Eペーパーディスプレイ市場 概要

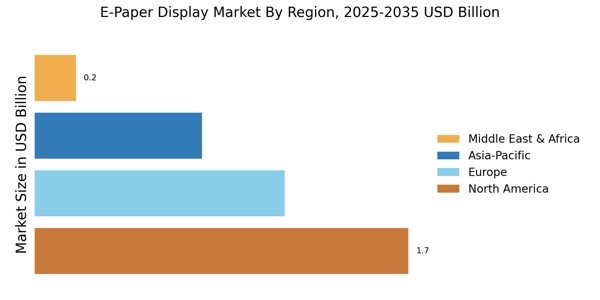

MRFRの分析によると、E-Paper Display市場の規模は2024年に38.33億米ドルと推定されています。E-Paper Display業界は、2025年に43.98億米ドルから2035年には173.8億米ドルに成長する見込みで、2025年から2035年の予測期間中に年平均成長率(CAGR)は14.73を示します。

主要な市場動向とハイライト

E-Paperディスプレイ市場は、持続可能性と技術の進歩によって大幅な成長が見込まれています。

- "北米は、電子書籍リーダーやコンシューマーエレクトロニクスの需要増加により、電子ペーパーディスプレイの最大市場であり続けています。

- アジア太平洋地域は、電子棚ラベルやウェアラブルデバイスの著しい増加により、最も成長が著しい地域として認識されています。

- 電子書籍リーダーが市場を支配しており、電子棚ラベルはその多様性から最も成長が著しいセグメントとして浮上しています。

- 主要な市場推進要因には、持続可能性への強い焦点と、IoT技術との統合が含まれます。"

市場規模と予測

| 2024 Market Size | 3.833 (USD十億) |

| 2035 Market Size | 173.8億ドル |

| CAGR (2025 - 2035) | 14.73% |

主要なプレーヤー

E Ink Holdings(台湾)、Plastic Logic(イギリス)、Pervasive Displays(イギリス)、Visionect(スロベニア)、Gamma Dynamics(アメリカ)、Solomon Systech(香港)、Witdisplay(中国)、Papercast(イギリス)