To gather both qualitative and quantitative information, the primary research process involved interviewing players from both the supply and demand sides. On the supply side, we had meetings with tempered glass company CEOs and GMs, mobile accessory brand VPs of product development, OEM/ODM operations heads in Guangdong and Shenzhen, regulatory compliance officers, and raw material suppliers' procurement directors (glass substrate, oleophobic coating, and adhesive film providers). On the demand side, we had category managers from mobile network operators (like AT&T, Verizon, Vodafone, and China Mobile), procurement heads from big-box electronics retailers (like Best Buy, MediaMarkt, JD.com, and Amazon), accessory buyers from flagship smartphone OEMs (like Apple, Samsung, Xiaomi, and OPPO), inventory managers from mobile repair chains (like uBreakiFix and CPR Cell Phone Repair), and e-commerce channel specialists who helped us out. Confirmation of 3D curved edge and privacy filter adoption timelines, validation of market segmentation across economy, mid-range, and premium price tiers, and insights on distribution channel dynamics, bundle strategies with new smartphone sales, and pricing elasticity across online and offline channels were all gleaned from primary research.

Primary Respondent Breakdown:

By Designation: C-level Primaries (28%), Director Level (35%), Others (37%)

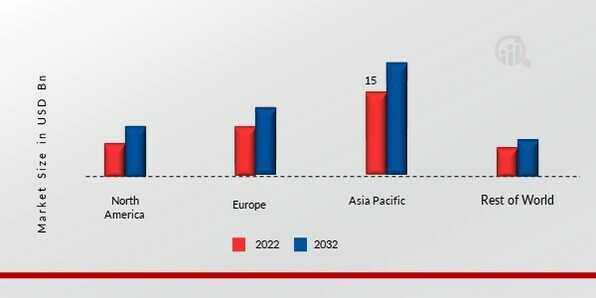

By Region: North America (28%), Europe (22%), Asia-Pacific (42%), Rest of World (8%)

Global market valuation was derived through revenue mapping and unit shipment analysis. The methodology included:

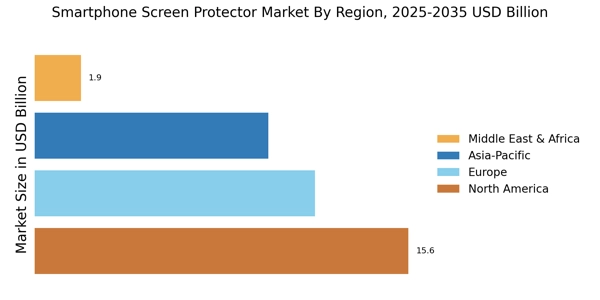

Identification of 60+ key manufacturers and OEM/ODM partners across North America, Europe, Asia-Pacific, and Latin America, including specialized tempered glass processors in Guangdong province and brand owners in North America/Europe

Product mapping across tempered glass (2D, 2.5D, 3D curved), PET film, TPU hydrogel, PMMA/acrylic, and nano-liquid screen protection categories

Analysis of reported and modeled annual revenues specific to screen protector portfolios and mobile accessory divisions

Coverage of manufacturers and contract manufacturers representing 75-80% of global market share in 2024, including major Shenzhen-based OEMs supplying white-label products to global brands

Extrapolation using bottom-up (global smartphone shipment volumes × accessory attachment rates × ASP by material type and region) and top-down (manufacturer revenue validation against retail sell-through data) approaches to derive segment-specific valuations for anti-blue light, privacy filters, matte/anti-glare, and gaming-specific screen protectors

Cross-validation with import/export data from UN Comtrade for glass and polymer films (HS Codes 7007, 3920, 3921) to triangulate manufacturing volume estimates