Germany : Innovation Drives Consumer Demand

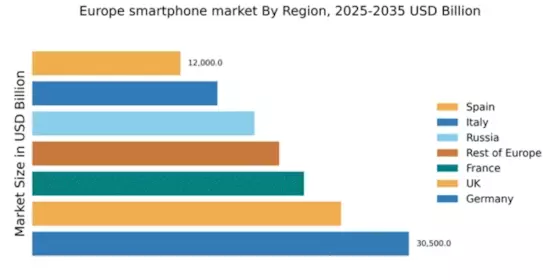

Germany holds a dominant position in the European smartphone market, accounting for 30.5% of the total market share with a value of $30,500 million. Key growth drivers include a strong emphasis on technological innovation, high disposable income, and a robust infrastructure supporting digital services. The demand for premium smartphones is rising, driven by consumer preferences for advanced features and sustainability. Government initiatives promoting digitalization further enhance market growth, while stringent regulations ensure product quality and safety.

UK : Consumer Preferences Shape Offerings

The UK smartphone market represents 25% of the European total, valued at $25,000 million. Growth is fueled by a diverse consumer base that values both premium and budget-friendly options. The rise of 5G technology and increasing online retailing are significant trends. Regulatory frameworks support consumer rights and data protection, fostering a secure shopping environment. The UK also benefits from a well-developed logistics network, enhancing distribution efficiency.

France : Luxury Meets Technology in France

France captures 22% of the European smartphone market, valued at $22,000 million. The market is driven by a growing appetite for high-end smartphones, particularly among urban consumers. Trends indicate a shift towards eco-friendly devices, supported by government policies promoting sustainability. The French market is characterized by a competitive landscape with strong local brands and international players vying for market share, particularly in metropolitan areas like Paris.

Russia : Tech Adoption on the Rise

Russia holds an 18% share of the European smartphone market, valued at $18,000 million. Key growth drivers include increasing smartphone penetration and a young, tech-savvy population. Demand for affordable smartphones is high, with local brands gaining traction. Government initiatives aimed at boosting the digital economy are also significant. Major cities like Moscow and St. Petersburg are central to market dynamics, with a competitive landscape featuring both global and local players.

Italy : Cultural Trends Influence Purchases

Italy accounts for 15% of the European smartphone market, valued at $15,000 million. The market is characterized by a strong preference for stylish and functional devices, reflecting the country's fashion-forward culture. Growth is driven by increasing smartphone adoption among younger demographics and a rise in e-commerce. Regulatory policies support consumer protection, while major cities like Milan and Rome serve as key markets for both premium and mid-range devices.

Spain : Affordability and Accessibility Key Factors

Spain represents 12% of the European smartphone market, valued at $12,000 million. The market is driven by a demand for affordable smartphones, particularly among younger consumers. Trends indicate a growing interest in online shopping and mobile payment solutions. Government initiatives to enhance digital literacy and infrastructure are also pivotal. Key markets include Madrid and Barcelona, where competition is fierce among both local and international brands.

Rest of Europe : Regional Variations in Consumer Behavior

The Rest of Europe accounts for 20% of the smartphone market, valued at $20,000 million. This sub-region encompasses a variety of markets, each with distinct consumer preferences and purchasing power. Growth is driven by increasing smartphone penetration and the rise of e-commerce. Regulatory frameworks vary, impacting market dynamics. Countries like the Netherlands and Sweden are notable for their high-tech adoption, while Eastern European markets show a preference for budget-friendly options.