Market Trends

Key Emerging Trends in the 3D Printing Plastics Market

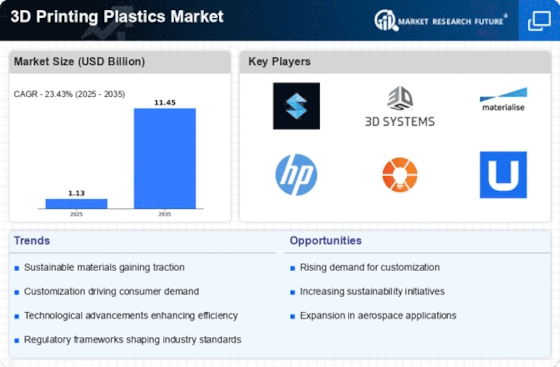

The 3D printing plastics market is witnessing significant trends that are reshaping the industry landscape and driving its growth.

Expanding Applications Across Industries: The adoption of 3D printing plastics is rapidly expanding across various industries, including aerospace, automotive, healthcare, consumer goods, and electronics. Plastics offer versatility, lightweight properties, and design flexibility, making them ideal materials for producing prototypes, functional parts, and customized products using additive manufacturing technologies. As industries recognize the potential of 3D printing plastics for rapid prototyping, product development, and manufacturing, the demand for these materials continues to grow.

Advancements in 3D Printing Technologies: Technological advancements in 3D printing technologies, including fused deposition modeling (FDM), stereolithography (SLA), selective laser sintering (SLS), and multi-jet fusion (MJF), are driving innovation and performance improvements in 3D printing plastics. Manufacturers are developing high-performance polymers, composite materials, and resin formulations specifically optimized for different 3D printing processes. These advancements enable precise control over printing parameters, enhanced resolution, and improved surface finish, expanding the capabilities and applications of 3D printing plastics.

Rise in Adoption of Engineering-grade Plastics: There is a growing demand for engineering-grade plastics in 3D printing applications due to their superior mechanical properties, thermal stability, and chemical resistance. Engineering-grade plastics such as ABS, polycarbonate (PC), nylon, and polyetherimide (PEI) are increasingly used for functional prototypes, end-use parts, and production components in demanding industries such as automotive and aerospace. As 3D printing technology matures and materials become more sophisticated, the adoption of engineering-grade plastics in additive manufacturing is expected to increase.

Focus on Bio-based and Sustainable Materials: With increasing environmental awareness and sustainability concerns, there is a growing interest in bio-based and sustainable materials for 3D printing applications. Bio-based plastics derived from renewable sources such as corn starch, soybeans, and algae offer a more eco-friendly alternative to traditional petroleum-based plastics. Manufacturers are developing bio-based filaments and resins for 3D printing, catering to the demand for sustainable materials in the additive manufacturing industry.

Customization and Personalization Trends: The ability to customize and personalize products is driving the demand for 3D printing plastics in consumer goods, healthcare, and other industries. Additive manufacturing enables the production of unique, complex, and customized designs without the need for traditional manufacturing processes such as injection molding or machining. Consumers are increasingly seeking personalized products, medical devices, and fashion accessories, leading to the adoption of 3D printing plastics for on-demand manufacturing and mass customization.

Expansion of Medical and Healthcare Applications: The medical and healthcare sectors are embracing 3D printing plastics for a wide range of applications, including surgical guides, prosthetics, orthopedic implants, and dental devices. Biocompatible plastics such as medical-grade ABS, polyethylene terephthalate glycol (PETG), and polylactic acid (PLA) are used in additive manufacturing for medical and healthcare applications due to their compatibility with sterilization processes and patient safety requirements. As the adoption of personalized medicine and patient-specific treatments increases, the demand for 3D printing plastics in the medical field is expected to grow.

Cost Reduction and Economies of Scale: As 3D printing technology matures and becomes more widespread, there is a trend towards cost reduction and economies of scale in additive manufacturing. Manufacturers are optimizing printing processes, improving material efficiency, and reducing production costs to make 3D printing plastics more economically viable for large-scale production and industrial applications. Additionally, advancements in material recycling and waste reduction contribute to cost savings and sustainability in the 3D printing plastics market.

Collaboration and Partnerships in the Industry: Collaboration and partnerships among 3D printer manufacturers, material suppliers, software developers, and end-users drive innovation, market growth, and adoption of 3D printing plastics. Strategic alliances enable knowledge sharing, technology transfer, and joint research initiatives to develop new materials, improve printing technologies, and address industry challenges. Partnerships between material suppliers and 3D printer manufacturers ensure compatibility, performance, and reliability of 3D printing plastics in additive manufacturing processes.

Regulatory Compliance and Quality Standards: Compliance with regulatory standards and quality specifications is essential for manufacturers and users of 3D printing plastics, particularly in industries such as healthcare and aerospace where safety and performance are critical. Material suppliers ensure that 3D printing plastics meet relevant regulatory requirements, industry standards, and quality certifications such as FDA approval for medical devices and UL certification for electronics applications. Adherence to regulatory compliance and quality standards enhances product integrity, reliability, and market acceptance.

Market Expansion in Emerging Economies: Emerging economies in Asia Pacific, Latin America, and Africa present growth opportunities for the 3D printing plastics market due to rapid industrialization, infrastructure development, and technological advancement. Countries such as China, India, Brazil, and South Africa are witnessing increased adoption of 3D printing technology and growing demand for 3D printing plastics in various industries. Manufacturers are expanding their presence and distribution networks in emerging markets to capitalize on growth opportunities and meet the rising demand for additive manufacturing materials.

Leave a Comment