Growth in Glass Manufacturing

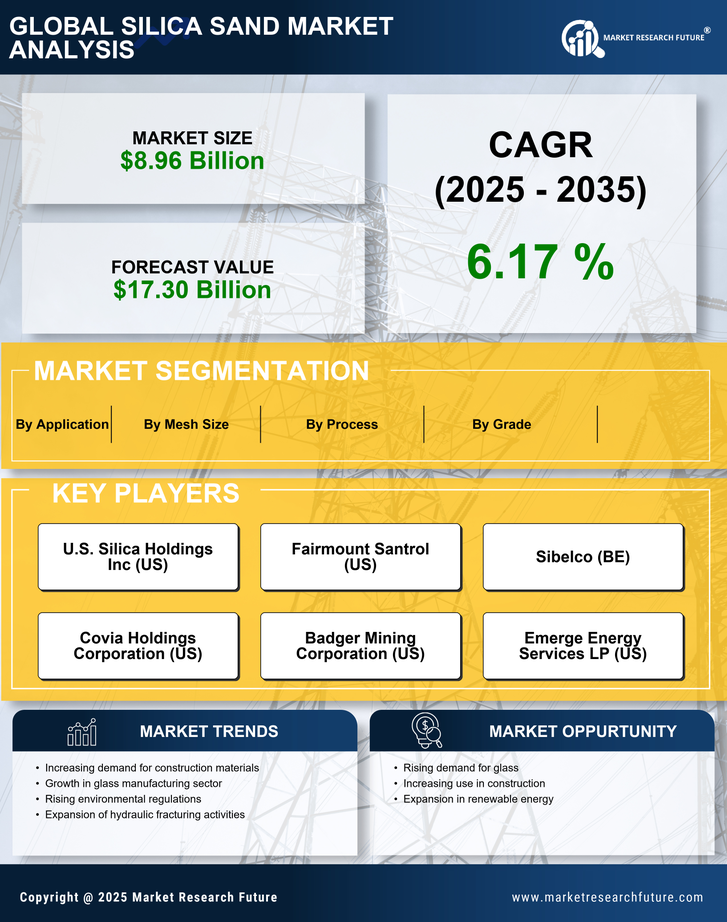

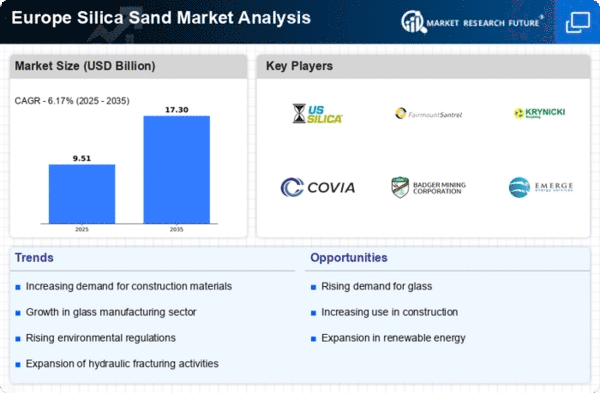

The glass manufacturing industry in Europe is a significant driver of the silica sand market, as silica sand is a primary raw material in glass production. With the increasing demand for glass products, including packaging, automotive, and architectural glass, the silica sand market is poised for growth. Recent data indicates that the glass sector is expected to grow at a CAGR of approximately 5% through 2027, which could lead to a corresponding increase in silica sand consumption. Furthermore, innovations in glass technology, such as the development of energy-efficient glass, may further enhance the demand for high-purity silica sand. As manufacturers strive to meet the evolving needs of consumers and industries, the silica sand market is likely to see a robust expansion driven by the glass manufacturing sector.

Expansion of Renewable Energy Projects

The expansion of renewable energy projects across Europe is emerging as a significant driver for the silica sand market. As countries strive to meet their renewable energy targets, the demand for materials used in solar panels and wind turbines is on the rise. Silica sand is a crucial component in the production of photovoltaic cells and other renewable energy technologies. Recent projections indicate that the renewable energy sector could grow by over 30% by 2030, which may lead to a corresponding increase in silica sand consumption. This trend not only supports the growth of the silica sand market but also aligns with broader sustainability goals, as renewable energy projects contribute to reducing carbon emissions and promoting environmental stewardship.

Rising Demand from Construction Sector

The construction sector in Europe is experiencing a notable surge in demand for silica sand, primarily due to the ongoing infrastructure projects and urban development initiatives. This sector is projected to account for a substantial share of the silica sand market, with estimates suggesting that it could represent over 40% of total consumption by 2026. The increasing need for high-quality concrete and glass products, which utilize silica sand as a key ingredient, further drives this demand. Additionally, the European Union's focus on sustainable construction practices may lead to an uptick in the use of silica sand, as it is often sourced from environmentally responsible suppliers. Consequently, the silica sand market is likely to benefit from this trend, as construction companies seek reliable and sustainable materials to meet regulatory standards and consumer expectations.

Technological Innovations in Extraction

Technological advancements in extraction methods are transforming the silica sand market in Europe. Innovations such as automated mining equipment and advanced processing techniques are enhancing efficiency and reducing operational costs. These technologies not only improve the quality of silica sand but also minimize waste and environmental impact. For instance, the adoption of precision mining techniques allows for more selective extraction, ensuring that only high-quality silica sand is harvested. As these technologies become more prevalent, they are likely to attract investment into the silica sand market, fostering growth and competitiveness. Furthermore, companies that leverage these innovations may experience increased productivity and profitability, positioning themselves favorably in a rapidly evolving market.

Environmental Regulations and Compliance

The silica sand market in Europe is increasingly influenced by stringent environmental regulations aimed at promoting sustainable mining and processing practices. Regulatory bodies are enforcing guidelines that require companies to minimize their environmental footprint, which may lead to a shift in sourcing and production methods. Compliance with these regulations often necessitates investments in cleaner technologies and sustainable practices, which could initially increase operational costs. However, in the long run, these measures may enhance the reputation of companies within the silica sand market, attracting environmentally conscious consumers and investors. As a result, firms that adapt to these regulations may gain a competitive edge, potentially leading to increased market share and profitability.