Market Share

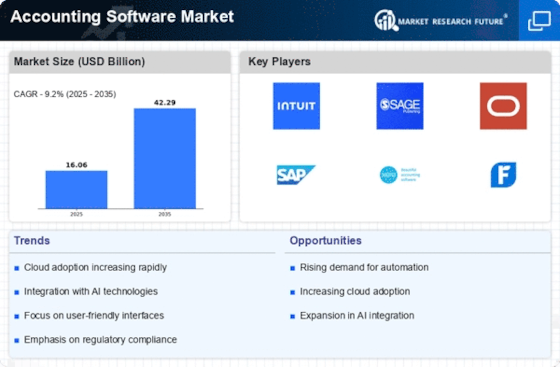

Accounting Software Market Share Analysis

AI-driven accounting technology revolutionizes mundane tasks like data entry and general bookkeeping, executing these responsibilities with unparalleled ease and precision. Its integration spans various sectors, notably tax compliances and bookkeeping, showcasing the prowess of AI in these domains. In the realm of tax compliance, robotic process automation (RPA) comes into play through 'bots,' functioning akin to human agents by undertaking tasks encompassing transaction entries, information extraction from multiple applications, intricate calculations, and the crucial filing of essential documents. An exemplar in this sphere is Botkeeper, an automated software harnessing the power of AI and machine learning for bookkeeping purposes. Its capabilities extend to categorizing expenses, invoicing customers, managing bill payments, accruing revenue and expenses, reconciling accounts, and proficiently entering data into accounting software.

Automation Anywhere stands as another notable provider in the realm of robotic process automation, offering innovative automation processes tailored for the financial services sector. Its portfolio includes solutions for accelerated underwriting and enhanced compliance processes, showcasing the transformative potential of AI in these critical areas. Testament to its impact, Automation Anywhere secured a significant funding amounting to USD 290 million in November 2019, earmarked for operational expansion and furthering its innovative endeavors.

AI-powered accounting technology is at the forefront of revolutionizing monotonous tasks such as data entry and general bookkeeping, demonstrating unparalleled efficiency and accuracy in these functions. Its implementation spans diverse sectors, prominently in tax compliance and bookkeeping, showcasing the transformative potential of AI in these domains. In the realm of tax compliance, the advent of robotic process automation (RPA) has ushered in 'bots' that emulate human agents, undertaking a gamut of tasks including transaction entries, information extraction from multiple applications, complex calculations, and the crucial filing of essential documents. An exemplary AI-driven software, Botkeeper, harnesses the prowess of AI and machine learning for comprehensive bookkeeping purposes. Its capabilities encompass diverse functions, from expense categorization and customer invoicing to bill payments, revenue and expense accruals, account reconciliations, and efficient data entry into accounting software.

Automation Anywhere emerges as another notable player in the domain of robotic process automation, offering bespoke automation solutions tailored for the financial services sector. Its portfolio includes cutting-edge solutions addressing accelerated underwriting and bolstered compliance processes, exemplifying AI's transformative potential in these critical areas. The substantial funding injection of USD 290 million secured by Automation Anywhere in November 2019 stands as a testament to its influence, earmarked for scaling operations and driving continued innovation in AI-powered solutions.

Leave a Comment