Account Payable Market Summary

As per MRFR analysis, the Account Payable Market Size was estimated at 1.41 USD Billion in 2024. The Account Payable industry is projected to grow from 1.535 in 2025 to 3.577 by 2035, exhibiting a compound annual growth rate (CAGR) of 8.83 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Account Payable Market is experiencing a transformative shift towards automation and digital solutions.

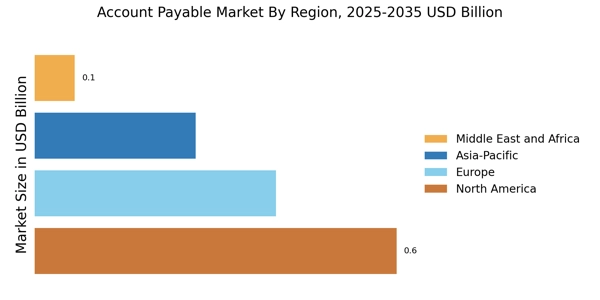

- Automation and digital transformation are reshaping the Account Payable Market, particularly in North America.

- The integration of AI and machine learning is becoming increasingly prevalent, enhancing efficiency and accuracy.

- Compliance and risk management are gaining prominence, especially in the Asia-Pacific region, as businesses adapt to regulatory demands.

- Rising demand for efficiency and a growing emphasis on data analytics are driving the shift towards cloud-based solutions in the service-managed segment.

Market Size & Forecast

| 2024 Market Size | 1.41 (USD Billion) |

| 2035 Market Size | 3.577 (USD Billion) |

| CAGR (2025 - 2035) | 8.83% |

Major Players

SAP (DE), Oracle (US), Coupa Software (US), Basware (FI), Tipalti (US), Bill.com (US), Tradeshift (US), AvidXchange (US)

Leave a Comment