Market Share

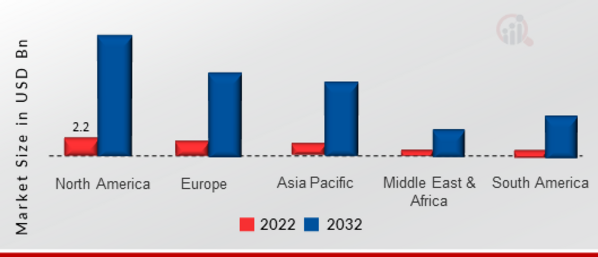

Wireless IoT Sensors Market Share Analysis

Government Support for IoT Adoption

Many governments in different countries, whether developed or developing, are working towards encouraging the use of IoT (Internet of Things). They want to make people aware of IoT and improve the technological infrastructure needed for it. For example, the Indian Government started the smart cities program to make life better in Indian cities. In such projects, sensors will be crucial for creating and using connected devices. Other countries like China, Malaysia, Mexico, Brazil, Russia, and South Korea are also taking similar steps to promote the use of connected devices.

IoT is an important part of making digital improvements in countries, whether they are highly developed or still developing. Governments worldwide are creating policies and offering incentives to support small businesses, start-ups, and students. They provide funds without any interest to help set up facilities for developing IoT technologies. For instance, in 2018, the National Centre of Excellence (CoE) worked with NASSCOM and other industry groups to support the IoT industry. They did this by setting up facilities for developing IoT technologies and helping businesses in terms of memberships and production of IoT devices.

Government initiatives, where they work together with industry groups, greatly speed up the use of connected devices. This opens up opportunities for companies in the global wireless IoT sensors market during the forecast period.

Use in Monitoring Industries

Smart wireless IoT sensors are useful in industries to keep an eye on how workers are doing and ensure their safety. With the growing use of IoT, it is now possible to collect data in real-time through IoT sensors to monitor workers. IoT devices can track the levels of supplies in washrooms in real-time and study how people use them to make sure there are always enough supplies. Smart wireless IoT sensors can also track employees and give them a warning if there is any dangerous substance leaking to keep them safe. They are also helpful in monitoring important products and checking the status of refrigeration in industries that have strict rules, like food processing. Big companies in the food and beverage industry such as McDonald’s and KFC are already using IoT sensors to keep an eye on cooking, cleaning, and storage equipment behind the counter to make sure customers have a good experience. So, the use of wireless IoT sensors in keeping an eye on industries that have strict rules is expected to create opportunities for companies in the global wireless IoT sensors market during the forecast period.

Leave a Comment