During the primary research process, qualitative and quantitative insights regarding the adoption of x-by-wire technology and automated steering architectures were obtained by interviewing supply-side and demand-side stakeholders. The supply-side sources consisted of the chiefs of autonomous driving divisions from Tier 1 steering system manufacturers, semiconductor suppliers, and automotive OEMs, as well as CTOs, VPs of Advanced Engineering, and directors of chassis systems. In addition to procurement directors from commercial vehicle OEMs, passenger car manufacturers, and electric vehicle firms, demand-side sources included vice presidents of vehicle dynamics engineering, chassis control engineers, and ADAS integration specialists. Primary research has affirmed the deployment timelines of autonomous vehicles, validated the propulsion segmentation (ICE vs. Electric), and collected insights on fail-operational system architectures, redundancy requirements, and supply chain localization strategies.

Primary Respondent Breakdown:

By Designation: C-level Primaries (28%), Director Level (32%), Senior Engineers/Managers (40%)

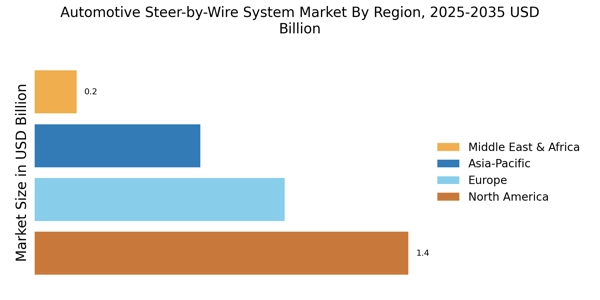

By Region: North America (38%), Europe (32%), Asia-Pacific (25%), Rest of World (5%)

By Value Chain Position: Steering System Manufacturers (45%), Automotive OEMs (35%), Semiconductor/Component Suppliers (20%)

Revenue mapping and vehicle installation rate analysis were employed to determine the global market valuation. The methodology comprised the following:

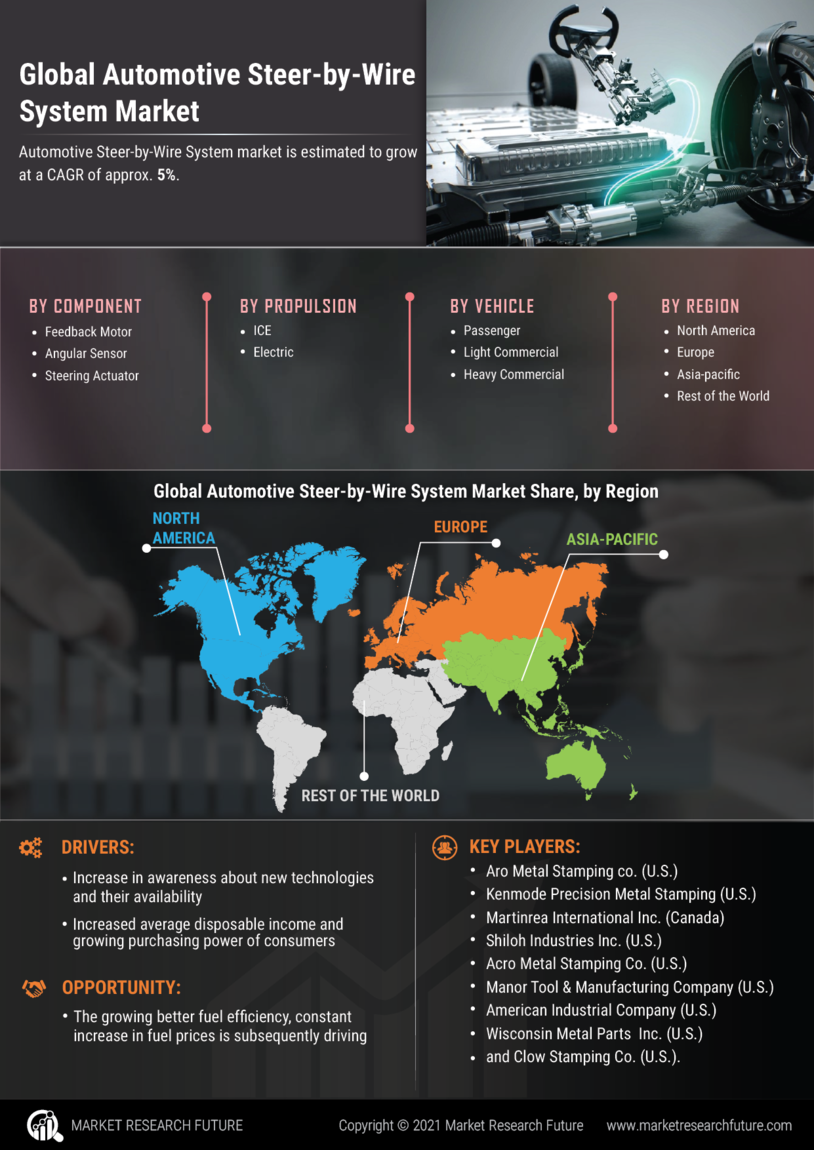

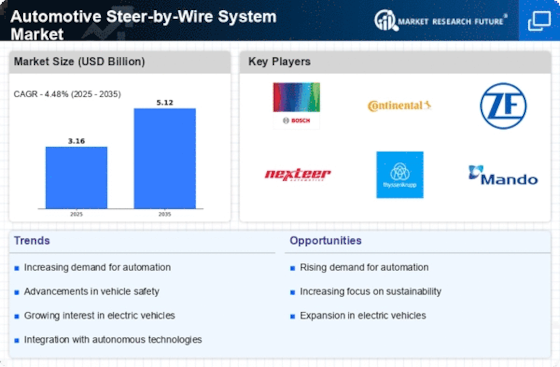

Identification of over 60 significant manufacturers and system integrators in North America, Europe, Asia-Pacific, and China

Product mapping encompasses electronic control modules, steering actuators, feedback motors, and angular sensors. Analysis of annual revenues that are specific to steer-by-wire portfolios and x-by-wire divisions, as reported and modeled

Manufacturers that account for 75-80% of the global market share in 2024 are included in the coverage.

The segment-specific valuations for passenger cars, light commercial vehicles, and heavy commercial vehicles across ICE and electric propulsion systems are derived through cross-validation using bottom-up (vehicle production volume × penetration rate × ASP by vehicle class) and top-down (manufacturer revenue validation) approaches.