Market Trends

Key Emerging Trends in the Turpentine Market

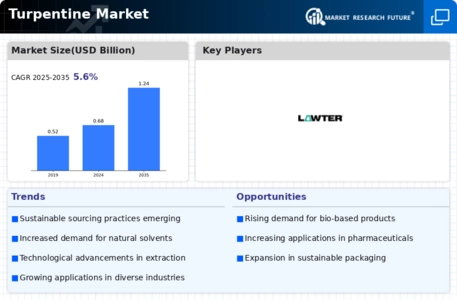

The turpentine market is experiencing notable trends influenced by various factors impacting supply, demand, and industry dynamics. One significant trend is the increasing use of turpentine as a natural and renewable solvent in various industrial applications. With growing concerns over the environmental impact of traditional solvents, there's a shift towards eco-friendly alternatives like turpentine, which is derived from pine trees. This trend is driven by a greater emphasis on sustainability and the adoption of green chemistry practices across industries such as paints and coatings, adhesives, and cleaning products.

Another noteworthy trend in the turpentine market is the expanding applications beyond traditional uses. While turpentine has long been valued for its solvent properties, it is now finding new applications in industries such as pharmaceuticals, cosmetics, and aromatherapy. Its natural and aromatic characteristics make it a popular ingredient in various products, including topical ointments, perfumes, and essential oils. This diversification of applications is fueling demand growth and expanding the market opportunities for turpentine producers.

Furthermore, technological advancements are driving innovation in the turpentine market. Manufacturers are investing in research and development to improve extraction techniques, enhance product quality, and develop novel derivatives of turpentine with enhanced properties. These advancements are not only increasing the efficiency of turpentine production but also expanding its potential applications in high-value markets such as fine chemicals and specialty materials.

The turpentine market is also witnessing a shift towards sustainable sourcing practices. As consumers become more conscious of the environmental and social impacts of their purchasing decisions, there is a growing demand for turpentine derived from responsibly managed forests and sustainable harvesting practices. This trend is driving certification programs and sustainability initiatives within the industry, encouraging producers to adopt practices that promote forest conservation, biodiversity, and community welfare.

Moreover, the market is experiencing consolidation and strategic partnerships among key players. As competition intensifies and economies of scale become increasingly important, companies are seeking opportunities for collaboration, merger, and acquisition to strengthen their market position and expand their product portfolios. These strategic moves allow companies to leverage synergies, streamline operations, and access new markets, driving growth and competitiveness in the turpentine market.

On the supply side, the turpentine market is influenced by factors such as weather conditions, forest management practices, and regulatory policies. Fluctuations in pine resin yields, driven by factors such as climate variability and disease outbreaks, can impact the availability and pricing of turpentine. Additionally, regulations governing forest harvesting and resin extraction practices can affect the sustainability and cost-effectiveness of turpentine production, influencing market dynamics and supply chain resilience.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment