Sustainability Trends

Sustainability trends are emerging as a crucial factor influencing the Smartphone Industry. Consumers are becoming more environmentally conscious, prompting manufacturers to adopt sustainable practices in their production processes. This includes the use of recyclable materials, energy-efficient manufacturing, and initiatives aimed at reducing electronic waste. As sustainability becomes a priority for consumers, brands that demonstrate a commitment to eco-friendly practices may gain a competitive edge in the market. This shift towards sustainability not only aligns with consumer values but also reflects a broader industry trend towards responsible production and consumption, potentially reshaping market dynamics.

Rising Consumer Demand

The Global Smartphone Industry experiences a notable surge in consumer demand, driven by the increasing reliance on mobile devices for communication, entertainment, and productivity. In 2024, the market is valued at approximately 609.3 USD Billion, reflecting the growing integration of smartphones into daily life. Consumers are increasingly seeking devices that offer advanced features, such as high-resolution cameras and enhanced processing power. This trend is further fueled by the proliferation of mobile applications and services, which enhance user experience and engagement. As a result, manufacturers are compelled to innovate continuously, ensuring that they meet the evolving preferences of consumers.

Growing E-commerce Sector

The expansion of the e-commerce sector is a significant driver of the Smartphone Market. As consumers increasingly turn to online shopping, the demand for smartphones that facilitate seamless e-commerce experiences is on the rise. Mobile shopping applications and payment solutions are becoming integral to consumer behavior, prompting manufacturers to enhance their devices' capabilities to support these functionalities. The convenience of shopping via smartphones, coupled with the growing trend of mobile wallets, is reshaping the retail landscape. This shift is likely to contribute to the overall growth of the smartphone market, as more consumers rely on their devices for purchasing goods and services.

Technological Advancements

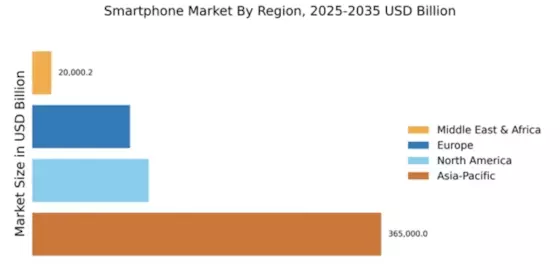

Technological advancements play a pivotal role in shaping the Global Smartphone Industry. Innovations in hardware and software, such as the introduction of 5G technology, artificial intelligence, and augmented reality, are transforming the capabilities of smartphones. These advancements not only improve device performance but also enhance user experience, making smartphones more appealing to consumers. The integration of AI-driven features, such as voice assistants and personalized recommendations, is particularly noteworthy. As the industry progresses towards 2035, the market is projected to reach 1322.2 USD Billion, indicating a robust growth trajectory fueled by these technological innovations.

Increased Internet Penetration

The Global Smartphone Industry is significantly influenced by the increasing penetration of the internet worldwide. As more individuals gain access to the internet, particularly in developing regions, the demand for smartphones rises correspondingly. This trend is evident in emerging markets, where affordable smartphones are becoming more accessible to a broader audience. The proliferation of mobile internet services facilitates the adoption of smartphones, enabling users to engage with digital content and services. Consequently, this surge in internet connectivity is anticipated to drive the market's growth, contributing to a projected compound annual growth rate of 7.3% from 2025 to 2035.