Increased Focus on Energy Efficiency

Energy efficiency has emerged as a pivotal concern within the 3D IC Market. As energy costs rise and environmental regulations tighten, manufacturers are increasingly seeking solutions that minimize power consumption. 3D IC Market technology allows for shorter interconnects and reduced power loss, making it an attractive option for energy-conscious companies. Recent studies suggest that 3D ICs can achieve up to 30% lower power consumption compared to traditional 2D ICs. This potential for energy savings is likely to drive further adoption of 3D IC Market technologies across various sectors, including telecommunications and data centers, where energy efficiency is paramount.

Miniaturization Trends in Electronics

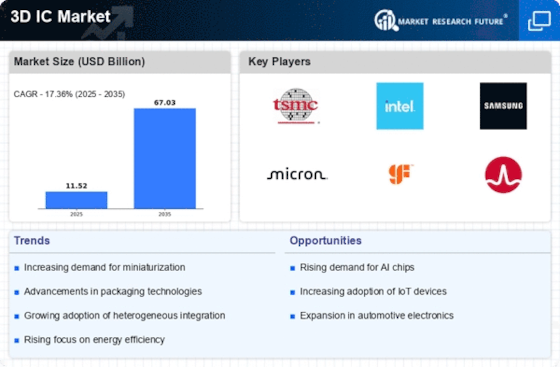

The trend towards miniaturization in electronics is a significant driver for the 3D IC Market. As consumer preferences shift towards smaller, more portable devices, manufacturers are compelled to innovate. 3D IC Market technology facilitates the integration of multiple functions into a single package, thereby reducing the overall footprint of electronic devices. This capability is particularly relevant in sectors such as mobile communications and wearable technology, where space is at a premium. Market analysis indicates that the miniaturization trend is expected to continue, with the 3D IC Market projected to reach a valuation of several billion dollars by 2027, reflecting the industry's adaptation to consumer demands.

Expansion of Internet of Things Applications

The expansion of Internet of Things (IoT) applications is significantly influencing the 3D IC Market. As IoT devices proliferate, the demand for efficient, compact, and high-performance integrated circuits rises. 3D IC Market technology is well-suited for IoT applications, as it enables the integration of various functionalities into a single chip, thereby enhancing performance while minimizing space. Market forecasts suggest that the IoT sector will witness exponential growth, with billions of connected devices anticipated by 2027. This growth is likely to create substantial opportunities for 3D IC Market manufacturers, as they cater to the evolving needs of IoT applications.

Rising Demand for High-Performance Computing

The 3D IC Market is experiencing a notable surge in demand for high-performance computing solutions. As applications in artificial intelligence, machine learning, and data analytics expand, the need for advanced processing capabilities becomes critical. 3D IC Market technology, with its ability to stack multiple layers of integrated circuits, offers enhanced performance and reduced latency. According to recent data, the market for high-performance computing is projected to grow at a compound annual growth rate of over 10% through 2026. This growth is likely to drive investments in 3D IC Market technologies, as companies seek to optimize their computing architectures to meet the increasing demands of complex applications.

Growing Investment in Research and Development

Investment in research and development is a crucial driver for the 3D IC Market. As competition intensifies, companies are allocating substantial resources to innovate and enhance their product offerings. This trend is particularly evident in semiconductor firms, which are increasingly focusing on developing advanced 3D IC Market technologies to maintain a competitive edge. Data indicates that R&D spending in the semiconductor sector is expected to exceed 20 billion dollars annually by 2026. Such investments are likely to accelerate advancements in 3D IC Market technology, fostering new applications and improving existing products, thereby propelling market growth.