Us Specialty Gas Size

US Specialty Gas Market Growth Projections and Opportunities

The US Specialty Gas Market is shaped by a range of market factors that contribute to its growth and dynamics. One of the primary drivers is the expanding industrial applications of specialty gases. These gases, known for their high purity and precise composition, find extensive use in industries such as healthcare, electronics, manufacturing, and analytical laboratories. As these sectors continue to advance and demand stringent quality control measures, the need for specialty gases has surged, propelling the growth of the US specialty gas market.

Furthermore, technological advancements and innovations in various industries play a pivotal role in influencing the market. The rapid pace of technological change has led to the development of new applications for specialty gases, particularly in emerging fields such as nanotechnology and biotechnology. The continuous demand for cutting-edge technologies and processes has driven the requirement for specialized gases, creating a favorable environment for the growth of the specialty gas market in the United States.

Government regulations and standards are also significant factors shaping the US Specialty Gas Market. Given the critical applications of specialty gases in industries like healthcare and environmental monitoring, stringent regulations govern their production, storage, and transportation. Compliance with these regulations is imperative, leading manufacturers to invest in advanced technologies and quality control measures to ensure the safety and reliability of specialty gases. Regulatory standards act as a driving force for market participants to maintain high-quality standards in their products.

Sustainability considerations are gaining prominence in the specialty gas market, reflecting broader environmental concerns. As industries increasingly focus on reducing their environmental impact, there is a growing demand for eco-friendly and sustainable practices, including the use of environmentally friendly gases. Specialty gas manufacturers are responding to this demand by exploring greener alternatives and implementing practices that minimize their carbon footprint. This sustainability-driven approach is influencing market dynamics and shaping the choices made by both suppliers and consumers in the US specialty gas industry.

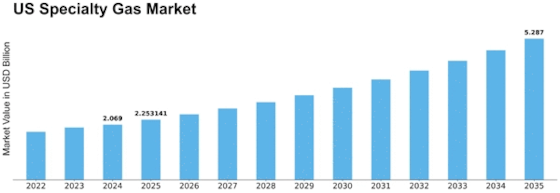

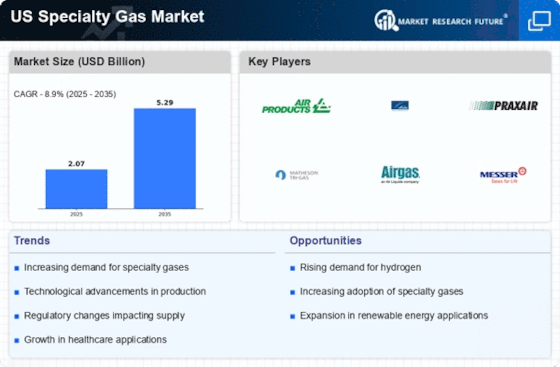

US Specialty Gas Market Size was valued at USD 1.8 Billion in 2022. The specialty gas industry is projected to grow from USD 1.9 Billion in 2023 to USD 3.9 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.90%

The competitive landscape and industry consolidation are additional factors impacting the US Specialty Gas Market. The market is characterized by the presence of both global and regional players, leading to intense competition. Mergers, acquisitions, and strategic partnerships are common as companies seek to enhance their product portfolios, expand their market reach, and capitalize on synergies. This competitive environment encourages continuous innovation, technological advancements, and the development of customized solutions to meet the specific needs of diverse industries.

The energy sector, particularly the growing emphasis on alternative energy sources, is a significant driver for the specialty gas market in the United States. Specialty gases play a vital role in various renewable energy technologies, including solar energy, wind energy, and fuel cells. As the US continues to invest in renewable energy initiatives, the demand for specialty gases used in these applications is expected to rise, contributing to the overall growth of the specialty gas market.

Leave a Comment