Regulatory Compliance

Regulatory compliance is becoming increasingly important within the Acrylates Market. Governments worldwide are implementing stringent regulations regarding the use of chemicals in various applications, particularly in consumer products and industrial processes. Compliance with these regulations is essential for manufacturers to maintain market access and avoid penalties. As a result, companies are investing in research and development to create acrylate products that meet these regulatory standards. This focus on compliance not only enhances product safety but also fosters consumer trust. The ongoing evolution of regulations is likely to shape product development strategies within the Acrylates Market.

Sustainability Initiatives

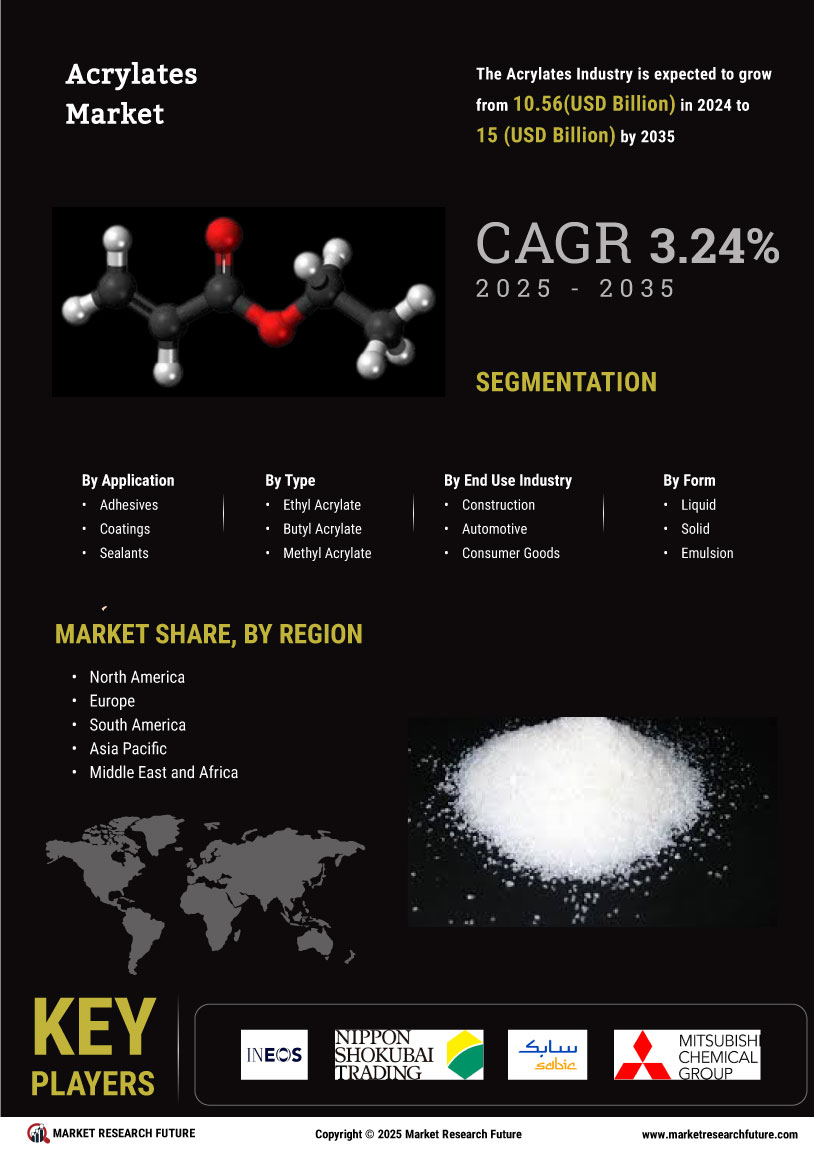

The Acrylates Market is experiencing a notable shift towards sustainability initiatives. Manufacturers are increasingly focusing on eco-friendly production processes and materials. This trend is driven by growing consumer awareness regarding environmental issues and regulatory pressures aimed at reducing carbon footprints. As a result, companies are investing in bio-based acrylates, which are derived from renewable resources. The market for bio-based acrylates is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This shift not only aligns with The Acrylates Industry.

Technological Advancements

Technological advancements play a crucial role in shaping the Acrylates Market. Innovations in production techniques, such as the development of more efficient catalysts and processes, are enhancing the yield and quality of acrylates. These advancements are expected to reduce production costs and improve the overall competitiveness of acrylates in various applications, including coatings, adhesives, and textiles. Furthermore, the integration of automation and digital technologies in manufacturing processes is streamlining operations, leading to increased efficiency. As a result, the Acrylates Market is likely to witness a surge in productivity, which could potentially lead to a broader adoption of acrylates across diverse sectors.

Expanding Application Scope

The expanding application scope of acrylates is a significant driver for the Acrylates Market. Acrylates Market are increasingly being utilized in diverse sectors, including automotive, electronics, and healthcare. The versatility of acrylates allows for their use in coatings, adhesives, sealants, and more. For example, the automotive industry is adopting acrylate-based materials for lightweighting and enhancing fuel efficiency. Market analysis suggests that the demand for acrylates in the automotive sector alone could increase by over 6% annually. This diversification of applications not only boosts the overall market growth but also encourages innovation within the Acrylates Market.

Rising Demand in Emerging Markets

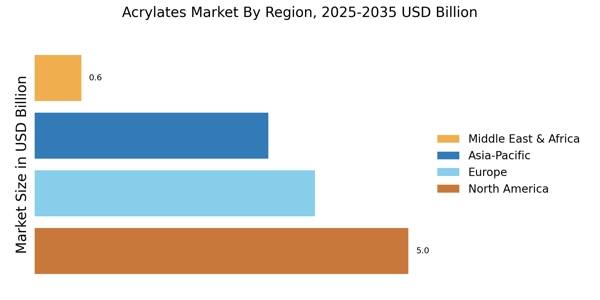

The Acrylates Market is witnessing a surge in demand from emerging markets, particularly in Asia-Pacific and Latin America. Rapid industrialization and urbanization in these regions are driving the need for acrylates in various applications, including construction, automotive, and consumer goods. For instance, the construction sector in Asia-Pacific is projected to grow at a robust pace, leading to increased consumption of acrylate-based products. Market data indicates that the demand for acrylates in these regions could grow by over 8% annually, reflecting the expanding manufacturing capabilities and infrastructure development. This trend presents significant opportunities for stakeholders within the Acrylates Market.