Market Analysis

In-depth Analysis of Smartphone Operating System Market Industry Landscape

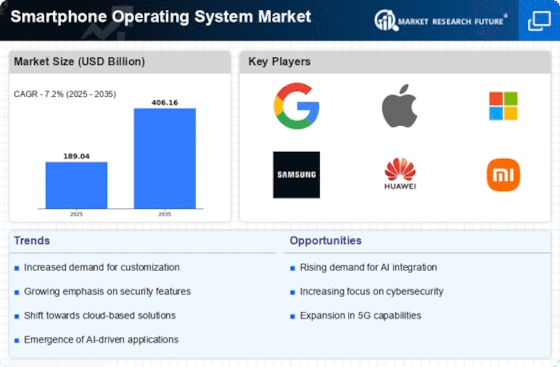

The smartphone operating system market is a dynamic and serious scene that assumes a urgent part in forming the versatile innovation industry. This market is portrayed by a couple of central parts, each competing for a critical offer and endeavouring to develop to fulfil the steadily developing needs of customers. Starting around my last information update in January 2022, the key part in the cell phone operating system market incorporates Google's Android, Apple's iOS, and less significantly, Microsoft's Windows, and others.

Android, created by Google, overwhelms the market with a largest part. Because it is open-source, a lot of device manufacturers have been able to adopt and customize it, resulting in a wide range of Android-powered smartphones at various price points. This variety has added to Android's far and wide reception, settling on it the operating system of decision for a larger part of clients internationally. Popularity is also aided by the extensive app ecosystem and frequent updates.

Then again, Apple's iOS, selective to the iPhone, holds a critical offer in the premium cell phone portion. Known for its consistent combination with Apple's equipment and a firmly controlled biological system, iOS requests to clients who focus on a smoothed out and easy to use insight. Market elements in the cell phone operating system industry are affected by a few variables, including mechanical progressions, client inclinations, and vital organizations. The fast development of portable innovations, like 5G network, foldable shows, and high-level camera capacities, makes a consistent requirement for operating system designers to adjust and improve their frameworks to bridle these developments.

Client inclinations likewise assume an urgent part in forming the market. Android is preferred by some users, who value customization options and a wide range of device options. Others favour the consistent combination and biological system given by iOS. Moreover, factors like application accessibility, security highlights, and UI configuration add to clients' choices while picking a cell phone operating system.

Key organizations between operating system suppliers and gadget makers further impact market elements. Joint efforts, selectiveness arrangements, and pre-introduced applications add to the progress of an operating system. For example, Google's organization with different Android gadget producers has been a critical driver of its strength on the lookout. In the interim, Apple's command over both equipment and programming considers a firmly coordinated and upgraded insight.

Additionally, new entrants and shifts in market share are possible in the smartphone OS market. Microsoft's Windows, while less noticeable lately, has made endeavours to reappear the market. In order to keep the market in a constant state of flux, other emerging players may introduce novel features or concepts that disrupt the existing dynamics.

Taking everything into account, market is set apart by powerful contest, with Android and iOS driving the way. Market growth is driven by technological advancements, user preferences, and strategic partnerships. The cell phone working framework market is probably going to go through shifts in piece of the pie, new contestants, and moving client assumptions as the business keeps on improving, bringing about a ceaselessly evolving scene.

Leave a Comment