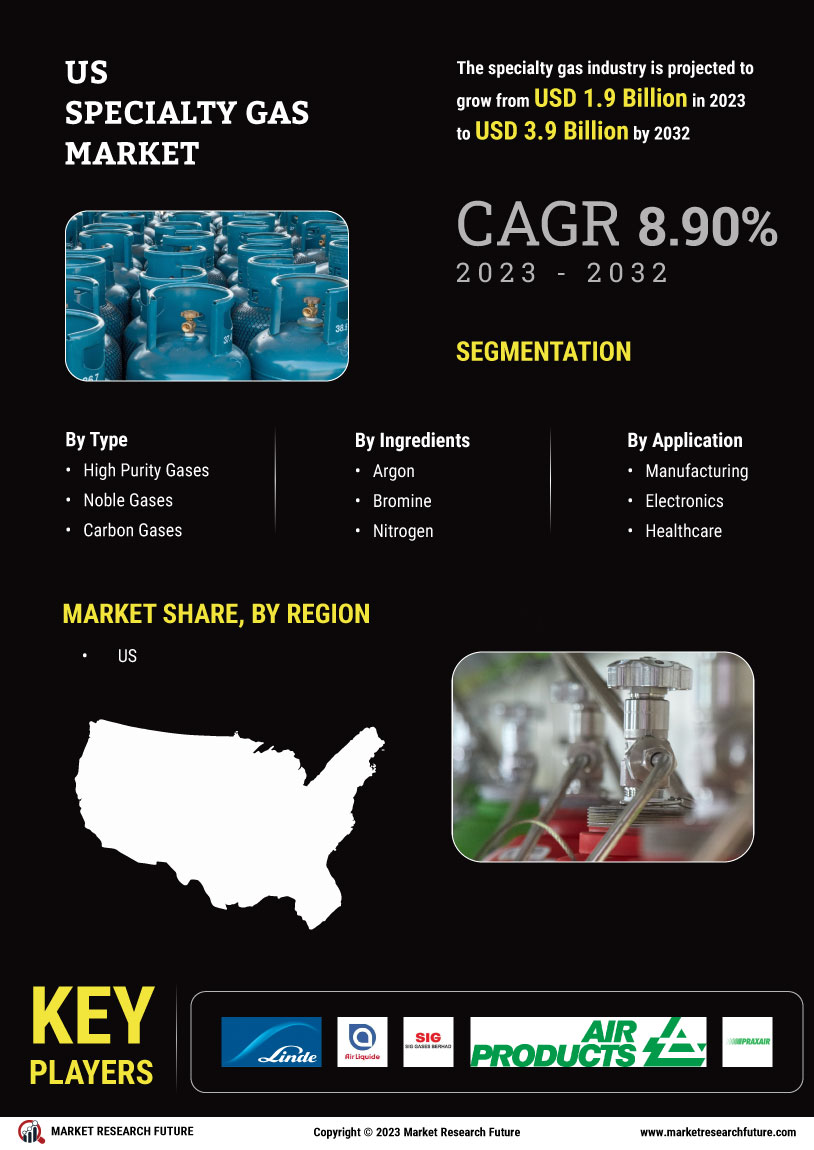

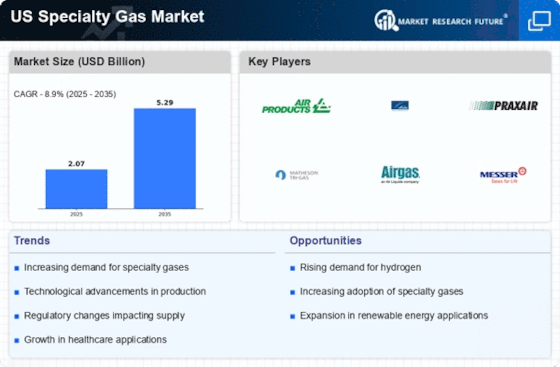

Rising Demand in Healthcare Sector

The US Specialty Gas Market experiences a notable surge in demand from the healthcare sector. Specialty gases such as nitrous oxide and medical-grade oxygen are essential for various medical applications, including anesthesia and respiratory therapies. The increasing prevalence of chronic diseases and the aging population contribute to this demand. According to recent data, the healthcare sector accounts for a significant portion of the specialty gas consumption, with projections indicating a growth rate of approximately 5% annually. This trend underscores the critical role of specialty gases in enhancing patient care and treatment outcomes, thereby driving the overall market growth.

Innovations in Energy Storage Solutions

Innovations in energy storage solutions are emerging as a pivotal driver for the US Specialty Gas Market. Gases such as hydrogen are gaining traction in energy storage applications, particularly in fuel cells and battery technologies. The transition towards renewable energy sources necessitates efficient storage solutions, and specialty gases play a vital role in this context. The energy storage market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This shift towards sustainable energy solutions is likely to enhance the demand for specialty gases, thereby impacting the US Specialty Gas Market positively.

Expansion of Semiconductor Manufacturing

The US Specialty Gas Market is significantly influenced by the expansion of semiconductor manufacturing. Specialty gases like nitrogen trifluoride and silane are crucial in the production of semiconductors, which are integral to various electronic devices. The semiconductor industry has witnessed robust growth, with a market size exceeding 200 billion dollars in recent years. This growth is driven by the increasing demand for electronics, including smartphones and computers. As manufacturers seek to enhance production efficiency and yield, the reliance on specialty gases is expected to rise, thereby propelling the US Specialty Gas Market forward.

Increased Focus on Environmental Regulations

The US Specialty Gas Market is also shaped by an increased focus on environmental regulations. Stricter regulations regarding emissions and environmental impact are prompting industries to adopt cleaner technologies, which often require specialty gases. For instance, the use of low-global warming potential gases is becoming more prevalent in various applications, including refrigeration and air conditioning. The regulatory landscape is evolving, with agencies implementing guidelines that encourage the use of environmentally friendly gases. This shift not only aligns with sustainability goals but also drives innovation within the US Specialty Gas Market, as companies seek compliant solutions.

Growth in Research and Development Activities

The US Specialty Gas Market is witnessing growth in research and development activities across various sectors. Industries such as aerospace, automotive, and pharmaceuticals are increasingly investing in R&D to explore new applications for specialty gases. This trend is fueled by the need for advanced materials and processes that enhance performance and efficiency. The R&D expenditure in these sectors has seen a steady increase, with estimates suggesting a growth rate of around 4% annually. As companies strive to innovate and improve their offerings, the demand for specialty gases is likely to rise, further propelling the US Specialty Gas Market.

Leave a Comment