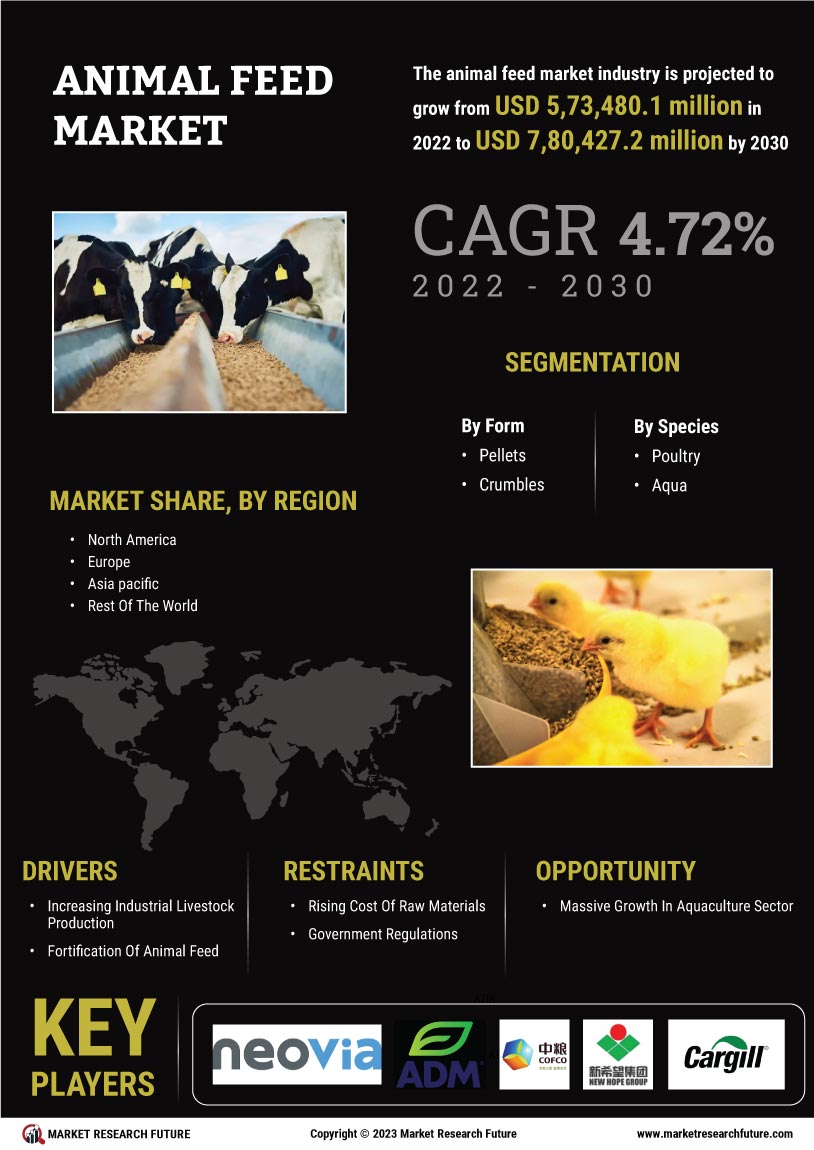

動物飼料市場 概要

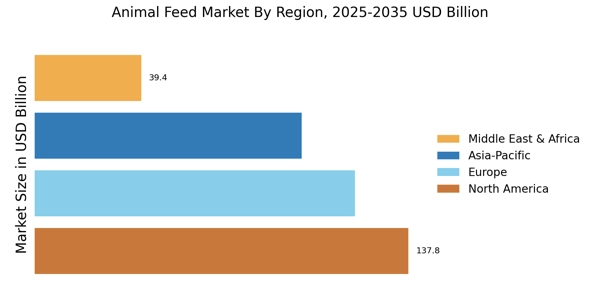

MRFRの分析によると、2024年の動物飼料市場規模は393.78億米ドルと推定されています。動物飼料業界は、2025年に400.95億米ドルから2035年には480.2億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は1.82を示す見込みです。

主要な市場動向とハイライト

動物飼料市場は、持続可能性と技術革新に向けたダイナミックな変化を経験しています。

- 北米は肉の消費が高く、先進的な農業慣行によって動物飼料の最大市場であり続けています。

- アジア太平洋地域は、タンパク質源の需要の増加と可処分所得の上昇を反映して、最も成長している地域です。

- 反芻動物用飼料は市場を支配し続けており、水産養殖活動の増加により水産セグメントは急速に拡大しています。

- 主要な市場の推進要因には、肉の消費の増加と動物の健康に対する意識の高まりが含まれ、これらが業界のトレンドを形成しています。

市場規模と予測

| 2024 Market Size | 393.78 (米ドル十億) |

| 2035 Market Size | 480.2 (USD十億) |

| CAGR (2025 - 2035) | 1.82% |

主要なプレーヤー

カーギル(米国)、アーチャー・ダニエルズ・ミッドランド(米国)、ニュートレコ(オランダ)、オールテック(米国)、BASF(ドイツ)、デ・ヒューズ(オランダ)、フォーファーマーズ(オランダ)、ランド・オ・レイクス(米国)、チャロン・ポクパンド・フーズ(タイ)