing Environmental Regulations and Sustainability Initiatives

Environmental regulations and sustainability initiatives are becoming increasingly influential in the Global Sand Control Systems Market Industry. Governments worldwide are implementing stricter regulations to minimize the environmental impact of oil and gas operations. This has led to a heightened focus on sustainable sand control solutions that reduce waste and enhance resource efficiency. Companies are compelled to adopt innovative technologies that comply with these regulations while maintaining operational efficiency. The emphasis on sustainability is likely to drive market growth as firms seek to align their practices with global environmental standards, ensuring long-term viability in a competitive landscape.