To gather both qualitative and quantitative information, the primary research process involved interviewing players from both the supply and demand sides. Oilseed breeding corporations, grain processing conglomerates, and agricultural trading enterprises' chief executive officers, vice presidents of agricultural operations, heads of seed technology, and commercial directors made up the supply side. On the demand side, we have commodities sourcing executives from food and beverage conglomerates, heads of procurement for vegetable oil refiners, animal feed manufacturers, and biofuel producers. Primary data was used to verify biotechnology pipeline schedules, validate crop segmentation, learn about crushing capacity use, understand spot pricing, and understand export-import dynamics, and to validate adoption patterns of hybrid seeds.

Primary Respondent Breakdown:

By Company Tier: Tier 1 (38%), Tier 2 (35%), Tier 3 (27%)

By Designation: C-level Primaries (32%), Director Level (30%), Others (38%)

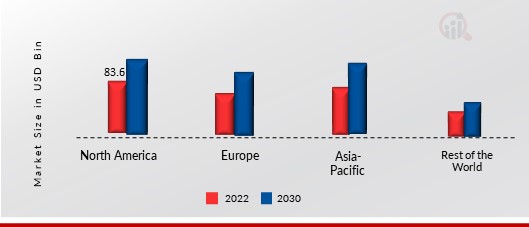

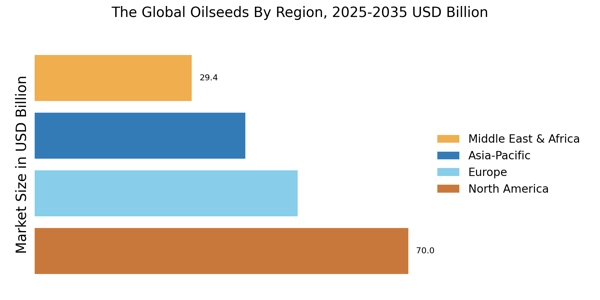

By Region: North America (32%), Europe (28%), Asia-Pacific (30%), Rest of World (10%)

Global market valuation was derived through production volume mapping and commodity price analysis. The methodology included:

Identification of 40+ key agribusiness entities and cooperatives across North America, South America, Europe, Asia-Pacific, and Africa

Crop mapping across soybeans, rapeseed/canola, sunflower seeds, palm kernel, cottonseed, groundnut, and copra segments

Analysis of reported and modeled annual revenues specific to oilseed cultivation, trading, and processing portfolios

Coverage of agribusiness entities representing 75-80% of global oilseed production and trade volume in 2024

Extrapolation using bottom-up (cultivated area × yield × farmgate price by country) and top-down (processor and trader revenue validation) approaches to derive segment-specific valuations for conventional and genetically modified (GM) categories across vegetable oil, animal feed, biofuels, and food applications

2/2