自動車フリートリース市場 概要

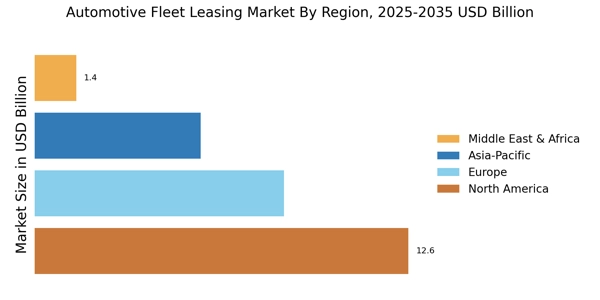

MRFRの分析によると、自動車フリートリース市場の規模は2024年に279億米ドルと推定されました。自動車フリートリース業界は、2025年に295.8億米ドルから2035年には531.8億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は6.04を示します。

主要な市場動向とハイライト

自動車フリートリース市場は、持続可能性とデジタル革新に向けた変革的なシフトを経験しています。

- 市場は、環境規制の強化により、持続可能性に向けた顕著なシフトを目撃しています。デジタルトランスフォーメーションは、フリート管理の実践を再構築し、運用効率とデータ活用を向上させています。特に乗用車セグメントにおいて、多様なクライアントのニーズに応えるために、リースオプションのカスタマイズと柔軟性が不可欠となっています。電子商取引と配送サービスの成長、コスト効率の要求が相まって、クローズドエンドリースオプションの拡大を促進しています。

市場規模と予測

| 2024 Market Size | 27.9 (USD十億) |

| 2035 Market Size | 53.18 (USD十億) |

| CAGR (2025 - 2035) | 6.04% |

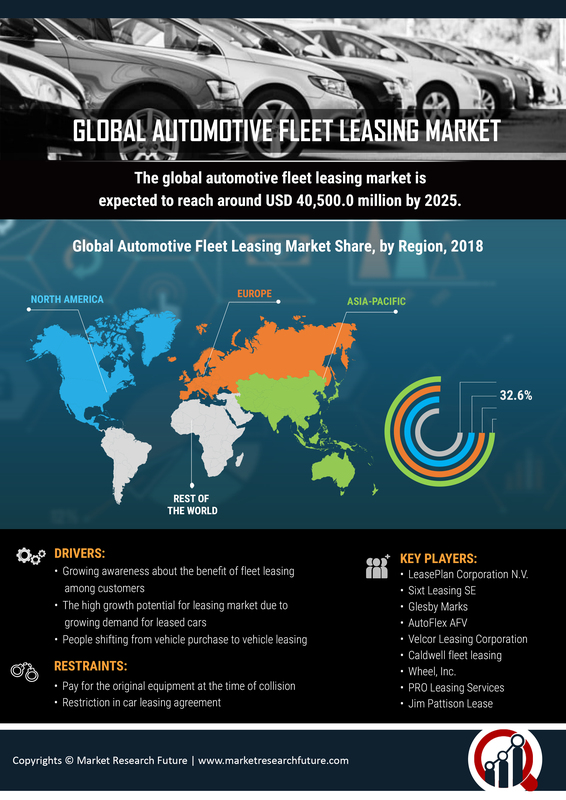

主要なプレーヤー

エンタープライズフリートマネジメント(米国)、リースプラン(オランダ)、アルヴァル(フランス)、ALDオートモーティブ(フランス)、ウィールズ社(米国)、ドンレン(米国)、エレメントフリートマネジメント(カナダ)、シクストリース(ドイツ)、ライダーシステム社(米国)