Market Trends

Key Emerging Trends in the Accounting Software Market

The global tax and accounting software market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 7.9% from 2019 to 2025, attributing its growth to the escalating demand for automated solutions spanning diverse industry sectors worldwide. This surge is fueled by the software's capacity to efficiently manage financial data, aiding in cost-effective planning within sectors such as manufacturing, retail & consumer goods, and the BFSI domain. Tax and accounting software encompass distinct solutions that enterprises and independent financial consultants employ to navigate financial transactions seamlessly. Tax software primarily facilitates filing various taxes—ranging from income tax to corporate tax and regional levies—while accounting software manages a spectrum of accounting transactions, including accounts payable, accounts receivable, bank reconciliation statements, journals, ledgers, and payroll.

These software solutions have emerged as pivotal tools for small, medium, and large enterprises, with market players offering integrated solutions like ERP systems and standalone solutions such as invoice and billing software and payroll management software.

The escalating enterprise count in developing regions like Asia-Pacific, South America, and the Middle East and Africa fuels the surge in demand for such solutions. Moreover, amendments in taxation policies, such as India's Goods and Services Tax (GST) and the European Union's (EU) Value-Added Tax (VAT), have increased the necessity for accessible tax software. Cloud-based accounting and tax software are also gaining traction among individual professionals for managing their financial affairs. For instance, FreshBooks' annual report estimated that approximately 24 million individuals would be self-employed in the US by 2019. This burgeoning population of self-employed individuals seeks cost-effective and user-friendly accounting and tax software, thereby elevating the demand for cloud-based solutions, a trend also witnessed in regions like Asia-Pacific and the Middle East and Africa.

Market players are strategically investing in research and development endeavors to deliver easy-to-use and cost-effective software solutions. Key industry players such as Xero Limited, Sage, and MYOB have shifted their focus to Amazon Web Services (AWS) and are actively automating bookkeeping services to simplify accounting processes. Xero Limited, for instance, has acquired Hubdoc Inc., utilizing Optical Character Recognition (OCR) technology to extract and analyze essential data, streamlining bank reconciliation processes.

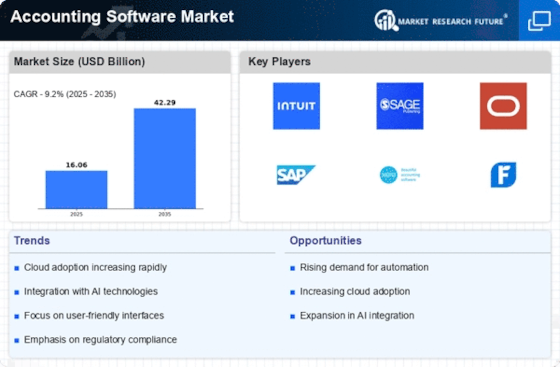

Although the global tax and accounting software market boasts numerous small- and mid-size players offering an array of solutions, a handful of key players such as Intuit Inc., Sage Group plc., Xero Limited, and SAP SE dominate the market landscape, engaging in intense competition based on pricing, software features, and market presence. Additionally, emerging players like Xero Limited and FreshBooks Reviso Cloud Accounting Limited have established themselves as market innovators, wielding strong regional footholds and striving to expand into lucrative markets like Asia-Pacific and the Middle East.

The market's projection paints a vibrant picture, with an anticipated CAGR of 7.9% from 2019 to 2025. In 2018, the accounting software segment commanded a significant market share of 67.5%, while tax software is expected to exhibit the highest CAGR of 8.4%. In terms of organization size, small- and medium-sized enterprises accounted for a substantial share of 58.91% in 2018, projected to grow at an even higher CAGR of 8.1% in the forecast period. Manufacturing stood as the dominant vertical, capturing 33.11% of the market in 2018. Geographically, North America led the tax and accounting software market with a 39.73% market share in 2018, closely followed by Europe with a share of 28.23%. Asia-Pacific exhibits the highest forecasted CAGR of 11.2% from 2019 to 2025, indicative of its burgeoning growth potential in the market.

Leave a Comment