-

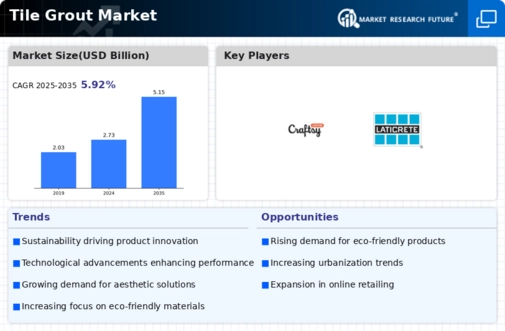

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Definition

- Assumptions

- Limitations

-

2.2.2

-

Research Objective

-

Research

- Primary Research

- Secondary Research

-

Process

-

Market

-

Size Estimation

-

Forecast Model

-

Market Landscape

-

Porter’s

- Threat of New Entrants

- Bargaining Power

- Threat of Substitutes

- Segment Rivalry

-

Five Forces Analysis

-

of Buyers

-

3.1.5

-

Bargaining Power of Buyers

-

Value Chain/Supply Chain Analysis

-

Market

-

Dynamics

-

Introduction

-

Market Drivers

-

Market Restraints

-

Market Opportunities

-

Global Tile Grout Market, by Type

-

Introduction

-

Unsanded Grout

- Market Estimates & Forecast, 2023-2032

-

5.2.2

-

Market Estimates & Forecast, by Region, 2023-2032

-

Finely Sanded Grout

- Market Estimates & Forecast, 2023-2032

- Market Estimates &

-

Forecast, by Region, 2023-2032

-

Quarry-type Grout

- Market Estimates

- Market Estimates & Forecast, by Region,

-

& Forecast, 2023-2032

-

Epoxy Grout

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast, by Region, 2023-2032

-

Global Tile

-

Grout Market, by Application

-

Introduction

-

Residential

- Market Estimates & Forecast,

-

6.2.1

-

Market Estimates & Forecast, 2023-2032

-

by Region, 2023-2032

-

Commercial

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2023-2032

-

6.3.3

-

Office Spaces

-

6.3.3.2

-

Market Estimates & Forecast, by Region, 2023-2032

-

6.3.4.1

-

Market Estimates & Forecast, 2023-2032

-

by Region, 2023-2032

-

Estimates & Forecast, 2023-2032

-

by Region, 2023-2032

-

& Forecast, 2023-2032

-

& Forecast, by Region, 2023-2032

-

& Forecast, 2023-2032

-

& Forecast, 2023-2032

-

6.4.5.2

-

Healthcare

-

Market Estimates & Forecast,

-

Shopping Malls & Centres

-

Market

-

Market Estimates & Forecast,

-

Educational Centres

-

Market Estimates

-

Market Estimates & Forecast, by Region,

-

Hospitality

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Others

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates

-

Industrial

- Market Estimates

- Market Estimates & Forecast, by Region,

- Warehousing/Storage facilities

- Manufacturing Units

- Others

-

Market Estimates & Forecast, by Region, 2023-2032

-

Global Tile Grout Market,

-

by Region

-

Introduction

-

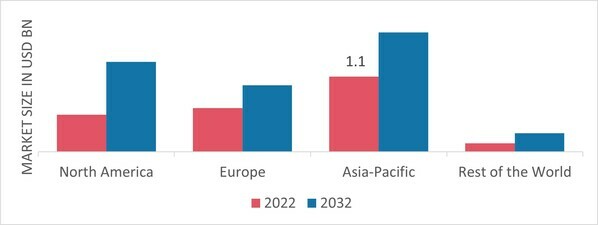

North America

- Market Estimates

- Market Estimates & Forecast, by Type, 2023-2032

- Market Estimates & Forecast, by Application, 2023-2032

- US

- Canada

-

& Forecast, 2023-2032

-

& Forecast, by Type, 2023-2032

-

by Application, 2023-2032

-

Forecast, 2023-2032

-

7.2.6

-

Mexico

-

Estimates & Forecast, by Type, 2023-2032

-

Forecast, by Application, 2023-2032

-

Europe

- Market Estimates

- Market Estimates & Forecast, by Type, 2023-2032

- Market Estimates & Forecast, by Application, 2023-2032

- UK

- Germany

- Italy

- Rest of Europe

-

& Forecast, 2023-2032

-

& Forecast, by Type, 2023-2032

-

by Application, 2023-2032

-

Forecast, 2023-2032

-

7.3.6

-

France

-

Estimates & Forecast, by Type, 2023-2032

-

Forecast, by Application, 2023-2032

-

& Forecast, 2023-2032

-

Estimates & Forecast, by Application, 2023-2032

-

Asia-Pacific

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Application, 2023-2032

- China

-

7.4.1

-

Market Estimates & Forecast, 2023-2032

-

by Type, 2023-2032

-

7.4.4.2

-

Market Estimates & Forecast, by Type, 2023-2032

-

& Forecast, by Application, 2023-2032

-

& Forecast, 2023-2032

-

7.4.6.2

-

Market Estimates

-

Japan

-

Market Estimates

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Application, 2023-2032

-

India

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Type, 2023-2032

-

& Forecast, by Application, 2023-2032

-

7.4.7.1

-

Market Estimates & Forecast, 2023-2032

-

by Type, 2023-2032

-

& Forecast, by Application, 2023-2032

-

Estimates & Forecast, 2023-2032

-

by Type, 2023-2032

-

Estimates & Forecast, by Application, 2023-2032

-

& Forecast, by Type, 2023-2032

-

by Application, 2023-2032

-

& Forecast, 2023-2032

-

& Forecast, by Type, 2023-2032

-

by Application, 2023-2032

-

& Forecast, 2023-2032

-

Estimates & Forecast, by Application, 2023-2032

-

& Africa

-

7.6.7.2

-

Market Estimates

-

Rest of Asia-Pacific

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application,

-

South America

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast, by Type, 2023-2032

- Market Estimates

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- Market Estimates

- Market Estimates & Forecast, by Type, 2023-2032

- Market Estimates & Forecast, by Application, 2023-2032

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East

-

Market Estimates & Forecast, by Type, 2023-2032

-

& Forecast, by Application, 2023-2032

-

Market Estimates

-

Competitive Landscape

-

Company

-

Profile

-

Bostik USA (US)

- Company Overview

- Products/Services

- Financial Overview

- Key Developments

- Key

- SWOT Analysis

-

Offered

-

Strategies

-

Sika AG (Switzerland)

- Company

- Products/Services Offered

- Financial Overview

- Key Strategies

- SWOT Analysis

-

Overview

-

9.2.4

-

Key Developments

-

ParexGroup

- Company Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

(Bangkok)

-

9.3.3

-

Financial Overview

-

9.3.6

-

SWOT Analysis

-

MAPEI S.p.A (Italy)

- Company Overview

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

9.4.2

-

Products/Services Offered

-

Building Adhesives Ltd

- Company Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

(UK)

-

9.5.3

-

Financial Overview

-

9.5.6

-

SWOT Analysis

-

Crafit (India)

- Company Overview

- Products/Services

- Financial Overview

- Key Developments

- Key

- SWOT Analysis

-

Offered

-

Strategies

-

Krishna Colours and Constchem PVT LTD

- Company Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

(India),

-

9.7.3

-

Financial Overview

-

9.7.6

-

SWOT Analysis

-

LATICRETE International, Inc (US)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

ARDEX UK (UK)

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

- Company Overview

- Products/Services

- Financial Overview

- Key Developments

- SWOT Analysis

-

9.9.1

-

Company Overview

-

9.10

-

FLEXTILE LTD. (Canada)

-

Offered

-

9.10.5

-

Key Strategies

-

List of Tables

-

Global

-

Tile Grout Market, by Region, 2023-2032

-

North America: Global Tile

-

Grout Market, by Country, 2023-2032

-

Europe: Global Tile Grout Market,

-

by Country, 2023-2032

-

Asia-Pacific: Global Tile Grout Market, by Country,

-

South America: Global Tile Grout Market, by Country, 2023-2032

-

Middle East and Africa: Global Tile Grout Market, by Country, 2023-2032

-

Global Tile Grout Market, by Type, by Region, 2023-2032

-

North

-

America: Global Tile Grout Market, by Type, by Country, 2023-2032

-

Europe:

-

Global Tile Grout Market, by Type, by Country, 2023-2032

-

Asia-Pacific:

-

Global Tile Grout Market, by Type, by Country, 2023-2032

-

South America:

-

Global Tile Grout Market, by Type, by Country, 2023-2032

-

Middle East

-

and Africa: Global Tile Grout Market, by Type, by Country, 2023-2032

-

Table

-

Global Tile Grout Market, by Application, by Region, 2023-2032

-

Table 14

-

North America: Global Tile Grout Market, by Application, by Country, 2023-2032

-

Europe: Global Tile Grout Market, by Application, by Country, 2023-2032

-

Asia-Pacific: Global Tile Grout Market by Application, by Country, 2023-2032

-

South America: Global Tile Grout Market, by Application, by Country,

-

Middle East and Africa: Global Tile Grout Market, by Application,

-

by Country, 2023-2032

-

Global Tile Grout Market, by Region, 2023-2032

-

Global Tile Grout Market, by Type, 2023-2032

-

Global Tile

-

Grout Market, by Application, 2023-2032

-

North America: Global Tile

-

Grout Market, by Country

-

North America: Global Tile Grout Market,

-

by Type

-

North America: Global Tile Grout Market, by Application

-

Europe: Global Tile Grout Market, by Country

-

Europe: Global

-

Tile Grout Market, by Type

-

Europe: Global Tile Grout Market, by Application

-

Asia-Pacific: Global Tile Grout Market, by Country

-

Asia-Pacific:

-

Global Tile Grout Market, by Type

-

Asia-Pacific: Global Tile Grout

-

Market, by Application

-

South America: Global Tile Grout Market, by

-

Country

-

South America: Global Tile Grout Market, by Type

-

Table

-

South America: Global Tile Grout Market, by Application

-

Middle

-

East and Africa: Global Tile Grout Market, by Country

-

Middle East

-

and Africa: Global Tile Grout Market, by Type

-

Middle East and Africa:

-

Global Tile Grout Market, by Application

-

List of Figures

-

Figure

-

Research Process of MRFR

-

Top-Down and Bottom-Up Approach

-

Figure

-

Market Dynamics

-

Impact Analysis: Market Drivers

-

Impact

-

Analysis: Market Restraints

-

Porter’s Five Forces Analysis

-

Value Chain Analysis

-

Global Tile Grout Market Share, by

-

Type, 2020 (%)

-

Global Tile Grout Market, by Type, 2023-2032 (USD Million)

-

Global Tile Grout Market Share, by Application, 2020 (%)

-

Figure

-

Global Tile Grout Market, by Application, 2023-2032 (USD Million)

-

Figure

-

Global Tile Grout Market Share (%), by Region, 2020

-

Global Tile

-

Grout Market, by Region, 2023-2032 (USD Million)

-

North America: Global

-

Tile Grout Market Share (%), 2020

-

North America: Global Tile Grout

-

Market by Country, 2023-2032 (USD Million)

-

Europe: Global Tile Grout

-

Market Share (%), 2020

-

Europe: Global Tile Grout Market, by Country,

-

Asia-Pacific: Global Tile Grout Market Share

-

(%), 2020

-

Asia-Pacific: Global Tile Grout Market, by Country, 2023-2032

-

(USD Million)

-

South America: Global Tile Grout Market Share (%),

-

South America: Global Tile Grout Market, by Country, 2023-2032

-

(USD Million)

-

Middle East and Africa: Global Tile Grout Market Share

-

(%), 2020

-

Middle East and Africa: Global Tile Grout Market, by Country,

Leave a Comment