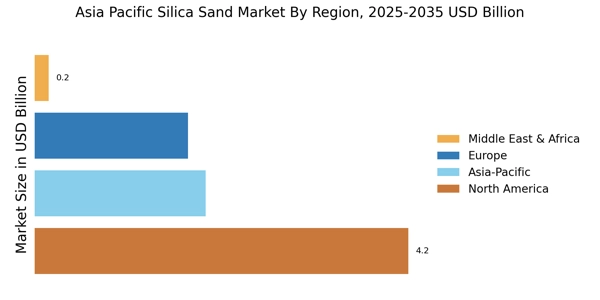

China : Unmatched Growth and Demand Trends

China holds a commanding 7.5% market share in the APAC silica sand market, driven by rapid industrialization and urbanization. Key growth drivers include the booming construction sector, which fuels demand for high-quality silica sand in concrete and glass manufacturing. Government initiatives aimed at infrastructure development, such as the Belt and Road Initiative, further bolster market growth. Regulatory policies promoting sustainable mining practices are also shaping consumption patterns favorably.

India : Strong Demand from Construction Sector

India's silica sand market accounts for 3.5% of the APAC total, with a value driven by increasing demand in construction and glass industries. The government's push for 'Housing for All' and infrastructure projects under the National Infrastructure Pipeline are key growth drivers. Consumption patterns are shifting towards high-purity silica sand, influenced by regulatory policies aimed at quality standards and environmental sustainability.

Japan : Innovation in Silica Sand Applications

Japan's market share stands at 2.8%, characterized by a focus on high-tech applications in electronics and automotive industries. The demand for silica sand is driven by advancements in technology and a shift towards eco-friendly materials. Government regulations promoting innovation and sustainability are pivotal in shaping market dynamics, encouraging the use of silica sand in various sectors, including construction and manufacturing.

South Korea : Strategic Investments in Infrastructure

South Korea holds a 1.8% market share, with significant growth driven by investments in infrastructure and industrial applications. The demand for silica sand is increasing in sectors like construction, glass, and ceramics. Government initiatives aimed at enhancing industrial capabilities and regulatory frameworks supporting sustainable practices are crucial for market expansion. The focus on high-quality silica sand is evident in consumption trends.

Malaysia : Focus on Sustainable Mining Practices

Malaysia's silica sand market, with a share of 0.9%, is characterized by niche applications in the glass and foundry industries. The growth is supported by government policies promoting sustainable mining and environmental protection. Demand trends indicate a shift towards high-purity silica sand, driven by local industries' needs. Infrastructure development in states like Selangor and Penang is also contributing to market growth.

Thailand : Emerging Hub for Regional Exports

Thailand's market share is 0.7%, with growth driven by its strategic location for silica sand exports to neighboring countries. The demand is primarily from the construction and glass industries. Government initiatives to enhance trade and regulatory policies supporting mining operations are pivotal. Key markets include Bangkok and Chonburi, where industrial activities are concentrated, fostering a competitive landscape.

Indonesia : Rising Demand in Construction Sector

Indonesia's silica sand market accounts for 0.6% of the APAC total, with growth driven by the booming construction sector. The government's infrastructure development initiatives, such as the National Medium-Term Development Plan, are key growth drivers. Consumption patterns are shifting towards high-quality silica sand, influenced by regulatory policies aimed at improving industry standards. Local demand is concentrated in Jakarta and Surabaya.

Rest of APAC : Varied Applications Across Sub-regions

The Rest of APAC holds a minimal market share of 0.11%, characterized by diverse applications of silica sand across various industries. Demand is influenced by local market conditions and regulatory frameworks that vary significantly by country. The competitive landscape is fragmented, with numerous small players catering to niche markets. Key applications include construction, glass manufacturing, and foundry industries, reflecting the region's varied industrial needs.