Increasing Health Consciousness

The Specialty Oils Market is experiencing a notable surge in demand due to the increasing health consciousness among consumers. As individuals become more aware of the health benefits associated with various oils, such as omega-3 fatty acids in flaxseed oil or the antioxidant properties of olive oil, the market is likely to expand. Reports indicate that the demand for specialty oils, particularly those derived from natural sources, is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This trend reflects a broader shift towards healthier dietary choices, which is influencing purchasing decisions across various demographics. Consequently, manufacturers are focusing on promoting the health benefits of their products, thereby driving growth in the Specialty Oils Market.

Expansion of Food and Beverage Sector

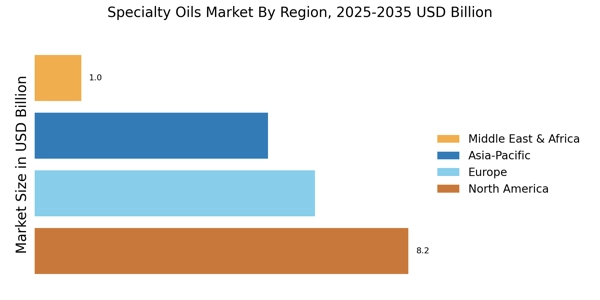

The Specialty Oils Market is significantly influenced by the expansion of the food and beverage sector. As culinary trends evolve, there is a growing preference for specialty oils that enhance flavor and provide unique culinary experiences. The market for specialty oils is projected to reach a valuation of several billion dollars, driven by the increasing incorporation of these oils in gourmet cooking and food processing. Additionally, the rise of plant-based diets and the demand for organic products are further propelling the use of specialty oils in various food applications. This expansion is not only limited to traditional markets but is also penetrating emerging markets, where consumers are becoming more adventurous in their culinary choices. Thus, the growth of the food and beverage sector is a critical driver for the Specialty Oils Market.

Rising Popularity of Personal Care Products

The Specialty Oils Market is witnessing a rise in demand due to the increasing popularity of personal care products that incorporate specialty oils. Consumers are increasingly seeking natural and organic ingredients in their skincare and haircare routines, leading to a surge in the use of oils such as argan oil, jojoba oil, and coconut oil. The personal care segment is expected to account for a substantial share of the specialty oils market, with projections indicating a growth rate of around 6% annually. This trend is driven by the perception that natural oils offer superior benefits compared to synthetic alternatives, including better hydration and nourishment. As a result, manufacturers are innovating and expanding their product lines to include specialty oils, thereby contributing to the overall growth of the Specialty Oils Market.

Technological Innovations in Oil Processing

Technological innovations in oil processing are playing a pivotal role in shaping the Specialty Oils Market. Advances in extraction techniques, such as cold pressing and supercritical fluid extraction, are enhancing the quality and yield of specialty oils. These innovations not only improve the efficiency of oil extraction but also preserve the nutritional and sensory properties of the oils. As a result, the market is likely to benefit from higher-quality products that meet consumer expectations for purity and efficacy. Furthermore, the integration of automation and digital technologies in production processes is streamlining operations, reducing costs, and increasing scalability. This technological evolution is expected to drive competitive advantages for manufacturers in the Specialty Oils Market, enabling them to cater to the growing demand for high-quality specialty oils.

Growing Interest in Aromatherapy and Wellness

The Specialty Oils Market is experiencing growth driven by the increasing interest in aromatherapy and wellness practices. essential oils and specialty oils are gaining traction among consumers seeking natural remedies for stress relief, relaxation, and overall well-being. The aromatherapy segment is projected to expand significantly, with a growing number of consumers incorporating these oils into their daily routines. This trend is supported by a rising awareness of the therapeutic benefits of various oils, such as lavender for relaxation and eucalyptus for respiratory health. As wellness trends continue to evolve, the demand for specialty oils in aromatherapy is likely to increase, presenting opportunities for manufacturers to innovate and diversify their product offerings. Consequently, the growing interest in aromatherapy and wellness is a key driver for the Specialty Oils Market.