Cost-Effectiveness of 3D Printed Implants

The cost-effectiveness of 3D printed implants is emerging as a significant driver in the 3D Printed Hip and Knee Implant Market. Traditional manufacturing methods often involve high production costs and longer lead times, whereas 3D printing can streamline the manufacturing process, reducing both time and expenses. This efficiency is particularly appealing to healthcare providers who are under pressure to manage costs while maintaining high-quality care. Market analysis suggests that the overall cost savings associated with 3D printed implants can be substantial, potentially lowering the financial burden on healthcare systems. As hospitals and clinics increasingly recognize the economic advantages of adopting 3D printing technologies, the market is likely to experience accelerated growth, driven by the dual benefits of affordability and customization.

Technological Advancements in 3D Printing

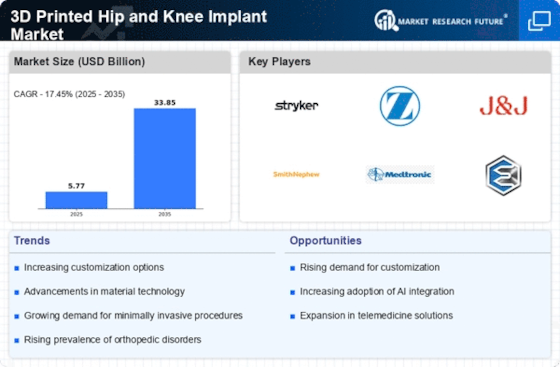

Technological innovations in 3D printing are significantly influencing the 3D Printed Hip and Knee Implant Market. The advent of advanced materials and printing techniques has enabled the production of implants that are not only lighter but also possess enhanced biocompatibility. For instance, the integration of titanium alloys and bioactive ceramics in 3D printing processes has shown promising results in improving implant longevity and performance. Market data suggests that the adoption of these technologies is expected to grow, with projections indicating a compound annual growth rate of over 20% in the coming years. This rapid evolution in technology is likely to attract more manufacturers to invest in 3D printing capabilities, thereby expanding the market and offering patients more effective treatment options.

Growing Focus on Patient-Centric Healthcare

The shift towards patient-centric healthcare is a pivotal driver in the 3D Printed Hip and Knee Implant Market. This approach emphasizes the importance of tailoring medical solutions to individual patient needs, which aligns seamlessly with the capabilities of 3D printing technology. By allowing for the customization of implants based on a patient's unique anatomy, 3D printed solutions enhance the overall patient experience and satisfaction. Furthermore, healthcare providers are increasingly prioritizing patient outcomes, which is likely to lead to a greater adoption of personalized implants. Market trends indicate that as patient engagement and satisfaction become central to healthcare delivery, the demand for 3D printed implants will continue to rise, fostering innovation and growth within the industry.

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive surgical techniques is a notable driver in the 3D Printed Hip and Knee Implant Market. Patients are increasingly seeking options that promise reduced recovery times and less postoperative pain. This trend is supported by data indicating that minimally invasive surgeries can lead to shorter hospital stays and quicker rehabilitation. As a result, orthopedic surgeons are more inclined to adopt 3D printed implants, which can be tailored to fit the unique anatomy of each patient. The ability to create patient-specific implants enhances surgical outcomes, thereby driving demand in the market. Furthermore, the growing awareness among patients regarding the benefits of such procedures is likely to propel the market forward, as more individuals opt for advanced solutions that align with their health and lifestyle preferences.

Aging Population and Increasing Incidence of Joint Disorders

The demographic shift towards an aging population is a critical driver for the 3D Printed Hip and Knee Implant Market. As individuals age, the prevalence of joint disorders such as osteoarthritis and rheumatoid arthritis tends to increase, leading to a higher demand for hip and knee replacements. Data indicates that by 2030, the number of total knee replacements is expected to reach 3.5 million annually in certain regions, underscoring the urgent need for innovative solutions. 3D printed implants offer a promising alternative, as they can be customized to meet the specific needs of older patients. This demographic trend is likely to sustain the growth of the market, as healthcare systems seek to address the rising burden of joint-related ailments effectively.

Leave a Comment