Global market valuation was derived through production capacity mapping and consumption volume analysis across swine, poultry, ruminant, and aquaculture feed applications. The methodology included:

Identification of over 50 significant lysine manufacturers and fermentation technology providers in North America, Europe, Asia-Pacific, China, and Latin America

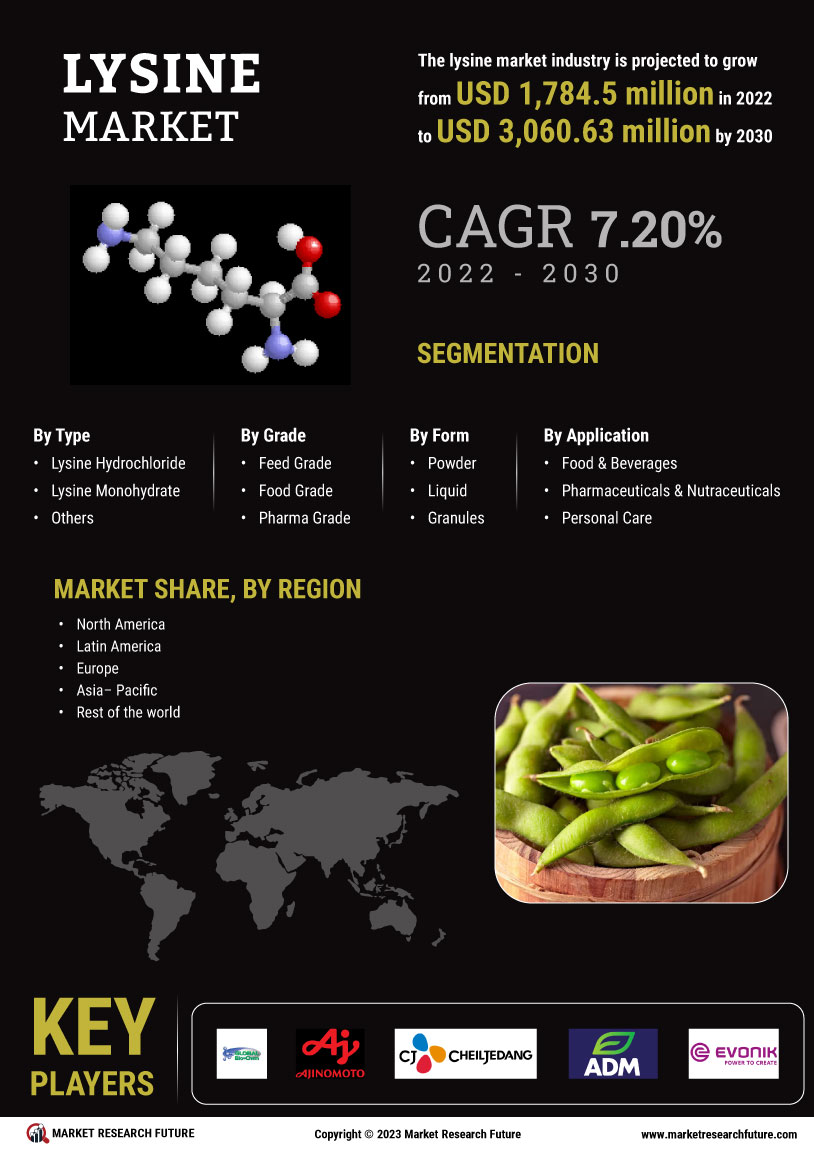

Product mapping across L-lysine HCl, L-lysine liquid/sulfate, granulated, and microencapsulated formulations for feed, food, and pharmaceutical grades

Analysis of installed fermentation capacities, utilization rates, and reported annual revenues specific to amino acid portfolios

Coverage of manufacturers representing 75-80% of global lysine production capacity in 2024

Extrapolation using bottom-up (livestock population × feed inclusion rates × regional pricing by country) and top-down (manufacturer revenue validation and trade data triangulation) approaches to derive segment-specific valuations for swine feed, poultry feed, and nutritional supplement applications

Structural adaptations made for lysine market:

Secondary sources: Shifted from medical/aesthetic organizations (ISAPS, ASPS) to agricultural/feed industry bodies (IFIF, FEFAC, AFIA) and government agriculture departments (USDA, FAO, Chinese Ministry of Agriculture)

Primary stakeholders: Changed from dermatologists/plastic surgeons to animal nutritionists, feed formulators, and livestock production managers

Market coverage: Focused on fermentation capacity, livestock demographics, and feed inclusion rates rather than aesthetic procedure volumes

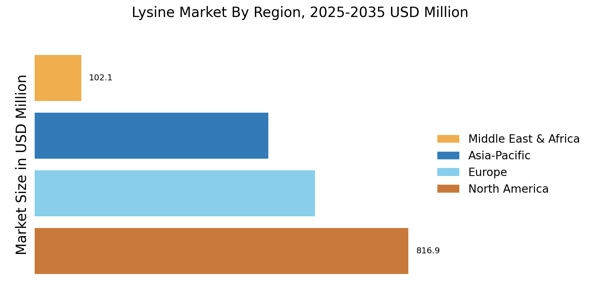

Geographic emphasis: Increased Asia-Pacific weighting (35% vs 30%) reflecting China's dominance in amino acid production, adjusted other regions accordingly