US Specialty Gas Market Share

US Specialty Gas Market Research Report Information By Type (High Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, and Others), By Ingredients (Argon, Bromine, Nitrogen, Helium, Carbon Monoxide, Xenon, Methane, Krypton Oxygen, Neon, Hydrogen, and Others), By Application (Manufacturing, Electronics, Healthcare, Academics, Analytical & Calibration, Refrigeration, and Others), - Market ...

Market Summary

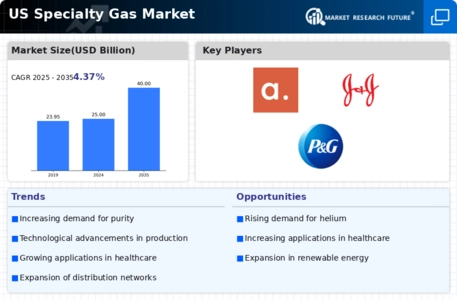

The US Specialty Gas Market is projected to grow from 25 USD Billion in 2024 to 40 USD Billion by 2035, reflecting a robust growth trajectory.

Key Market Trends & Highlights

US Specialty Gas Key Trends and Highlights

- The market is expected to expand at a compound annual growth rate of 4.37 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 40 USD Billion, indicating a substantial increase from the base year.

- In 2024, the market is valued at 25 USD Billion, laying a strong foundation for future growth.

- Growing adoption of specialty gases in various industries due to increasing demand for high-purity gases is a major market driver.

Market Size & Forecast

| 2024 Market Size | 25 (USD Billion) |

| 2035 Market Size | 40 (USD Billion) |

| CAGR (2025 - 2035) | 4.37% |

| Largest Regional Market Share in 2024 | -) |

Major Players

Apple Inc (US), Microsoft Corp (US), Amazon.com Inc (US), Alphabet Inc (US), Berkshire Hathaway Inc (US), Tesla Inc (US), Meta Platforms Inc (US), Johnson & Johnson (US), Visa Inc (US), Procter & Gamble Co (US)

Market Trends

Growing Use of Specialty Gases in Various Industries to Boost the Market Growth

Specialty gas is emerging as the go-to option for meeting requirements as businesses strive for more efficient operations and refined goods. For instance, to improve the purity of their goods, the oil and gas sector and petroleum refineries are putting more sophisticated technology into practice. The primary reason for this is that the industry as a whole aims to increase productivity and efficiency in every manner. Achieving and upholding this performance target requires specialty gas. The US is the world's largest oil producer and a center of the hydrocarbon processing sector.

The US produced almost 20% of the world's oil in 2022, which led to a notable increase in demand for this kind of gas. In addition, speciality gas is used in the food and beverage sector to improve the quality and safety of food products. These gases are used in many phases of research, clinical trials, and production by biotech and pharmaceutical businesses. The long-term storage of biological and clinical samples will increase demand for these gases, which will support the expansion of the specialty gas industry in the US.

The quality and purity of specialty gases have increased due to the development of sophisticated manufacturing and purification processes. This has made it possible to precisely control the composition of the gases, guaranteeing consistency and dependability across a range of applications. Furthermore, a number of developments in analytical instruments have raised the need for specialty gases in industries like chemical analysis, pharmaceutical research, and environmental monitoring. For instance, high-purity specialized gases are needed for mass spectrometry and gas chromatography procedures to produce precise and consistent findings.

In addition, by guaranteeing the effective and secure transportation of gases to end users, ongoing innovation and advancement in gas handling, storage, and distribution systems has also aided in the expansion of the specialty gases market. Thus, driving the specialty gas market revenue.

The U.S. specialty gas market is experiencing a dynamic shift driven by increasing demand across various sectors, particularly in healthcare and technology, which suggests a robust growth trajectory in the coming years.

U.S. Department of Energy

US Specialty Gas Market Market Drivers

Market Trends and Projections

Growth in Renewable Energy Sector

The Global US Specialty Gas Market Industry is positively impacted by the growth in the renewable energy sector. Specialty gases play a critical role in the production of solar panels and wind turbines, where gases like argon are used in manufacturing processes. As the shift towards renewable energy sources accelerates, the demand for specialty gases is likely to rise. This trend aligns with broader energy policies promoting sustainability and could contribute to the market's projected growth, with an anticipated value of 25 USD Billion in 2024 and a potential increase to 40 USD Billion by 2035.

Advancements in Healthcare Applications

The Global US Specialty Gas Market Industry is significantly influenced by advancements in healthcare applications, particularly in medical imaging and diagnostics. Gases such as helium and carbon dioxide are crucial for various medical procedures, including MRI scans and laparoscopic surgeries. The increasing prevalence of chronic diseases and the demand for advanced medical technologies are likely to drive the consumption of specialty gases in healthcare. This sector's growth contributes to the overall market expansion, with a projected compound annual growth rate of 4.37% from 2025 to 2035, underscoring the importance of specialty gases in modern medicine.

Environmental Regulations and Compliance

The Global US Specialty Gas Market Industry is shaped by stringent environmental regulations aimed at reducing greenhouse gas emissions. Specialty gases, particularly those used in industrial applications, must comply with regulations set by agencies such as the Environmental Protection Agency. This compliance often necessitates the use of more environmentally friendly alternatives, driving innovation and the development of new specialty gas products. As industries adapt to these regulations, the market is expected to evolve, potentially leading to increased demand for specialty gases that meet regulatory standards, thereby influencing overall market dynamics.

Rising Demand in Electronics Manufacturing

The Global US Specialty Gas Market Industry experiences a notable surge in demand driven by the electronics manufacturing sector. Specialty gases such as nitrogen trifluoride and sulfur hexafluoride are essential in the production of semiconductors and flat-panel displays. As the electronics industry continues to expand, particularly with the rise of 5G technology and electric vehicles, the need for high-purity specialty gases is expected to grow. This trend is reflected in the projected market value, which is anticipated to reach 25 USD Billion in 2024 and potentially 40 USD Billion by 2035, indicating a robust growth trajectory.

Emerging Applications in Food and Beverage Industry

The Global US Specialty Gas Market Industry is witnessing emerging applications in the food and beverage sector, where specialty gases are utilized for packaging and preservation. Gases such as nitrogen and carbon dioxide are essential for extending shelf life and maintaining product quality. As consumer preferences shift towards fresh and minimally processed foods, the demand for specialty gases in this industry is likely to grow. This trend not only supports the market's expansion but also aligns with the projected compound annual growth rate of 4.37% from 2025 to 2035, indicating a robust future for specialty gases in food preservation.

Market Segment Insights

Specialty Gas Type Insights

The US Specialty Gas market segmentation, based on type includes High Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, and Others. The carbon gases segment dominated the market mostly. Medical equipment, including that utilized in ophthalmology, magnetic resonance imaging, nuclear magnetic resonance imaging, and other fields, frequently uses carbon gases. Industries including chemicals, electronics, manufacturing, and healthcare have a strong demand for carbon gases. The need for carbon gases is rising due to their expanding range of applications in instrument calibration.

Figure 1: US Specialty Gas Market, by Type, 2022 & 2032 (USD Billion)Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Specialty Gas Ingredients Insights

The US Specialty Gas market segmentation, based on ingredients, includes Argon, Bromine, Nitrogen, Helium, Carbon Monoxide, Xenon, Methane, Krypton Oxygen, Neon, Hydrogen, and Others. The carbon monoxide category generated the most income. In terms of market share, carbon monoxide (CO) is the most common and well-known gas. Owing to its special qualities and uses, this colorless, odorless gas—produced when fuels containing carbon burn incompletely—is extensively employed in a variety of sectors.

The market is expanding in part because of the growing demand for carbon monoxide in the chemical sector, where it is used as an intermediate and raw material in the synthesis of various chemicals, including formaldehyde, methanol, and acetic acid.

Specialty Gas Application Insights

The US Specialty Gas market segmentation, based on application, includes Manufacturing, Electronics, Healthcare, Academics, Analytical & Calibration, Refrigeration, and Others. The healthcare category generated the most income. Various specialty gases, including oxygen, medical air, medical nitrous oxide, and medical helium, are used in the healthcare industry. The primary drivers of the market are anticipated to be the rising use of advanced medical technology and the increased spending on healthcare by governments worldwide.

Specialty Gas Country Insights

The US is a major global user of industrial gas, and during the past five years, there has been a notable surge in the country's need for specialty gases. These include high purity gases, carbon gases, and noble gases. They are used in a variety of industries, including the food and beverage, electronics, hydrocarbon processing, and life sciences sectors. Additionally, the US is propelled by the existence of several major businesses in a wide range of industries, including healthcare, electronics, automotive, and manufacturing.

The nation is also growing as a result of a number of technical developments, the developing semiconductor sector, healthcare services, and a growing emphasis on renewable energy technologies. In addition, growing medical technology and an aging population are major factors driving the need for medical gases, which is largely driven by the healthcare sector. For uses such as anesthetic and diagnostic testing, specialty gases are indispensable. It is anticipated that this trend will accelerate market expansion as healthcare quality becomes increasingly important.

Get more detailed insights about US Specialty Gas Market Research Report - Forecast by 2034

Regional Insights

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the specialty gas market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, specialty gas industry must offer cost-effective items.

Major players in the specialty gas market are attempting to increase market demand by investing in research and development operations includes The Linde Group (Germany), Air Liquide (France), Air Products and Chemicals Inc. (U.S.), Praxair Technology, Inc. (U.S.), Showa Denko K.K. (Japan), Southern Industrial Gas Sdn Bhd (Malaysia), Messer Group Gmbh (Germany), Mitsui Chemicals Inc. (Japan), and TAIYO NIPPON SANSO CORPORATION (Japan).

Key Companies in the US Specialty Gas Market market include

Industry Developments

February 2023: One of the top American manufacturers, H2 Merck KGaA, intends to build a new production facility in Taiwan as part of its expansion plans. The corporation will be able to increase its market share abroad thanks to this production facility's ability to produce these gasses and semiconductor materials.

December 2022: In order to distribute and supply Solvay's product, Solvaclean, the Electronic Fluorocarbons (EFC) Company, a significant specialized gas provider to the semiconductor sector, teamed with Solvay. This product is a mixture of fluorine gases that are useful for cleaning semiconductor equipment. Through this collaboration, Solvay will be able to join the American market, and EFC will gain from having more items in its line.

Future Outlook

US Specialty Gas Market Future Outlook

The US Specialty Gas Market is projected to grow at a 4.37% CAGR from 2024 to 2035, driven by technological advancements, increasing demand in healthcare, and environmental regulations.

New opportunities lie in:

- Invest in R&D for innovative specialty gas applications in renewable energy.

- Expand distribution networks to enhance accessibility in emerging markets.

- Leverage digital technologies for real-time monitoring and optimization of gas usage.

By 2035, the US Specialty Gas Market is expected to achieve substantial growth, reflecting evolving industry dynamics.

Market Segmentation

Specialty Gas Type Outlook

- High Purity Gases

- Noble Gases

- Carbon Gases

- Halogen Gases

- Others

Specialty Gas Application Outlook

- Manufacturing

- Electronics

- Healthcare

- Academics

- Analytical & Calibration

- Refrigeration

- Others

Specialty Gas Ingredients Outlook

- Argon

- Bromine

- Nitrogen

- Helium

- Carbon Monoxide

- Xenon

- Methane

- Krypton Oxygen

- Neon

- Hydrogen

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 2.07 Billion |

| Market Size 2025 | USD 2.25 Billion |

| Market Size 2034 | USD 4.85 Billion |

| Compound Annual Growth Rate (CAGR) | 8.90% (2025-2034) |

| Base Year | 2024 |

| Market Forecast Period | 2025-2034 |

| Historical Data | 2020- 2024 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Ingredients, Application, and Region |

| Countries Covered | US |

| Key Companies Profiled | The Linde Group (Germany), Air Liquide (France), Air Products and Chemicals Inc. (U.S.), Praxair Technology, Inc. (U.S.), Showa Denko K.K. (Japan), Southern Industrial Gas Sdn Bhd (Malaysia), Messer Group Gmbh (Germany), Mitsui Chemicals Inc. (Japan), and TAIYO NIPPON SANSO CORPORATION (Japan) |

| Key Market Opportunities | Establishment of novel, environmentally beneficial technologies |

| Key Market Dynamics | Expanding use of specialty gas in the electronics sector Rapidly expanding healthcare industry |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the specialty gas market?

The US Specialty Gas market size was valued at USD 2.07 Billion in 2024.

What is the growth rate of the specialty gas market?

The market is projected to grow at a CAGR of 8.90% during the forecast period, 2025-2034.

Who are the key players in the specialty gas market?

The key players in the market are The Linde Group (Germany), Air Liquide (France), Air Products and Chemicals Inc. (U.S.), Praxair Technology, Inc. (U.S.), Showa Denko K.K. (Japan), Southern Industrial Gas Sdn Bhd (Malaysia), Messer Group Gmbh (Germany), Mitsui Chemicals Inc. (Japan), and TAIYO NIPPON SANSO CORPORATION (Japan).

Which ingredients led the specialty gas market?

The carbon monoxide category dominated the market in 2024.

Which application had the largest market share in the specialty gas market?

The healthcare category had the largest share in the market.

-

Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

- Data Triangulation

- Validation

- Overview

- Drivers

- Restraints

- Opportunities

- Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

-

Bargaining Power of Buyers

-

Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

Threat of New Entrants

-

GAS MARKET, BY TYPE

- Overview

- High Purity Gases

- Noble Gases

- Carbon Gases

- Halogen Gases

- Others

- Overview

- Argon

- Bromine

- Nitrogen

- Helium

- Carbon Monoxide

- Xenon

- Methane

- Krypton Oxygen

- Neon

- Hydrogen

- Others

-

US SPECIALTY GAS MARKET, BY APPLICATION

- Overview

- Manufacturing

- Electronics

- Healthcare

- Academics

- Analytical & Calibration

- Refrigeration

- Others

- Overview

- Competitive Analysis

- Market Share Analysis

- Major Growth Strategy in the US Specialty Gas Market

- Competitive Benchmarking

- Leading Players in

-

Terms of Number of Developments in the US Specialty Gas Market

- Key

-

developments and Growth Strategies

-

New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income, 2022

-

New Product Launch/Service Deployment

-

Major Players R&D Expenditure. 2022

-

The Linde Group (Germany)

-

Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AIR LIQUIDE (FRANCE)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Air Products and Chemicals Inc. (U.S.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

PRAXAIR TECHNOLOGY, INC. (U.S.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Showa Denko K.K. (Japan)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

Southern Industrial Gas Sdn Bhd (Malaysia)

-

Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MESSER GROUP GMBH (GERMANY)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MITSUI CHEMICALS INC. (JAPAN)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

TAIYO NIPPON SANSO CORPORATION (Japan)

-

Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- References

- Related Reports

-

Company Overview

-

GAS MARKET, ESTIMATES & FORECAST, 2025 - 2034 (USD BILLION)

-

US SPECIALTY GAS MARKET, BY INGREDIENTS, 2025 - 2034 (USD BILLION)

-

FOR THE US SPECIALTY GAS MARKET GAS MARKET

-

SPECIALTY GAS MARKET, SHARE (%), BY APPLICATION, 2022 GAS MARKET: COMPANY SHARE ANALYSIS, 2022 (%) (GERMANY): FINANCIAL OVERVIEW SNAPSHOT SWOT ANALYSIS

-

INC. (U.S.): FINANCIAL OVERVIEW SNAPSHOT INC. (U.S.): SWOT ANALYSIS FINANCIAL OVERVIEW SNAPSHOT SWOT ANALYSIS SNAPSHOT

-

MESSER GROUP GMBH (GERMANY): FINANCIAL OVERVIEW SNAPSHOT GROUP GMBH (GERMANY): SWOT ANALYSIS FINANCIAL OVERVIEW SNAPSHOT ANALYSIS SNAPSHOT

US Specialty Gas Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment