북미 : 혁신의 시장 리더

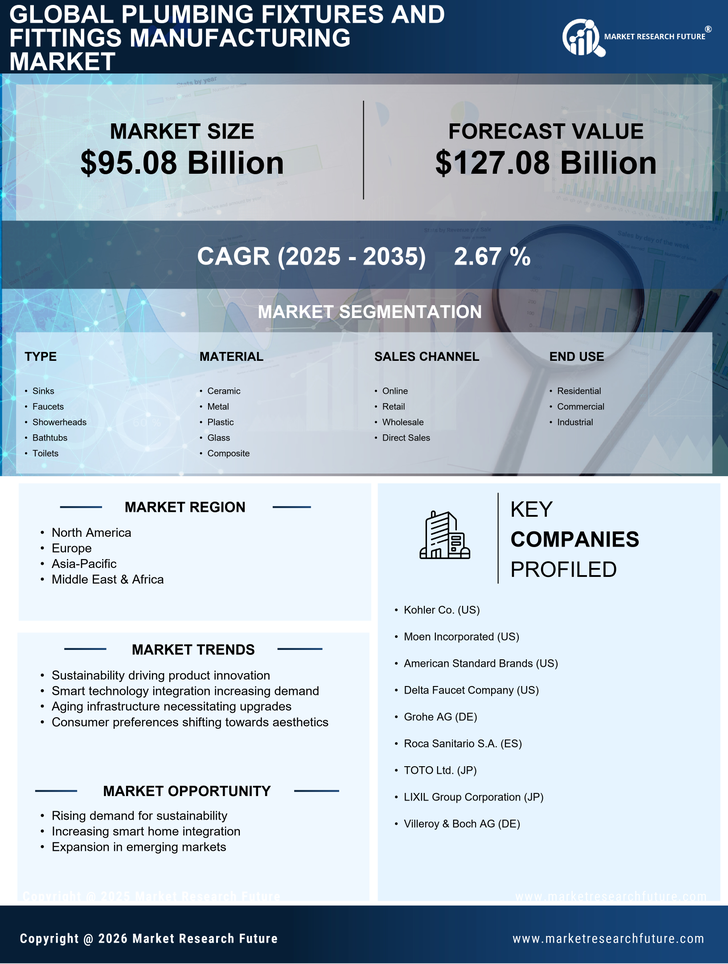

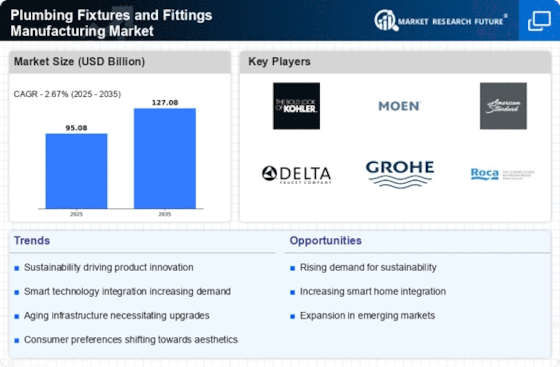

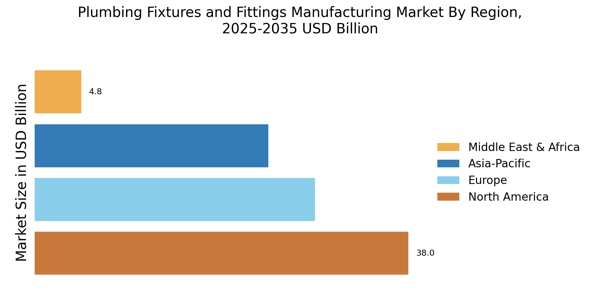

북미는 배관 기구 및 부속품의 가장 큰 시장으로, 전 세계 시장 점유율의 약 40%를 차지하고 있습니다. 성장은 증가하는 건설 활동, 리노베이션 프로젝트, 그리고 물 절약 기술에 대한 관심 증가에 의해 촉진되고 있습니다. 물 효율성과 지속 가능성을 개선하기 위한 규제 이니셔티브도 시장 확장의 중요한 촉매제입니다.

미국은 이 지역을 지배하고 있으며, Kohler Co., Moen Incorporated, American Standard Brands와 같은 주요 기업들이 경쟁 환경을 이끌고 있습니다. 첨단 제조 기술과 강력한 유통 네트워크의 존재는 시장 역학을 더욱 강화합니다. 스마트 배관 솔루션에 대한 수요도 증가하고 있으며, 이는 변화하는 소비자 선호를 반영합니다.

유럽 : 지속 가능성과 디자인 중심

유럽은 배관 기구 및 부속품의 두 번째로 큰 시장으로, 전 세계 시장 점유율의 약 30%를 차지하고 있습니다. 이 지역의 성장은 물 효율성과 지속 가능성을 촉진하는 엄격한 규제와 현대적이고 미적으로 만족스러운 디자인에 대한 증가하는 경향에 의해 촉진됩니다. 독일과 스페인과 같은 국가들이 이 시장의 선두에 있으며, 강력한 건설 및 리노베이션 활동에 의해 주도되고 있습니다.

독일은 Grohe AG와 Villeroy & Boch AG와 같은 선도적인 제조업체들이 있는 곳으로, 이들은 혁신적인 디자인과 친환경 제품으로 잘 알려져 있습니다. 경쟁 환경은 지속 가능성에 중점을 둔 기존 브랜드와 신생 기업들이 혼합되어 특징지어집니다. 유럽 시장은 또한 사용자 경험과 효율성을 향상시키는 디지털 솔루션으로의 전환을 목격하고 있습니다.

아시아-태평양 : 빠른 성장과 도시화

아시아-태평양 지역은 도시화, 인구 증가, 그리고 증가하는 가처분 소득에 의해 배관 기구 및 부속품 시장에서 빠른 성장을 목격하고 있습니다. 이 지역은 전 세계 시장 점유율의 약 25%를 차지하고 있으며, 중국과 인도가 이끌고 있습니다. 인프라 및 위생 개선을 목표로 하는 정부 이니셔티브가 중요한 성장 동력입니다.

중국은 이 지역에서 가장 큰 시장으로, TOTO Ltd.와 LIXIL Group Corporation과 같은 주요 기업들이 혁신적인 배관 솔루션에 상당한 투자를 하고 있습니다. 경쟁 환경은 진화하고 있으며, 지역 브랜드와 국제 브랜드가 시장 점유율을 놓고 경쟁하고 있습니다. 고품질 및 기술적으로 진보된 배관 제품에 대한 수요가 증가하고 있으며, 이는 변화하는 소비자 선호와 생활 수준 향상을 반영합니다.

중동 및 아프리카 : 신흥 시장 잠재력

중동 및 아프리카 지역은 배관 기구 및 부속품의 잠재적 시장으로 부상하고 있으며, 전 세계 시장 점유율의 약 5%를 차지하고 있습니다. 성장은 주로 증가하는 도시화, 인프라 개발, 그리고 물 부족 문제로 인한 물 절약에 대한 관심 증가에 의해 촉진됩니다. UAE와 남아프리카 공화국과 같은 국가들이 이 성장을 주도하고 있으며, 물 관리 개선을 위한 정부 이니셔티브에 의해 지원받고 있습니다.

경쟁 환경은 혁신적이고 지속 가능한 솔루션에 중점을 둔 지역 및 국제 기업들이 혼합되어 특징지어집니다. 고품질 배관 제품에 대한 수요가 증가하고 있으며, 이는 증가하는 중산층과 건설 활동 증가에 의해 촉진됩니다. 이 지역은 특히 스마트 배관 기술에서 성장의 중요한 기회를 제공합니다.