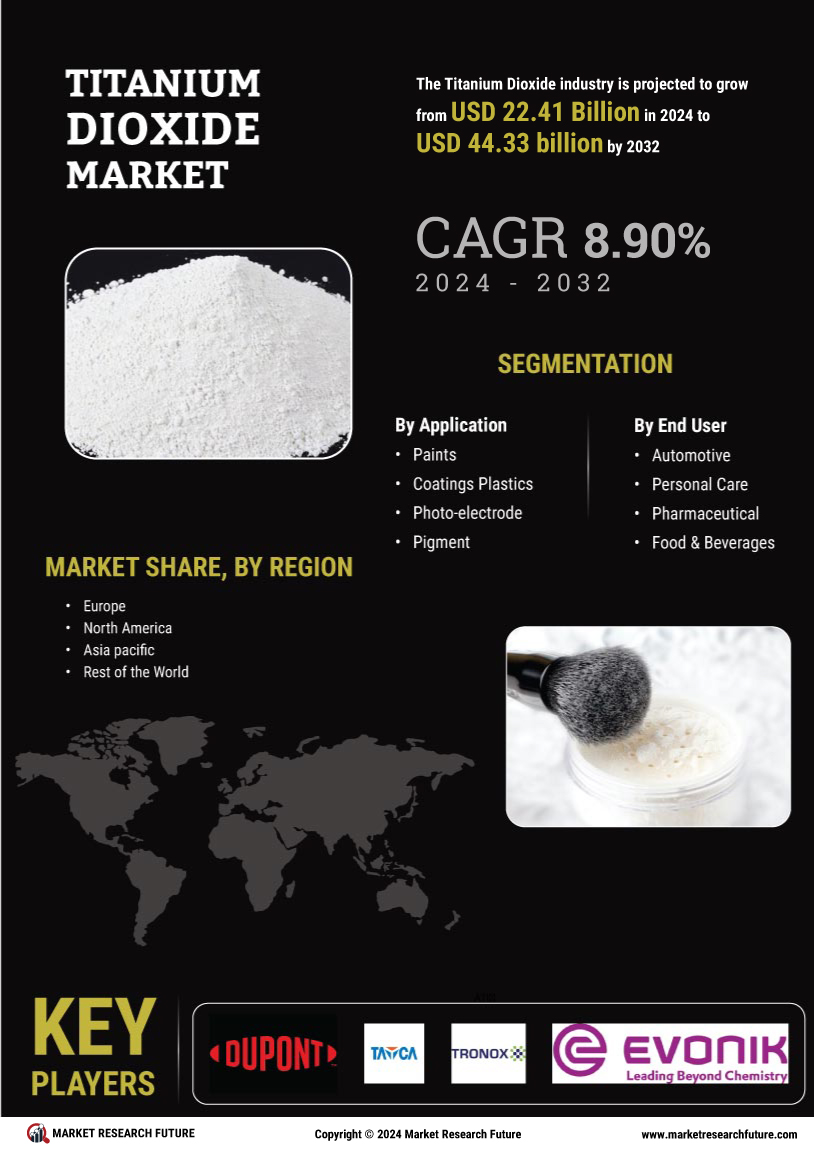

二酸化チタン市場 概要

MRFRの分析によると、2024年の二酸化チタン市場規模は224.1億米ドルと推定されています。二酸化チタン産業は、2025年に244.0億米ドルから2035年には572.6億米ドルに成長する見込みで、2025年から2035年の予測期間中に年平均成長率(CAGR)は8.9%となることが予想されています。

主要な市場動向とハイライト

二酸化チタン市場は、持続可能性と技術の進歩によって成長する準備が整っています。

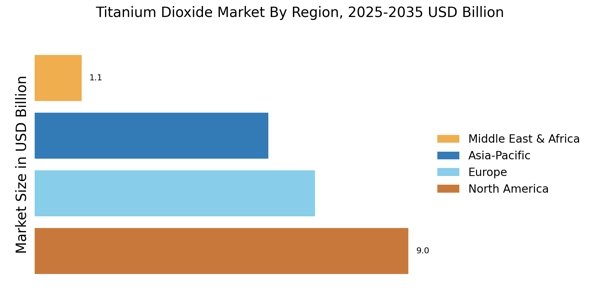

- "北米は、主に塗料セグメントにおける堅調な需要により、二酸化チタンの最大市場であり続けています。

- アジア太平洋地域は、産業活動の増加と都市化により、最も成長が早い地域として認識されています。

- 塗料セグメントは市場を支配し続けており、コーティングセグメントは革新的な応用により急速に成長しています。

- 塗料とコーティングにおける需要の高まりと、生産における技術革新が市場拡大を促進する主要な要因です。"

市場規模と予測

| 2024 Market Size | 224.1億ドル |

| 2035 Market Size | 57.26 (USD十億) |

| CAGR (2025 - 2035) | 8.9% |

主要なプレーヤー

ケモアーズ(米国)、ハンツマン(米国)、トロノックス(米国)、クリスタル(サウジアラビア)、クロノス・ワールドワイド(米国)、ベナター(イギリス)、ロモン・ビリオンズ(中国)、ザハトレーベン(ドイツ)、石原産業株式会社(日本)