-

EXECUTIVE SUMMARY 14

-

GLOBAL SOCKS MARKET, PRODUCT TYPE 16

-

GLOBAL SOCKS MARKET, BY MATERIAL 17

-

GLOBAL SOCKS MARKET, BY END USER 18

-

GLOBAL SOCKS MARKET, BY DISTRIBUTION CHANNEL 19

-

GLOBAL SOCKS MARKET, BY REGION 20

-

MARKET INTRODUCTION 21

-

DEFINITION 21

-

SCOPE OF THE STUDY 21

-

RESEARCH OBJECTIVE 21

-

MARKET STRUCTURE 22

-

KEY BUYING CRITERIA 23

-

RESEARCH METHODOLOGY 24

-

RESEARCH PROCESS 24

-

PRIMARY RESEARCH 25

-

SECONDARY RESEARCH 26

-

MARKET SIZE ESTIMATION 27

-

FORECAST MODEL 28

-

LIST OF ASSUMPTIONS & LIMITATIONS 29

-

MARKET DYNAMICS 30

-

INTRODUCTION 30

-

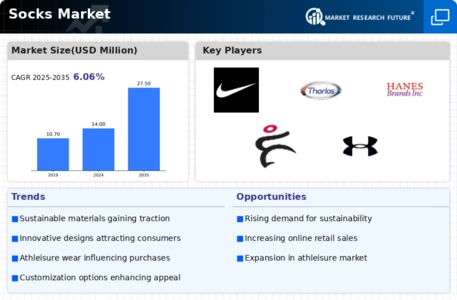

DRIVERS 31

- INCREASING NUMBER OF SOCKS BRANDS WITH GROWING RETAIL STORES AND LAUNCH OF ATTRACTIVE PATTERNS AND PRINTS DRIVES SOCKS MARKET 31

- GROWING POPULATION OF WHITE-COLLAR WORKING PROFESSIONALS 31

- DRIVERS IMPACT ANALYSIS 32

-

RESTRAINT 32

- INCREASING DEMAND FOR FOOTWEAR, SUCH AS SANDALS AND SLIPPERS AND IMPROPER USE OF

- RESTRAINT IMPACT ANALYSIS 33

-

MATERIALS IN THE SOCKS HAMPER THE GROWTH 32

-

OPPORTUNITIES 33

- USE OF FUNCTIONAL FABRICS 33

- GROWTH OF SUSTAINABILITY IN SOCKS 33

-

-

TRENDS 34

- RISE OF E-COMMERCE 34

- GROWTH OF DIFFERENT TYPES OF SOCKS 34

-

COVID 19 IMPACT ANALYSIS 35

- IMPACT OF COVID–19 ON GLOBAL ECONOMY 35

- INDUSTRIES IMPACT OF COVID-19 PANDEMIC ON GLOBAL SOCKS MARKET 35

- IMPACT ON SOCKS PRODUCTION MARKET 35

- IMPACT ON SUPPLY CHAIN 36

- IMPACT ON MARKET RAW MATERIALS AVAILABILITY 36

- IMPACT ON ONLINE VS STORE-BASED SALES 37

- IMPACT ON PRICING 37

-

MARKET FACTOR ANALYSIS 38

-

SUPPLY/ VALUE CHAIN ANALYSIS 38

- RAW MATERIAL SUPPLY 39

- MANUFACTURE 39

- DISTRIBUTION & SALES 39

- END-USE 39

-

PORTER’S FIVE FORCES MODEL 40

- THREAT OF NEW ENTRANTS 40

- BARGAINING POWER OF SUPPLIERS 41

- BARGAINING POWER OF BUYERS 41

- THREAT OF SUBSTITUTES 41

- RIVALRY 41

-

SUSTAINABILITY IN SOCKS MARKET 42

- R&D INTO ECO-FRIENDLY SOCKS 43

- ALTERNATIVE MATERIAL ANALYSIS 44

-

CONSUMER PREFERENCE ANALYSIS, BY LENGTH 44

-

CONSUMER PREFERENCE ANALYSIS, BY MATERIAL 45

-

DEMAND SUPPLY ANALYSIS 45

- PRODUCTION STATISTICS (BY TOP 10 COUNTRIES) – 2023(VALUES IN MILLION) 46

- TOP IMPORTERS/EXPORTERS 47

-

AVAILABILITY/SCARCITY STATISTICS AND PRICING FORECAST TRENDS, BY MATERIAL 48

-

PREFERRED BRAND ANALYSIS, BY PRODUCT TYPE 48

- SKIING AND HIKING/TREKKING SOCKS 49

- RUNNING SOCKS 50

-

-

GLOBAL SOCKS MARKET, BY PRODUCT TYPE 52

-

OVERVIEW 52

- GLOBAL SOCKS MARKET ESTIMATES & FORECAST, PRODUCT TYPE, 2023–2030 53

-

ATHLETIC SOCKS 54

- ATHLETIC SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 54

-

SPECIALTY SOCKS 55

- SPECIALTY SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 55

-

TROUSER SOCKS 56

- TROUSER SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 56

-

CASUAL SOCKS 57

- CASUAL SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 57

-

MULTIPLE TOE SOCKS 58

- MULTIPLE TOE SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 58

-

OTHERS SOCKS 59

- OTHER SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 59

-

GLOBAL SOCKS MARKET, BY MATERIAL OVERVIEW 60

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY MATERIAL, 2023–2030 61

-

POLYESTER 61

- POLYESTER: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 61

-

COTTON 62

- COTTON: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 62

-

WOOL 63

- WOOL: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 63

-

NYLON 64

- NYLON: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 64

-

GLOBAL SOCKS MARKET, BY END USER 65

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030 66

-

MEN 66

- MEN: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 66

-

WOMEN 67

- WOMEN: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 67

-

CHILDREN 68

- CHILDREN: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 68

-

GLOBAL SOCKS MARKET, BY DISTRIBUTION CHANNEL 69

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 70

-

SUPERMARKETS & HYPERMARKETS 70

- SUPERMARKETS AND HYPERMARKETS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 70

-

CONVENIENCE STORES 71

- CONVENIENCE STORES: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 71

-

SPECIALTY STORES 72

- SPECIALITY STORES: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 72

-

ONLINE 73

- ONLINE: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 73

-

GLOBAL SOCKS MARKET, BY REGION 74

-

OVERVIEW 74

- GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 75

-

NORTH AMERICA 76

- US 78

- CANADA 80

-

EUROPE 82

- SWOT ANALYSIS OF TURKEY 82

- BELARUS 85

- RUSSIA 86

- AZERBAIJAN 88

- MOLDOVA 89

- UKRAINE 91

- REST OF EUROPE 92

-

ASIA PACIFIC 94

- ARMENIA 95

- KAZAKHSTAN 96

- KYRGYZSTAN 98

- TAJIKISTAN 99

- UZBEKISTAN 101

- TURKMENISTAN 102

- REST OF ASIA PACIFIC 104

-

LATIN AMERICA 106

- MEXICO 107

- BRAZIL 108

- COLOMBIA 110

- REST OF LATIN AMERICA 111

-

MIDDLE EAST & AFRICA 113

- GCC COUNTRIES 114

- SOUTH AFRICA 115

- REST OF MIDDLE EAST & AFRICA 117

-

COMPETITIVE LANDSCAPE 119

-

INTRODUCTION 119

-

STRATEGIC COLLABORATIONS ARE LIKELY TO WIDEN SCOPE OF MARKET GROWTH 119

-

COMPETITIVE BENCHMARKING 120

-

COMPANY PROFILES 121

-

NIKE INC. 121

- COMPANY OVERVIEW 121

- FINANCIAL OVERVIEW 122

- PRODUCTS OFFERED 122

- KEY DEVELOPMENTS 122

- SWOT ANALYSIS 123

- KEY STRATEGIES 123

-

PUMA S.E. 124

- COMPANY OVERVIEW 124

- FINANCIAL OVERVIEW 125

- PRODUCTS OFFERED 125

- KEY DEVELOPMENTS 126

- SWOT ANALYSIS 126

- KEY STRATEGIES 127

-

ADIDAS A.G. 128

- COMPANY OVERVIEW 128

- FINANCIAL OVERVIEW 129

- PRODUCTS OFFERED 130

- KEY DEVELOPMENTS 130

- SWOT ANALYSIS 131

- KEY STRATEGIES 131

-

ASICS CORPORATION. 132

- COMPANY OVERVIEW 132

- FINANCIAL OVERVIEW 133

- PRODUCTS OFFERED 134

- KEY DEVELOPMENTS 134

- SWOT ANALYSIS 135

- KEY STRATEGIES 135

-

RENFRO CORPORATION. 136

- COMPANY OVERVIEW 136

- PRODUCTS OFFERED 136

- KEY DEVELOPMENTS 137

- SWOT ANALYSIS 137

- KEY STRATEGIES 138

-

THORLO, INC. 139

- COMPANY OVERVIEW 139

- PRODUCTS OFFERED 139

- KEY DEVELOPMENTS 139

- KEY STRATEGIES 140

-

HANESBRANDS INC. 141

- COMPANY OVERVIEW 141

- PRODUCTS OFFERED 141

- KEY DEVELOPMENTS 142

- KEY STRATEGIES 142

-

BALEGA. 143

- COMPANY OVERVIEW 143

- PRODUCTS OFFERED 143

- KEY DEVELOPMENTS 143

- KEY STRATEGIES 144

-

DRYMAX TECHNOLOGIES INC. 145

- COMPANY OVERVIEW 145

- PRODUCTS OFFERED 145

- KEY DEVELOPMENTS 146

- KEY STRATEGIES 146

-

UNDER ARMOUR, INC. 147

- COMPANY OVERVIEW 147

- PRODUCTS OFFERED 147

- KEY DEVELOPMENTS 148

- KEY STRATEGIES 148

-

-

LIST OF TABLES

-

PRIMARY INTERVIEWS 25

-

LIST OF ASSUMPTIONS & LIMITATIONS 29

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, TYPE, 2023–2030(USD MILLION) 53

-

ATHLETIC SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 54

-

SPECIALTY SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 55

-

TROUSER SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 56

-

CASUAL SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 57

-

MULTIPLE TOE SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 58

-

OTHER SOCKS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 59

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY MATERIAL, 2023–2030(USD MILLION) 61

-

POLYESTER: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 61

-

COTTON: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 62

-

WOOL: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 63

-

NYLON: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 64

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 66

-

MEN: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 66

-

WOMEN: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 67

-

CHILDREN: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 68

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 70

-

SUPERMARKETS AND HYPERMARKETS: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030 (USD MILLION) 70

-

CONVENIENCE STORES: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 71

-

SPECIALITY STORES: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 72

-

ONLINE: MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 73

-

GLOBAL SOCKS MARKET ESTIMATES & FORECAST, BY REGION, 2023–2030(USD MILLION) 75

-

NORTH AMERICA: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2023–2030(USD MILLION) 76

-

NORTH AMERICA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 77

-

NORTH AMERICA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 77

-

NORTH AMERICA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 77

-

NORTH AMERICA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 78

-

US: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 78

-

US: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 79

-

US SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 79

-

US SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 79

-

CANADA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 80

-

CANADA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 80

-

CANADA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 80

-

CANADA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 81

-

EUROPE: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2023–2030(USD MILLION) 84

-

BELARUS: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 85

-

BELARUS: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 85

-

BELARUS SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 85

-

BELARUS SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 86

-

RUSSIA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 86

-

RUSSIA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 87

-

RUSSIA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 87

-

RUSSIA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 87

-

AZERBAIJAN: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 88

-

AZERBAIJAN: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 88

-

AZERBAIJAN SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 88

-

AZERBAIJAN SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 89

-

MOLDOVA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 89

-

MOLDOVA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 90

-

MOLDOVA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 90

-

MOLDOVA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 90

-

UKRAINE: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 91

-

UKRAINE: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 91

-

UKRAINE SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 91

-

UKRAINE SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 92

-

REST OF EUROPE: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 92

-

REST OF EUROPE: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 93

-

REST OF EUROPE SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 93

-

REST OF EUROPE SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 93

-

ASIA PACIFIC: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2023–2030(USD MILLION) 94

-

ARMENIA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 95

-

ARMENIA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 95

-

ARMENIA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 95

-

ARMENIA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 96

-

KAZAKHSTAN: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 96

-

KAZAKHSTAN: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 97

-

KAZAKHSTAN SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 97

-

KAZAKHSTAN SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 97

-

KYRGYZSTAN: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 98

-

KYRGYZSTAN: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 98

-

KYRGYZSTAN SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 98

-

KYRGYZSTAN SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 99

-

TAJIKISTAN: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 99

-

TAJIKISTAN: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 100

-

TAJIKISTAN SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 100

-

TAJIKISTAN SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 100

-

UZBEKISTAN: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 101

-

UZBEKISTAN: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 101

-

UZBEKISTAN SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 101

-

UZBEKISTAN SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 102

-

TURKMENISTAN: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 102

-

TURKMENISTAN: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 103

-

TURKMENISTAN SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 103

-

TURKMENISTAN SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 103

-

REST OF ASIA PACIFIC: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 104

-

REST OF ASIA PACIFIC: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 104

-

REST OF ASIA PACIFIC SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030 (USD MILLION) 104

-

REST OF ASIA PACIFIC SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 105

-

LATIN AMERICA: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2023–2030(USD MILLION) 106

-

MEXICO: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 107

-

MEXICO: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 107

-

MEXICO SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 107

-

MEXICO SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 108

-

BRAZIL: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 108

-

BRAZIL: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 109

-

BRAZIL SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 109

-

BRAZIL SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 109

-

COLOMBIA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 110

-

COLOMBIA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 110

-

COLOMBIA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 110

-

COLOMBIA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 111

-

REST OF LATIN AMERICA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 111

-

REST OF LATIN AMERICA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 112

-

REST OF LATIN AMERICA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030 (USD MILLION) 112

-

REST OF LATIN AMERICA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 112

-

MIDDLE EAST & AFRICA: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2023–2030(USD MILLION) 113

-

GCC COUNTRIES: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 114

-

GCC COUNTRIES: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 114

-

GCC COUNTRIES SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 114

-

GCC COUNTRIES SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030(USD MILLION) 115

-

SOUTH AFRICA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 115

-

SOUTH AFRICA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 116

-

SOUTH AFRICA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 116

-

SOUTH AFRICA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2023–2030 (USD MILLION) 116

-

REST OF MIDDLE EAST & AFRICA: SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 117

-

REST OF MIDDLE EAST & AFRICA: SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 117

-

REST OF MIDDLE EAST & AFRICA SOCKS MARKET ESTIMATES & FORECAST, BY END USER, 2023–2030(USD MILLION) 117

-

REST OF MIDDLE EAST & AFRICA SOCKS MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL,

-

NIKE INC.: PRODUCTS OFFERED 122

-

PUMA S.E.: PRODUCTS OFFERED 125

-

PUMA S.E.: KEY DEVELOPMENTS 126

-

ADIDAS A.G.: PRODUCTS OFFERED 130

-

ASICS CORPORATION.: PRODUCTS OFFERED 134

-

RENFRO CORPORATION.: PRODUCTS OFFERED 136

-

RENFRO CORPORATION.: KEY DEVELOPMENTS 137

-

THORLO, INC..: PRODUCTS OFFERED 139

-

HANESBRANDS INC.: PRODUCTS OFFERED 141

-

HANESBRANDS INC.: KEY DEVELOPMENTS 142

-

BALEGA.: PRODUCTS OFFERED 143

-

DRYMAX TECHNOLOGIES INC.: PRODUCTS OFFERED 145

-

DRYMAX TECHNOLOGIES INC.: KEY DEVELOPMENTS 146

-

UNDER ARMOUR, INC.: PRODUCTS OFFERED 147

-

-

LIST OF FIGURES

-

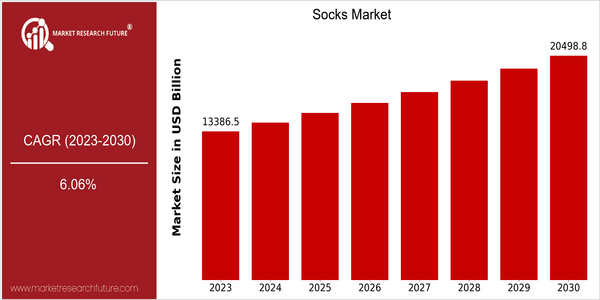

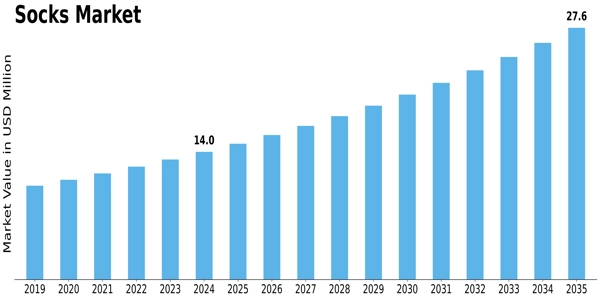

MARKET SYNOPSIS 15

-

GLOBAL SOCKS MARKET ANALYSIS, PRODUCT TYPE, 2023 AND MARKET VALUE FROM 2023-2030 16

-

GLOBAL SOCKS MARKET ANALYSIS, BY MATERIAL, 2023 AND MARKET VALUE FROM 2023-2030 17

-

GLOBAL SOCKS MARKET ANALYSIS, BY END USER, 2023 AND MARKET VALUE FROM 2023-2030 18

-

GLOBAL SOCKS MARKET ANALYSIS, BY DISTRIBUTION CHANNEL, 2023 AND MARKET VALUE FROM 2023-2030 19

-

GLOBAL SOCKS MARKET ANALYSIS, BY REGION, 2023 20

-

GLOBAL SOCKS MARKET: STRUCTURE 22

-

KEY BUYING CRITERIA FOR SOCKS 23

-

RESEARCH PROCESS 24

-

TOP-DOWN & BOTTOM-UP APPROACHES 27

-

MARKET DYNAMICS OVERVIEW 30

-

DRIVERS IMPACT ANALYSIS: GLOBAL SOCKS MARKET 32

-

RESTRAINT IMPACT ANALYSIS: GLOBAL MINING CHEMICALS MARKET 33

-

GLOBAL SOCKS MARKET: SUPPLY / VALUE CHAIN 38

-

GLOBAL SOCKS MARKET, PRODUCT TYPE, 2023 (% SHARE) 52

-

GLOBAL SOCKS MARKET, PRODUCT TYPE, 2023–2030(USD MILLION) 53

-

GLOBAL SOCKS MARKET, BY MATERIAL, 2023 (% SHARE) 60

-

GLOBAL SOCKS MARKET, BY MATERIAL, 2023–2030(USD MILLION) 60

-

GLOBAL SOCKS MARKET, BY END USER, 2023 (% SHARE) 65

-

GLOBAL SOCKS MARKET, BY END USER, 2023–2030(USD MILLION) 65

-

GLOBAL SOCKS MARKET, BY END USER, 2023 (% SHARE) 69

-

GLOBAL SOCKS MARKET, BY END USER, 2023–2030(USD MILLION) 69

-

GLOBAL SOCKS MARKET, BY REGION, 2023–2030(USD MILLION) 74

-

GLOBAL SOCKS MARKET, BY REGION, 2023 (% SHARE) 75

-

NORTH AMERICA: SOCKS MARKET SHARE, BY COUNTRY, 2023 (% SHARE) 76

-

EUROPE: SOCKS MARKET SHARE, BY COUNTRY, 2023 (% SHARE) 84

-

ASIA PACIFIC: SOCKS MARKET SHARE, BY COUNTRY, 2023 (% SHARE) 94

-

LATIN AMERICA: SOCKS MARKET SHARE, BY COUNTRY, 2023 (% SHARE) 106

-

MIDDLE EAST & AFRICA: SOCKS MARKET SHARE, BY COUNTRY, 2023 (% SHARE) 113

-

NIKE INC: FINANCIAL OVERVIEW SNAPSHOT 122

-

NIKE INC.: SWOT ANALYSIS 123

-

PUMA S.E.: FINANCIAL OVERVIEW SNAPSHOT 125

-

PUMA S.E.: SWOT ANALYSIS 126

-

ADIDAS A.G.: FINANCIAL OVERVIEW SNAPSHOT 129

-

ADIDAS A.G.: SWOT ANALYSIS 131

-

ASICS CORPORATION.: FINANCIAL OVERVIEW SNAPSHOT 133

-

ASICS CORPORATION.: SWOT ANALYSIS 135

-

RENFRO CORPORATION.: SWOT ANALYSIS 137'

Leave a Comment